Mergers and Acquisitions (M&A) is the most popular route used by companies looking to consolidate businesses, expand operations, rationalize holding structures, enhance shareholders' value, meet regulatory requirements, or, in some cases, wade off competition.

Historically, Tax and Regulatory considerations have always assumed great significance while undertaking such M&A activities, especially where the same involves cross-border structures involving multiple jurisdictions.

Tax consideration surrounding M&A

Most countries' Tax and Regulatory frameworks often provide exemptions/incentives to support and encourage M&A activities, especially where the same can help stimulate certain objectives like the development of a particular sector, encouraging a shift towards new technologies, overall growth of industry and employment generation. The Indian Government, too, has launched various tax schemes and exemptions from time to time.

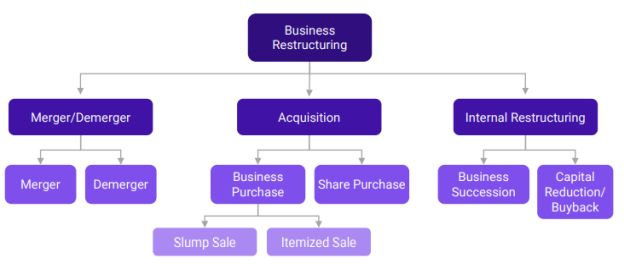

M&A transactions can be implemented by various modes of restructuring, both internal and external, be it mergers, demergers, acquisition of shares, asset sale, buybacks, etc. Each mode of restructuring comes with its own set of tax considerations. In this article, we attempt to give a glimpse of the tax implications associated with the various restructuring modes under the Indian Income-tax Act (ITA).

A snapshot of commonly adopted restructuring strategies is pictographically depicted below:

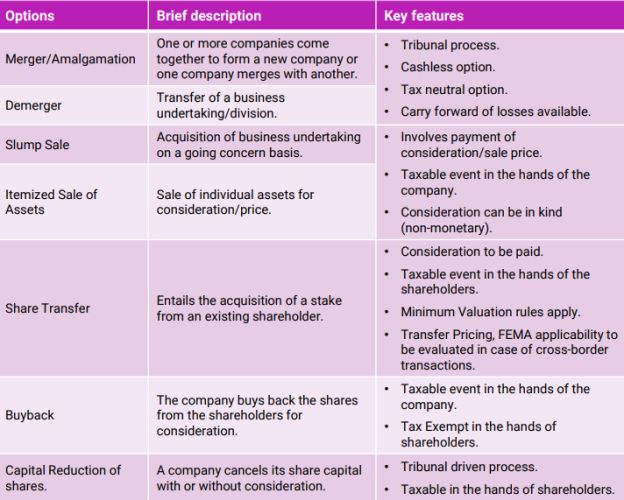

A brief comparative summary of various restructuring options from an Indian context is mentioned below:

We now proceed to understand the tax implications surrounding the prominent modes of restructuring hereunder:

Tax issues pertaining to external restructuring modes

Mergers/Amalgamation (Domestic scenario)

A merger/amalgamation is a popular mode of restructuring for companies trying to pool their resources to mutually benefit by synergy or integrate and diversify their operations or rationalize the number of legal entities in the group.

From a taxation perspective, too, a merger is often preferred as ITA provides tax neutrality to all the parties on satisfaction of certain conditions. The conditions for tax neutrality involve transfer of majority of the assets and liabilities of the amalgamating/transferor company or to become that of the amalgamated/transferee company. Also, shareholders holding not less than 3/4th of the value of the amalgamating company should become shareholders of the amalgamated company.

Apart from the tax neutrality, the ITA also provides for certain additional benefits like:

- Carry forward of accumulated losses and unabsorbed depreciation, if any, of the transferor company to the transferee company subject to meeting of certain conditions by both the 'transferor' (in terms of engaging in the lossgenerating business for a minimum period of time, holding fixed assets transferred in the merger for a minimum period of time) as well 'transferee' company (with respect to continuance of business of the transferor company by the transferee company for certain period, maintenance of minimum level of production, continuing to hold assets transferred from transferor company for certain period, etc.)

- Continuity of certain tax incentives/deductions/as were available to the transferor company.

- Carry forward of tax credits, if any, of the transferor company

- Enabling provisions for shareholders to continue with the benefit of cost of acquisition and period of holding of shares of the transferor company.

Considering the above, the below aspects also merit consideration while evaluating the viability of a merger as an option:

Treatment of Goodwill arising on Amalgamation

The allowability of depreciation on Goodwill arising in the course of amalgamation had been a matter of substantial litigation in India. The ITA was amended with effect from April 1, 2020, to exclude Goodwill from the definition of intangible assets. As a result, Goodwill arising on amalgamation is no longer eligible for depreciation.

However, if any other intangibles are acquired during a merger, then identifying and recording other intangible assets like know-how, patents, trademarks, etc., should be appropriately done. Potentially, depreciation on such other intangibles should be available and should be evaluated on a case-to-case basis.

Role of Tax Authorities in approving the scheme of Merger/Amalgamation

An amalgamation/merger scheme requires prior approval from the National Company Law Tribunal (NCLT). While approving such schemes, the NCLT calls for objections, if any, from various regulatory authorities, including Tax Authorities. There have been several instances where schemes of amalgamation have been rejected by NCLT based on objections raised by Tax Authorities alleging that the merger lacks commercial rationale and has been undertaken mainly with the objective of tax evasion or is used as a tool for tax avoidance or planning.

Wide powers have been vested with Tax Authorities to review the tax impact on the account of a merger as a part of revenue audit proceedings. In a few instances, there have been cases where the NCLT approved the scheme and post that the Tax Authorities have invoked the General Anti-Avoidance Rules (GAAR) and disregarded the carry forward and set-off of losses where the companies were not able to substantiate the commercial rationale behind the schemes.

