- Tribunal upholds that interest expenditure is not to be disallowed as per Section 14A in case of leveraged investments unless dividend income is actually received from the investment;

- Private debt structures and leveraged acquisition structures may avoid tax hit if dividends are not declared;

- However, uncertainty caused by contradictory decisions reveals urgent need to relook at the applicability of disallowance in such structures.

In a decision which further incentivizes structured leverage transactions, the Bangalore bench of Income Tax Appellate Tribunal ("Tribunal") in Alliance Infrastructure Projects v. DCIT1 has held that interest expenditure incurred on borrowed funds which are invested in the shares of a company cannot be disallowed unless the entity claiming such expenditure is in actual receipt of tax exempt income. The decision is a major shot in the arm for debt structured investments and importantly, comes at a time when the investment climate in India is on the rise.

BACKGROUND

Alliance Infrastructure Projects ("Alliance") is a company which had made investments in the shares of various companies as well as investments in a partnership entity (collectively referred to as the "Investments") during the assessment years 2009-2010 and 2010-2011. Alliance had also obtained loans from few of its group companies and had sought to deduct the expenditure incurred by way of interest paid on these loans from its total income. In fact, Alliance had not received any dividends from the aforesaid Investments for the concerned assessment years. However, the Assessing Officer ("AO") held that the loans taken by Alliance had been utilized to make Investments, the income (dividend) from which would be tax free income, and hence disallowed the interest expenditure claimed by it as per Section 14A of the Income Tax Act ("ITA").

Section 14A of the ITA essentially mandates that no deduction shall be allowed in relation to any expenditure incurred for earning income which is exempt from tax in India in a particular assessment year. The modalities surrounding the disallowance under Section 14A are further explained in Rule 8D of the Income Tax Rules, 1962 ("Rules"). This provision is of special relevance in case of borrowed funds being used for the purpose of acquiring equity shares to set up a parent-subsidiary relationship where dividend pay-outs are expected. This is because dividends are taxed out of the distributable profits in the hands of the subsidiary and not in the hands of the parent. On this basis, the tax authorities have taken the view that interest expenditure incurred in respect of the loan used for the purpose of acquiring shares should be disallowed under Section 14A since the shares lead to dividend pay-outs and dividends are 'exempt' in the hands of the parent (although taxed in the subsidiary's hands).

In the present case, the disallowance was made by the AO based on the following grounds:

- That the interest expenditure incurred by Alliance during the concerned assessment years was not directly attributable to any particular income or receipt of any income [as per rule 8D (2) (ii) of the Income Tax Rules, 1962 ("Rules")] ("Disallowance 1");

- That the income which may arise from the Investment made by Alliance will in any case not form part of the total income of Alliance which will be taxable [as per rule 8D (2) (iii) of the Rules] ("Disallowance 2").

On appeal, the Commissioner of Income-Tax (Appeals) ("CIT(A)") found that Alliance, in addition to the funds which it had borrowed from its group companies, also had interest free funds in excess of the Investments amount. As a result, the CIT(A) held that when there exists a mixed pool of funds, i.e. (i) funds on which interest is to be paid and (ii) interest-free funds, the presumption was that investments would be made out of interest-free funds. Therefore, the CIT(A) deleted the Disallowance 1 made by the AO; but insofar as the Disallowance 2 was concerned, the CIT(A) held that the AO's decision was correct on the basis that the relevant provision does not give scope for any other interpretation.

Aggrieved by the decision of the CIT(A), cross-appeals were filed by the Revenue and Alliance respectively contesting the deletion of Disallowance 1 and the retention of Disallowance 2 respectively.

RULING OF THE TRIBUNAL

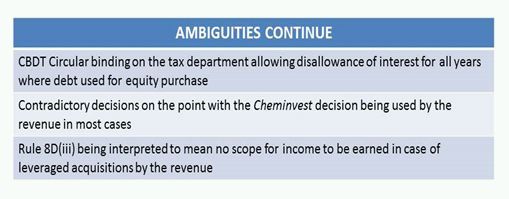

The Revenue contented that the receipt of actual income was not a mandatory pre-requisite for disallowance to be made under Section 14A. To support this, the Revenue relied on the Cheminvest case2, which had held that an assessee does not need to be in receipt of actual tax exempt income in order for disallowance to be made under Section 14A of the ITA. On the contrary, Alliance contended that the Cheminvest case does not reflect the apt position of law in this regard, and that the case has been overruled by many High Court judgments delivered post the Cheminvest case. The submission of Alliance was that the disallowance under Section 14A cannot be made unless there is actual receipt of tax exempt income.

