1. Background

Finance Act, 2012 introduced a tax on closely held companies when it received consideration from resident investors on issue of shares at a value that exceeded fair market value ("FMV"). This tax, enshrined under Section 56(2)(viib) of the Income Tax Act, 1961, came to be known as Angel Tax as angel investors faced the brunt while investing in startups. The original intent of introducing these provisions was to plug money laundering practices.

Finance Act, 2023 expanded the scope of these provisions to consideration received from non-resident investors. This spooked the startup community considering the wide scope (to include non-resident investors) and severe ramifications (being liable to tax at 30%, plus surcharge and cess).

The FMV, for this purpose, is to be computed in a manner prescribed in Rule 11UA of the Income Tax Rules, 1962 ("IT Rules"). These rules were to be updated to include valuation norms applicable for investment from non-resident investors. Furthermore, the original prescribed valuation methods, such as Net Asset Value ("NAV") and Discounted Free Cash Flow ("DCF") method, were applicable only in case of issuance of unquoted equity shares. No specific valuation method was prescribed for Compulsorily Convertible Preference Shares ("CCPS").

Post the amendments in Finance Act, 2023, several representations were made to the Government by various stakeholders raising concerns regarding the undue hardship that would be faced by genuine non-resident investors.

In response to the representations received, the Central Board of Direct Taxes ("CBDT") released draft Rules for public consultation in May 2023, and basis the suggestions and comments received from the stakeholders, CBDT has notified the amended Rule 11UA vide Notification No. 81/2023 dated 25th September 2023 ("Notification").

This tax alert summarizes the amended Rule 11UA.

2. Existing valuation methods

Under the existing provisions, Rule 11UA(2) of the IT Rules prescribed only two valuation methods for valuing unquoted equity shares. These methods were:

(i) NAV method (based on a prescribed formula).

(ii) DCF Method.

As per amended Rule 11UA, the DCF method is now applicable even for CCPS issuance to both resident and non-resident investors.

3. Five new valuation methods – only for non-resident investors

In addition to the above valuation methods, the amended Rule 11UA prescribes five new valuation methods in respect of foreign investors investing in unquoted equity shares or CCPS. The additional methods are:

(i) Comparable Company Multiple Method,

(ii) Probability Weighted Expected Return Method,

(iii) Option Pricing Method,

(iv) Milestone Analysis Method, and

(v) Replacement Cost Method.

4. Price matching mechanism

The amended Rule 11UA introduces price matching mechanism for investment from resident as well as non-resident investors. These are summarized as follows:

4.1. Price matching with investment received from specified funds:

Where a closely held company receives consideration from a venture capital fund, venture capital company, or specified fund (Category I or Category II Alternative Investment Fund registered with SEBI or regulated under the International Financial Services Centre Authority (Fund Management) Regulations, 2022), the price of shares corresponding to this consideration can be taken as the FMV for both resident and non-resident investors, provided that:

- The consideration from such FMV does not exceed the aggregate consideration received from the specified entity; and

- The consideration from the specified entity is received within 90 days before or after the date of share issuance.

Illustration: If a closely held company receives a consideration of INR 50,000 from a venture capital company for 100 shares at the rate of INR 500 per share, it can issue 100 shares at this rate (i.e., INR 500 per share) to any other investor (resident or non-resident) within a period of 90 days before or after the receipt of consideration from venture capital company.

4.2 Price matching with investment received from notified non-resident entities:

Similarly, a price matching mechanism is also available with respect to investment received from specified non-resident entities as notified vide notification no. 29/2013 dated 24th May 2023. The notified entities are as under:

- Government and Government related investors such as central banks, sovereign wealth funds, international or multilateral organizations, or agencies including entities controlled by the Government or where direct or indirect ownership of the Government is 75% or more;

- Regulated banks or insurance entities;

- Certain entities, resident in specified

countries/territories1, subject to applicable

regulations in their home country:

- Category I Foreign Portfolio Investors ("FPIs") registered with SEBI;

- Endowment funds associated with a university, hospitals or charities;

- Pension funds; and

- Broad Based Pooled Investment Vehicle or fund having more than 50 investors (not a hedge fund or a fund which employs diverse or complex trading strategies).

5. Tolerance limit

The amended Rule 11UA introduces a tolerance limit of 10% of the valuation price. This means that if the issue price doesn't exceed 110% of the FMV calculated using prescribed methods (excluding the price matching mechanism), then, in such instances, the issue price will be considered equal to the FMV of those shares, and no adverse tax consequences shall follow.

