Knowing what business is worth and what determines its value is prerequisite for intelligent decision making. It is the process of determining the "Economic Wealth" of company under certain assumptions and limiting condition and subject to data available on the valuation date. It is pertinent to mention that the valuation of a business is not an exact science and ultimately depends upon a number of factors like the purpose of valuation, stage of business, past financials, expected financial results, industry scenario, market recognition etc.

What Is Business Valuation?

The Business Valuation is a process to estimate the economic worth of stakeholder's interest in a business.

To determine the value of any business, the reasons for and circumstances surrounding the business valuation must be pre ascertained.

These are formally known as the "Standard of Value" and "Premise of Value".

To be precise, the "Standard of Value" is the hypothetical conditions under which the business is valued and the "Premise of Value" relates to the assumptions upon which the valuation is based.

Key Facts of Business Valuation:

- Price is not the same as Value

The Value of a business, by whatever business valuation method it

is obtained, is not the selling price of the business. As

Warren Buffett said, "Price is what you pay; Value is what you

get." They are not the same.

- Value varies with Person, Purpose and

Time

The Value is a subjective term and can have different connotations

meaning different things to different people and the result will

not be the same, should the context or time changes.

- Transaction concludes at Negotiated

Prices

Though the value of a business can be objectively determined

employing valuation approaches, this value is still subjective,

dependent on buyer and seller expectations and subsequent

negotiations and the Transaction happens at negotiated price

only.

- Valuation is hybrid of Art &

Science

Valuation is more of an art and not an exact science. The Art is

Professional Judgment and Science is Statistics. Mathematical

certainty is neither determined nor indeed is it possible as use of

professional judgment is an essential component of estimating

value.

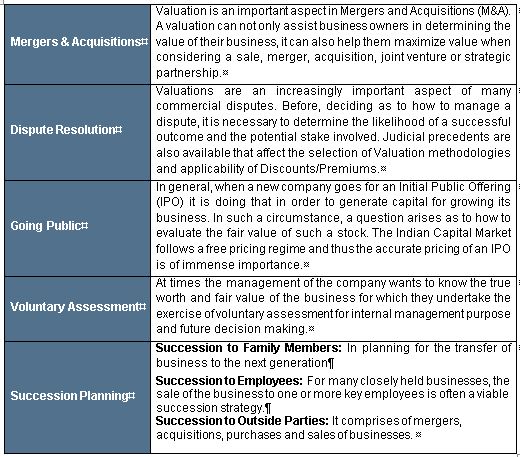

Some Basic Reasons to get Business Valuation

How of Business Valuation - India's Perspective

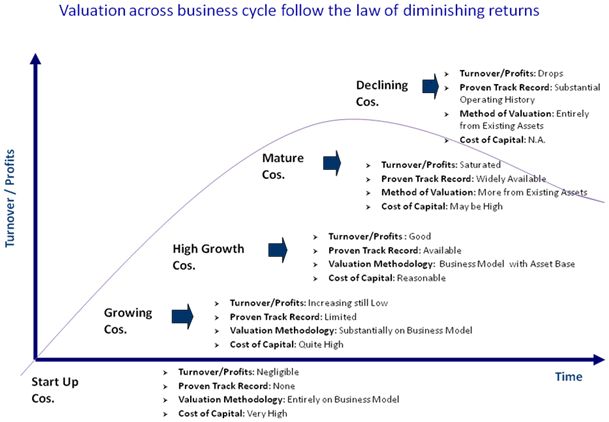

At present there are no prescribed standards and codes for valuation in India, in many cases the valuation lacks the uniformity and generally accepted global valuation practices. A number of business valuation models can be constructed that utilize various methods under the broad business valuation approaches.

In determining which of these approaches to use the valuation professional must exercise discretion. Each technique has advantages and drawbacks, which must be considered when applying those techniques to a particular business. Most treatises and court decisions encourage the valuer to consider more than one method, which must be reconciled with each other to arrive at a Value conclusion. Understanding of the internal resources and intellectual capital of the business being valued is as important as the economic, industrial and social environment.

Generally Acceptable Methodologies of Valuation

There are broadly three approaches to valuation which need to be considered in any Business Valuation exercise as each approach has its own significance and being helpful in making a sanity check.

- Asset Approach

- Income Approach

- Market Approach

- Asset Approach (NAV) - Generally the Net Asset Value reflected in books do not usually include intangible assets enjoyed by the business and are also impacted by accounting policies which may be discretionary at times. NAV is not perceived as a true indicator of the fair business value. However, it is used to evaluate the entry barrier that exists in a business and is considered viable for companies having reached the mature or declining growth cycle and also for property and investment companies having strong asset base.

- Book Value Method - It is based on the balance sheet review of assets and liabilities;

- Replacement Cost Method - It is based on current set up cost of plant of a similar age, size and capacity;

- Liquidation Value Method - It is based on estimated realizable value of various assets.

- Income Approach - The Income based method of valuations are based on the premise that the current value of any business is a function of the future value that an investor can expect to receive from purchasing all or part of the business.

