- within Corporate/Commercial Law, Strategy and Consumer Protection topic(s)

- in Asia

- with readers working within the Securities & Investment and Law Firm industries

1. INTRODUCTION

The Companies (Amendment) Bill, 2014, a bill to amend the Companies Act, 2013 ("Act"), has now been passed by both the houses of the Parliament and has received the assent of the President of India on May 25, 2015 making it the Companies (Amendment) Act, 2015 ("Amendment Act"). The provisions of the Amendment Act have come into force from May 29, 2015 (except Section 13 and 14 of the Amendment Act which will come into force on such date as will be notified by the Central Government).

The Amendment Act has been introduced with the following legislative intent:

(a) Ease of doing business;

(b) Removal of drafting errors from the Act;

(c) Correction of oversight errors; and

(d) Removal of provisions which are ex-facto oppressive to an environment to do business.

2. ANALYSIS AND IMPACT OF THE KEY AMENDMENTS

I. Related Party Transactions ("RPTs")

Section 297 of the erstwhile Companies Act, 1956 set out the requirement for procuring Central Government approval for RPTs while the Act required a special resolution for RPTs where a shareholder who was a related party was not allowed to vote on such special resolution. Now, the Amendment Act further relaxes this provision and allows companies to enter into RPTs after passing an ordinary resolution for the same. This will enable group companies in transacting inter se business. Further, the requirement of shareholder's approval in case of RPT between holding company and wholly owned subsidiary ("WOS") has been dispensed with. This exception was earlier present under the Companies (Meetings of Board and its Powers) Rules, 2014 ("Rules") and now has been incorporated in the substantive law itself.

II. Omnibus approval for RPTs

In addition to the amendment of allowing companies to undertake RPTs through an ordinary resolution, the Amendment Act amends Section 177 whereby a new proviso to Section 177 (4) has been inserted which reads as follows "provided that the Audit Committee may make omnibus approval for related party transactions proposed to be entered into by the company, subject to such conditions as may be prescribed." Thus, for ease in doing business, now the audit committee will be empowered to give omnibus approvals for related party transactions to be entered into by the company.

This amendment seems to be in line with the provisions of the recently amended Clause 49 of the Listing Agreement as regards omnibus approval of related party transactions by the audit committee constituted under the Board of the company. This amendment may also result in defeating the principles of healthy corporate governance practices to be followed by companies whereby they are required to inform the shareholder of all pertinent details in relation to a related party transaction so as to enable him to take an informed decision. The conditions for the omnibus approval are yet to be notified and are expected to bring in more clarity on the subject.

[Note: This provision has not yet been enforced.]

III. Minimum Capital Requirement

The requirement for having a minimum paid-up capital of Rupees 1,00,000 for private limited companies and Rupees 5,00,000 for public limited companies has now been done away with. This amendment is expected to reduce registration costs for incorporation of new companies. However, the minimum capital requirements generally acted as filters and, to an extent, ensured the formation of companies for bona fide and genuine purposes. This amendment may now encourage formation of bogus shell companies.

IV. Loan to WOS

Section 185 of Act prohibits a company from:

i. advancing any loan, including a loan represented by a book debt, to its director or to any other person in whom the said director is interested; and/or

ii. giving any guarantee or providing any security in connection with any loan taken by the director or any other person in whom the director is interested.

Transactions in the nature of loans and guarantees between a holding company and its WOS were exempted from the applicability of Section 185. This exemption was already provided for in the Rules and now it has been incorporated in the substantive law itself.

V. Restriction on inspection of Board Resolutions

Section 117 of the Act required a company to file certain specified resolutions with the Registrar of Companies and permitted public inspection of such resolutions, thus raising concerns of breach of confidentiality. This provision under the Act was not well received by the stakeholders. The Amendment Act now inserts a new proviso to clause (g) of Section 117 of the Act, which states that "provided that no person shall be entitled under section 399 to inspect or obtain copies of such resolutions" thus ensuring confidentiality of such resolutions.