It is pertinent to note that this 10% tolerance limit or buffer applies to both unlisted equity shares and CCPS issued to residents and non-residents.

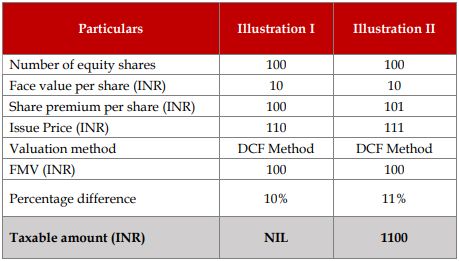

The concept of tolerance limit can be explained with the help of following example:

In Illustration I, since the issue price does not exceed the 10% tolerance limit, there will be no adverse tax implications. However, under Illustration II, since the issue price exceeds 110% of FMV determined under DCF method, the difference of INR 11 per share [i.e., INR 111 (issue price) minus INR 100 (FMV)] would be chargeable to tax under angel tax provisions without any benefit of tolerance limit.

6. 90 days grace period for valuation report

Under the existing provisions, the valuation of shares was required to be determined as of the date when the consideration for the issuance of shares was received by the company.

However, the amended Rule 11UA introduces a relaxation, allowing the valuation report to be obtained from the merchant banker up to 90 days prior to the date of share issuance. It may be noted that the grace period of 90 days shall be available for both unlisted equity shares and CCPS.

7. Option to value CCPS based on FMV of unquoted equity shares

The amended Rule 11UA also provides an option for the company to determine the FMV of CCPS based on the FMV of unquoted equity shares determined as per prescribed methods.

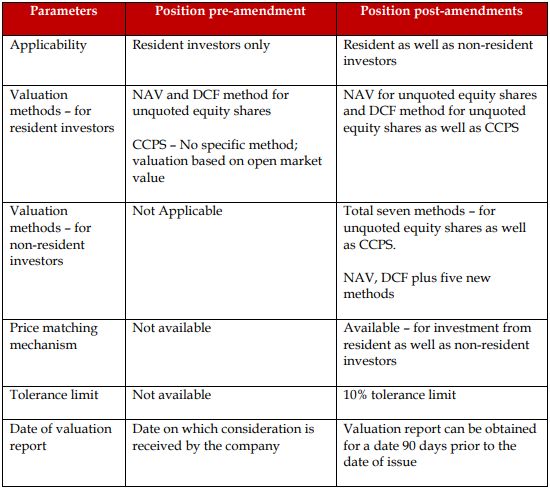

8. Summary and comparison of the amended Rule 11UA with the pre-amended Rules:

A chart below summarizes the pre and post amendment position on valuation requirement for the purpose of Angel Tax.

9. IndusLaw comments

The clarification on valuation rules were eagerly awaited particularly since the law, to apply Angel Tax for foreign investment, was applicable since April 1, 2023.

Some of the key considerations or issues flowing from the amendments to Rule 11UA are summarised below:

It is interesting to note that the Notification provides the effective date of its applicability as the date of publication in the Official Gazette, which is September 25, 2023. Consequently, a question may arise whether the amended Rule would apply to share issuances undertaken before this date or only for issuances undertaken on or after September 25, 2023. CBDT must clarify this aspect to avoid confusion.

Moreover, the amended Rule 11UA introduces additional valuation methods for non-resident investors, offering them the flexibility to select the most optimum method. However, a question remains whether the company issuing shares can adopt different valuation methods for different investor classes (e.g., resident and non-resident) within the same round of share issuances.

While the five additional methods are made applicable only for non-resident investors, to avoid any discrimination and maintain consistency, the same ought to have been made applicable even to resident investors. So far, no rationale is provided for excluding resident investors to be able to take advantage of additional five methods.

Typically, non-resident investors subscribe to CCPS of an Indian company at a value higher than the FMV. This is undertaken, to a large extent, to obtain various value protection and economic rights such as anti-dilution or liquidation preference. While the 10% tolerance limit is welcome, it may not fully aid non-resident investors to capture their commercial intent.

Lastly, clarity on the valuation for CCPS is particularly welcome and will certainly alleviate investor concerns to a large extent.

Footnote

1. Australia, Austria, Belgium, Canada, Czech Republic, Denmark, Finland, France, Germany, Iceland, Israel, Italy, Japan, Korea, New Zealand, Norway, Russia, Spain, Sweden, United Kingdom, United States

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.