The Tribunal, after examining several High Court judgments3 on the point, agreed with the submissions made by Alliance and held that the Cheminvest case, in fact, stands impliedly overruled. The Tribunal noted that Alliance did not receive any dividends during the assessment years involved and that it did not receive any exempt income during the period. On this basis, the Tribunal overruled the disallowances made by the CIT(A) and ruled that a disallowance under Section 14A of the ITA read with Rule 8D of the Rules can be made only upon receipt of tax exempt income by Alliance.

CONCLUSION AND ANALYSIS

While the Tribunal's decision is certainly a positive development, there is still a sense of ambiguity surrounding the application of Section 14A of the ITA. Despite several judgments holding that a disallowance under Section 14A can be made only upon receipt of tax exempt income, a recent CBDT circular4 has stated that disallowance under Section 14A can be made even where the taxpayer has not earned any exempt income during a particular year. Nonetheless, judicial authorities across the country have unanimously decided in favour of the taxpayers in this regard and the Tribunal following t he same in the present case is a most welcome trend.

However, it is important to note that the Tribunal has failed to address the larger question as to whether a disallowance under Section 14A read with Rule 8D is warranted at all in case of investments in shares of a company. Section 14A of the ITA was introduced by the Finance Act, 2001 primarily to ensure that taxpayers do not reduce their tax liability by claiming expenditure on certain categories of income which are completely tax exempt, such as agricultural income.5 However, the broadly drafted wording of the provision has meant that the tax department has used the provision indiscriminately to disallow any expenditure in earning of any income which may be characterized as exempt in the hands of the taxpayer. Therefore, this provision i s increasingly being used by the revenue authorities to disallow expenditure incurred in respect of investment in equity of a company on the ground that dividends are now exempt in the hands of the shareholder, foregoing the fact that dividends are subject to tax at the company level.

It is an accepted canon of tax law that each transaction should only be taxed once, so as to avoid 'economic double taxation'.6 Therefore, it may be noted that dividends are made exempt in the hands of the shareholder purely because they are made taxable at the company level. In such a situation, it is hard to understand how expenditure incurred in relation to investment in shares may be termed as expenditure incurred to earn 'exempt income' since dividend income is bound to be taxed at one level. This position is even more difficult to understand in case of an investment in unlisted equity shares since a later disposal of the shares may lead to taxable capital gains income in the hands of the shareholder.7

Private debt leverage is being increasingly used by foreign players in the real estate, infrastructure, IT and ITES industries for tax-efficient up-streaming of money from India since up-streaming by way of dividends is subject to dividend distribution tax, which may not be creditable in the foreign jurisdiction (please see our research paper on Private Equity and Private Debt Investments in India here for more details). Section 14A of the ITA is extremely significant in private debt transactions and structured leverage transactions since the use of borrowed funds to acquire equity may result in large interest disallowances, which is a major commercial consideration for market players. In this context, the present decision provides respite to the taxpayer to the extent that interest may not be disallowed for the years in which dividend has not been declared. Therefore, taxpayers who seek to retire equity for debt for more efficient up-streaming may rely on this position and claim deductions so long as dividends are not declared. Further, listed market promoter financing structures where debt in the form of non-convertible debentures is used to purchase equity in listed companies and returns are serviced as a function of the underlying equity pricing (in a quasi-PIPE model) which are prevalent in the market today have been blessed as per the present case from a tax perspective until dividends are declared.

However, as discussed earlier, Section 14A seems to be achieving an object which is beyond the scope for which the provision was introduced. One can only hope that in light of the object and purpose of the provision, clarifications are introduced to the extent that Section 14A is allowed to be used only in cases where the transaction as such is exempt from taxation.

Footnotes

* Special assistance from Joachim Saldanha

1 ITA Nos. 220 & 1043 (BNG)/2013.

2 Cheminvest v ITO, 121 ITD 318

3 CIT v. Shivam Motors (P) Ltd., ITA No.88/2014 (All HC); CIT v. Corrtech Energy (P) Ltd., ITA No. 239/2014 (Guj HC); CIT v. Winsome Textile Industries Ltd., (2009) 319 ITR 204 (P&H);

4 Circular No.5.2014, dated 11.02.2014

5 Circular No.11/2001, dated 23.07.2001

6 See Lang, Introduction to the Law of Double Taxation Conventions, 2010, IBFD, at p. 23-25; The principle has also been upheld by the Mumbai bench of the Tribunal in Linklaters LLP v. ITO, [2010] 40 SOT 51 (Mum).

7 This logic was followed by the Delhi High Court recently in CIT v. Holcim India (P) Limited, ITA No. 299,486 of 2014 while overturning a disallowance under Section 14A.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.