- Discounted Cash Flow Method (DCF) - DCF expresses the present value of the business as a function of its future cash earnings capacity. In this method, the appraiser estimates the cash flows of any business after all operating expenses, taxes, and necessary investments in working capital and capital expenditure is being met. Valuing equity using the free cash flow to stockholders requires estimating only free cash flow to equity holders, after debt holders have been paid off.This approach catches the future business potential of a company and is very prevalent in the service industry.

- Capitalization of Earning Method - The capitalization method basically divides the business expected earnings by the so-called capitalization rate. The idea is that the business value is defined by the business earnings and the capitalization rate is used to relate the two.

- Market Based Approach - In this method, value is determined by comparing the subject, company or assets with its peers or Transactions happening in the same industry and preferably of the same size and region. This is also known as Relative Valuation Method.

- Comparable Companies Multiples Approach- Market Multiples of Comparable Listed Companies are computed and applied to the Company being valued to arrive at a multiple based valuation.

- Comparable Transaction Multiples Method - This technique is mostly used for valuing a company for M&A, the transaction that have taken place in the Industry which are similar to the transaction under consideration are taken into account.

- Market Value Approach - The Market Value method is generally the most preferred method in case of frequently traded Shares of Companies listed on Stock Exchanges having nationwide trading as it is perceived that the market value takes into account the inherent potential of the Company.

- Other Valuations Approaches

- Contingent Claim Approach - Under this valuation approach, Option Pricing Model is applied to estimate the Value. Generally ESOP Valuation for Accounting purpose is done using the Black Scholes Method. Now even Patent Valuation is also done using Black Scholes Method.

- Price of Recent Investment Approach - Under this valuation approach, the recent investment in the business by an Independent party may be taken as the base value for the current appraisal, if no substantial changes have taken place since the date of such last investment. Generally the last Investment is seen over a period of last 1 year and suitable adjustments are made to arrive at current value.

- Rule of Thumb Approach - Although technically not a valuation method, a rule of thumb or benchmark indicator is used as a reasonableness check against the values determined by the use of other valuation approaches.

Recent Regulatory Changes

- For so long, Valuation has been debated in India as an Art or Science and substantial part of the litigation in Mergers & Acquisitions (M&A) takes place on the issue of Valuation as it involves an element of subjectivity that often gets challenged. More so, as in India, there are no standards for business valuation specifically for unlisted and private companies so in many cases the Valuation lacks the uniformity and generally accepted global Valuation practices. Even limited judicial guidance is available over the subject in India. Further, absence of any stringent course of action and Non Regulation under any Statute is also leading to loose ends.

- Institute of Chartered Accountants of India (ICAI) has recently developed and recommended Business Valuation Practice Standards (BVPS) aiming to establish uniform principles, practices and procedures for valuers performing valuation services in India.

- The introduction of concept of Registered Valuer in the Companies Bill, 2011 has also provided a framework to enable fair valuation in companies and thus, charts a need for professional valuers for standardizing the use of valuation practices in India, leading to transparency and better governance.

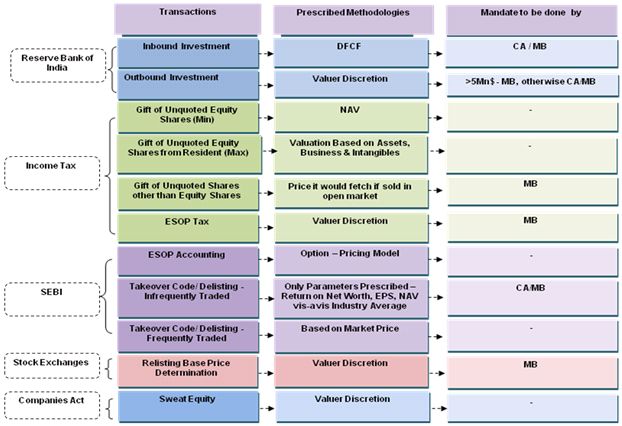

- It has been observed that different regulators in India (RBI, Income Tax, SEBI, etc) have prescribed different and in some cases conflicting valuation methodologies creating practical difficulties. A diagrammatic view is provided below:

Conclusion

Valuation is more of an art and not an exact science, though the value of a business can be objectively determined employing valuation approaches, this value is still subjective, dependent on buyer and seller expectations and subsequent negotiations and use of professional judgment is an essential component of estimating value.

In the absence of standards of business valuation the valuation is more on an art based on the professional experience of the valuer rather than a science based on empirical studies and logics. Though Internationally Business Valuations are governed by broadly various standards like: Valuation Standards of American Institute of CPAs (AICPA), American Society of Appraisers (ASA), Institute of Business Appraisers (IBA), National Association of Certified Valuation Analysts (NACVA), The Canadian Institute of Chartered Business Valuators (CICBV), Revenue Ruling 59- 60 (USA), ICAI Valuation Standard (Recommendatory)however keeping in view the growing relevance and importance of valuation in business and investment decisions as well as in regulatory compliance processes the development of practice of valuation as a discipline and profession in the present context has become a necessity because of imperatives of financial markets, emerging global economy, and changing framework of accounting and financial reporting.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.