VI. Common Seal

The Amendment Act has omitted the words 'and a common seal' appearing under Section 9 of the Act which means it shall not be mandatory for a company to have a common seal. This is not a majorchange yet it is a welcome change. In the era of digital signatures and documents being maintained in the electronic form, common seal was an obsolete requirement of the law.

VII. Deposits

Section 76(A) has been inserted by the Amendment Act whereby a minimum penalty of Rs. 1 Crore is sought to be imposed on companies which "accept or invite or allow or cause any other person to accept or invite on its behalf" deposit in contravention of provisions of Section 73 of the Act or "fails to repay the deposit and interest thereon". This insertion seeks to protect the interests of the funds of the investors and imposes a harsh fine and punishment on the company as well as every other officer who is in default in relation to such non-compliance.

VIII. No dividend, without depreciation

The Companies (Declaration and Payment of Dividend) Rules, 2014 were amended by the Companies (Declaration and Payment of Dividend) Amendment Rules, 2014 whereby companies were prohibited from declaring dividend unless the previous year or years' losses and unabsorbed depreciation which had not been provided for by the company were set off against current year's profits. This provision has been incorporated in the substantive law by amendment of Section 123 of the Act. This is a welcome move for ensuring financial health of a company.

IX. Fraud Reporting-threshold limits

The Act required an auditor, who believes that an offence involving a fraud is being or has been committed in a company, to report the same to the Central Government. The existing Section 143 (12) has been substituted by a new clause which stipulates that if the auditor, during the course of his audit, discovers or suspects a fraud, he has to report it to the Central Government when the amount of the fraud crosses the threshold limit to be prescribed by the Central Government and in respect of other frauds/suspected frauds below the threshold limit, the same needs to be reported by the auditor to the audit committee constituted under the Board of the company and in cases where the company does not have an audit committee, the same may be reported to the Board of the company. Whether or not the amendment is a welcome change can be more affirmatively ascertained upon notification of the threshold limits.

[Note: This provision has not yet been enforced.]

X. Special Courts

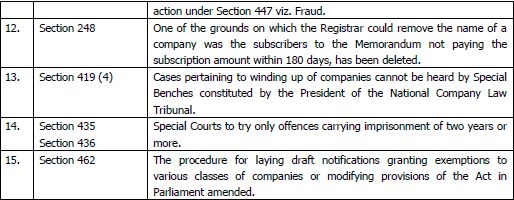

The Amendment Act amends the provisions of Section 435 whereby the Special Courts constituted under the Act shall try only those offences which are punishable by an imprisonment of two years or more. All other offences may be tried by the Metropolitan Magistrate or Judicial Magistrate First Class.

XI. Bail restrictions to apply only for offence relating to fraud.

Section 212 of the Act specified the offences under specific Sections of the Act which attracted the punishment for fraud under Section 447 and which were to be cognizable offences and in respect of which, bail restrictions as specified in Section 212 (6) (i) and (ii) would apply. The Amendment Act now widens the ambit of Section 212 to remove the specific list of offences and specifies that any offence which falls within the definition of 'fraud' under Section 447 shall be considered a cognizable offence and the bail restrictions bail restrictions as specified in Section 212 (6) (i) and (ii) would apply to any such offence.

3. SECTION-WISE SUMMARY OF AMENDMENTS

The Amendment Act is a welcome initiative towards the objective facilitating ease in doing business. However, the Amendment Act focuses on correcting anomalies and oversight errors rather than introducing any major change. Contrary to expectations, the Amendment Act does not introduce exemptions for private limited companies from applicability of certain provisions of the Act. Also, the dilution of conditions for undertaking related party transactions might impact principles of good corporate governance.

The Ministry of Corporate Affairs continues to issue clarifications to the Act and the rules promulgated thereunder from time to time to remove various difficulties. Keeping in line with its object of facilitating ease in doing business, the Central Government should come out with a substantial and consolidated amendment of the Act instead of issuing piecemeal amendments /clarifications.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.