Thus, while a merger is a highly attractive option considering its tax benefits and being a cashless option, with the GAAR provisions coming into play, mere satisfaction of conditions for tax neutrality is not sufficient. Companies will have to justify the commercial rationale behind the scheme to the satisfaction of the Tax Authorities. Hence, it is advisable that the scheme documents also adequately capture the commercial rationale to strengthen its case.

Foreign Company Mergers/Amalgamation involving the transfer of shares of Indian company

In case of transfer of shares of an Indian company pursuant to a merger between two or more foreign companies (FCo), such transfer is also exempted from tax under ITA subject to satisfying certain conditions.

It is pertinent to note that exemption is also provided to the shareholders of the amalgamating foreign company, which derives its value substantially from shares of an Indian company on fulfillment of certain conditions. In a scenario where the conditions are not satisfied, the availability of relief under the Double Taxation Avoidance Agreement (DTAA), if any, needs to be evaluated separately.

Cross-border M&A - Merger of Indian and Foreign companies

Inbound mergers (i.e., where the resultant entity is an Indian entity) are provided tax neutrality if the prescribed conditions are satisfied. However, no specific exemption is provided under the ITA for a merger of an Indian company with a foreign company, i.e., outbound mergers. Also, such mergers also call for certain regulatory approvals. As such, currently, less traction is witnessed in this area.

Share Purchase/Share Acquisition deal

Another commonly adopted mode of acquisition is a share purchase/acquisition deal. This mode is often resorted to as an alternative, where a complete acquisition of a company is contemplated.

While mergers are tax neutral, the transfer of shares attracts capital gains taxes in the hands of the transfer or shareholders. As an anti-avoidance measure, ITA provides minimum valuation rules for the transfer of shares. Furthermore, where share transfers are effected between associated enterprises, transfer pricing implications would also need to be considered.

Where the transferor is a non-resident, capital gains are computed with regard to the provisions of the tax treaty between India and the respective country, if any. Also, the buyer is required to withhold the applicable taxes and undertake withholding tax compliances.

In case of transfer of shares/interest in an overseas company by the non-resident, such transfers are taxable in India if such share/ interest derives its values substantially directly or indirectly from assets located in India (where the value of assets in India exceeds INR 100 million and value of Indian assets is 50% or more of the value of all assets owned by the overseas company).

Considering the above, it becomes critical that the sellers duly discharge the taxes in connection with share transfers. The ITA also provides discretionary powers to Tax Authorities to treat share transfer transactions as void to recover any outstanding taxes of the seller on the date of transfer.

On the other hand, the purchase of shares at less than fair market value can also attract taxability under ITA in the hands of the acquiring company. Additionally, ITA casts an obligation on the acquirer to withhold taxes at source at the time of share purchase on the purchase consideration exceeding INR 5 million.

Thus, while share transfers are fairly less burdensome in respect to regulatory compliances and approvals in India, such transactions are liable to tax.

While mergers and share purchases are relevant M&A routes from a buyer's perspective, companies looking to hive off a part of their undertaking or business may consider the following options.

Demergers

A demerger essentially means splitting a large company (referred to as a 'demerged company') into two or more parts (referred to as 'resulting company(s)'). This route is often preferred by companies who intend to streamline their businesses, segregate non-core assets from core business, focus/hive off particular business segments, or list a particular line of business.

The ITA provides certain conditions for transactions to qualify as a valid demerger. Most importantly, it should constitute an 'undertaking,' which is a unit or, division, or business activity taken as a whole but does not include individual assets or liabilities. Another important condition, amongst others, is that all the property and assets of the undertaking are to be transferred to the resulting company at book values on a going-concern basis, pursuant to the demerger. Furthermore, the resulting company should issue its shares to the shareholders of the demerged company on a proportionate basis as a consideration for such a transfer.

Similar to mergers, any transfer of a capital asset being shares held in an Indian company by a demerged FCo to a resulting FCo is also deemed not to be a taxable transfer on satisfaction of certain conditions.

Another salient feature of a demerger is that tax losses and depreciation of the demerged undertaking can be carried over by the resulting company for the unexpired period of eight years.

Given the above, a demerger has several tax advantages. However, demergers also need the NCLT's approval, which involves similar issues as highlighted above for mergers. An alternative approach to achieve the same result of separating a particular business unit/division is the slump sale of business, which is discussed further.

Slump Sale

A slump sale means the transfer of one or more undertakings for a lump-sum consideration. The parties can implement this option by executing a Business Transfer Agreement, which does not require formal approval from any authorities. Hence, this is a preferred option where timing is of essence or where the transacting parties are closely held groups and the public is not interested at large.

In case of a slump sale, unlike demergers, consideration for the transfer is received by the transferor company and not by its shareholders. Thus, gains arising from such transfer are taxable as capital gains. The ITA provides minimum valuation rules for determining the transfer price. Furthermore, a specific computation mechanism is provided for computing the capital gains.

Unlike demergers, slump sales do not provide the benefit of carry-over of losses and unabsorbed depreciation of the seller (with respect to undertaking transferred) by the buyer. However, under this option, the buyer is not accountable nor has to deal with any historical issues of the seller company as it's a purchase of an undertaking.

Itemized Sale

Contrary to a slump sale, an itemized sale enables cherry-picking individual assets and liabilities that need to be transferred. In this case, the values are assigned separately for each item of asset and liabilities. Such sales generally result in capital gains taxation. The manner of taxation and rate of taxation varies depending on the nature of the asset transferred.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.