The Mumbai Bench of the Income Tax Appellate Tribunal ("ITAT") has recently held in the case of Euro RSCG advertising (P) Ltd.1("Taxpayer") that the sale of shares by the Taxpayer to its parent company, at cost, which is higher than the fair market value provided in the valuation certificate submitted to the Reserve Bank of India ("RBI"), cannot be presumed to be a colorable device for avoidance of tax. The judgment is particularly relevant to share transfers to related parties, in a group restructuring exercise.

Background

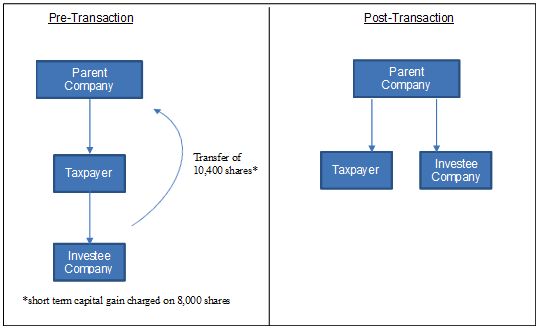

The Taxpayer is an Indian company engaged in the business of providing communication services including advertising, sale promotion and marketing. As part of its group restructuring process in March, 2006, the Taxpayer sold certain shares ("Shares") of another Indian company, Euro RSCG Target Media Pvt. Ltd. ("Investee Company") to its parent company incorporated outside India ("Parent Company"). The transfer of Shares by the Taxpayer to the Parent Company was undertaken pursuant to a share purchase agreement to which the Taxpayer was a party ("Agreement"). In December, 2005 the Investee Company had submitted a valuation report to the RBI reporting the valuation of the shares based on net asset value ("NAV").

The Shares were originally acquired by the Taxpayer in two tranches i.e. partly in the year 2002, and the remaining in January 2006 as consideration for the transfer of its media business to the Investee Company. The Taxpayer transferred the second tranche of Shares to its Parent Company at cost and hence, the transfer did not result in any capital gains income in the hands of the Taxpayer.

However, the assessing officer ("AO") disputed the cost of acquisition of the Shares, which was much higher than the fair market value arrived at in the valuation report submitted to the RBI, and opined that the allotment was done at an unreasonably high premium to the reported fair market value. The AO also held that the agreement entered into between the related parties was a self-serving document and could not be relied upon. Accordingly, short term capital gains were calculated in the hands of the Taxpayer by treating the fair market value of the Shares as the cost of their acquisition.

In appeal from the order of the AO, the Commissioner of Income Tax (Appeals) ("CIT-A") upheld the decision of the AO. Hence, the Taxpayer further appealed from the decision of the CIT-A before the ITAT.

ITAT's Decision

In appeal before the ITAT, the Taxpayer contended that the cost of acquisition of Shares, which was also the book value of such Shares in the previous assessment year i.e. assessment year 2006-07, had been accepted by the AO in an order passed by him previously, and hence cannot be disputed. Regarding the valuation report, it was stated that the same was prepared only for RBI purposes. The Taxpayer further relied on the Agreement to contend that the cost of acquisition of the Shares as the book value was valid and acceptable.

The arguments of the Taxpayer found favour with the ITAT. The ITAT observed that the cost of acquisition of the Shares had been previously accepted by the AO in its previous order. Hence, once the cost of acquisition has been accepted by the tax department, and is substantiated by the Agreement, the AO was not justified in holding that the cost shown by the Taxpayer was fictitious. It held that the valuation report showing the fair market value of the Shares was only for the purpose of calculating NAV of the Shares, and the Agreement could not be brushed aside unless there was something on record to prove that it was not a genuine arrangement.

As a result, the ITAT held that the transaction was not sham, or a colorable device, and the cost of acquisition recorded at the book value by the Taxpayer was to be accepted for the purposes of computation of short term capital gain. Finally, the ITAT held that since the Shares were transferred by the Taxpayer to the Parent Company at the cost of acquisition, there was no taxable gain in the hands of the Taxpayer.

Analysis

This case assumes relevance amidst the ongoing debate on tax planning / avoidance and the uncertainty surrounding general anti avoidance rules ("GAAR"). The ITAT clearly stated that a transaction could not be treated as a sham merely because it was undertaken between related parties at cost. Besides, according to the often quoted definition of 'sham' as articulated by the House of Lords in the case of Snook v. London & West Riding Investments Ltd2, for an act or a document to be sham, there must be an intention to give an appearance, to third parties or Court, of rights and obligations different from the actual legal rights or obligations (if any) which the parties intend to create. There was no proof of such appearance given in the present case. Further, it was legally permissible to transfer the shares of an Indian company to a non-resident at a price higher than the fair market value in the valuation report submitted to the RBI.

The ITAT in this judgment applied an objective test and held that in absence of any material to doubt the book value of the shares; the tax department was not justified in rejecting the same. Also, even though valuation per se could be questioned but once that value is accepted it may not be appropriate to raise fresh objections to it at a later point in time. In our view, the judgment of the ITAT is sound and based on correct principles of law.

The need to restructure within group holdings arises for efficiency purposes and as this case demonstrates, tax provisions could prove to be a hindrance in that exercise. Notably, the newly introduced GAAR, which are proposed to become effective from April, 2013, would grant to the tax department wide discretionary powers and an additional tool to reject objective evidence and base its decision on subjective elements like intention of parties.

We have in our previous hotlines extensively discussed the applicability of GAAR and its effect on stakeholders3. GAAR could potentially apply to most transactions between companies of the same group, or other related parties, and such transactions could be called in question if GAAR subsists in its present form. It is important that genuine business transactions between group companies are not adversely affected by GAAR and are unambiguously and objectively addressed in the final print so that there is no scope left for further doubt and litigation.

Footnotes

1. Euro RSCG Advertising (P) Ltd v. Assistant Commissioner of Income-Tax, IT Appeal No.4306/MUM/2011 (A.Y. 2007-08), Date of Pronouncement: July 11, 2012

2. (1967) 1 All E.R. 518

3. Antidote for panic: FM announces delay of GAAR

Draft GAAR guidelines: More threatening than welcoming to foreign investors

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.