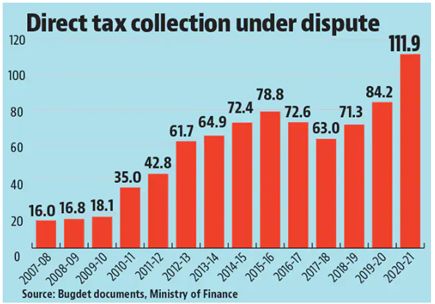

Direct tax collection and management in India has witnessed significant reforms in the recent years. However, disputes management is still a challenge for both- assessees as well as the tax authorities. With an estimated INR 10.6 trillion stuck in Income tax disputes at the end of FY 2020-21, there is an urgent need to improve the mechanisms for not only solving tax disputes, but more importantly for avoiding them.

As can be seen in the adjoining figure, in the previous decade, income tax disputes have risen rapidly with a slight dip in FY 2016-17 and FY 2017-18, but then increasing substantially in FY 2020-21. While the Government has consistently expressed its intention to expedite the dispute resolution process, it is not nearly enough.

This article analyzes expectations (and apprehensions!) from Budget 2023 on direct tax assessment and litigation.

New Dispute Resolution Scheme

The Sabka Vishwas Scheme for Indirect Taxes (2019) resulted in settling over 1,89,000 cases and similarly the Vivad se Vishwas Scheme for Direct Taxes (2020) encouraged over 1,29,000 taxpayers to settle tax disputes of over INR 980 billion.

In line with the above schemes, Finance Act, 2021 inserted Section 245MA to the Income-tax Act, 1961 where specified disputes can be resolved through a Dispute Resolution Committee. The scheme is available on a voluntary basis and is an alternate to the appellate mechanism. However, the scheme is limited to small assessees where the returned income is less than INR 50 Lakhs and the disputed addition is less than INR 10 Lakhs. One hopes that in this year's Union Budget announcement, the existing scheme may be extended to other large taxpayers. This will significantly help resolve matters with higher tax demands which are still in limbo with the appellant authorities.

Faceless ITAT Scheme

Introduction of enabling provisions for faceless ITAT proceedings have already created several apprehensions for assessees. Ideally the scheme should have been introduced in the Parliament, but it is a delegated legislation. The ITAT does not function under the administrative control of the Government. It is a quasi-judicial authority that operates independently and is empowered to lay down its own procedure.

Both, members and representatives of the assessees and tax department faced many practical challenges in conducting the hearings under the Faceless Assessment and Faceless Appeals Scheme. The issues of not granting personal hearings, stringent time limits for filing responses1, inability of the assessees to communicate their unique fact pattern to the authorities, etc. persist. Though the provisions empowering the Central Government to publish the Faceless ITAT Scheme has been introduced vide Finance Act, 2021, no such scheme has been notified till date. The worry is that if the Faceless ITAT Scheme is implemented amidst all the ongoing issues, it would defeat the elemental purpose of the ITAT.

It is pertinent to note that the ITAT is the last fact-finding authority in the appellate hierarchy for Income tax matters. The Supreme Court and High Court admit only questions of law and do not interfere on the facts established by the ITAT. Recently, the Hon'ble Supreme Court, in Muthoot Leasing and Finance Limited2 observed that the High Courts can interfere with the finding of facts by ITAT only under exceptional circumstances and after applying stringent parameters. Further, interference with the findings of fact can only be done when such findings are not supported by the material on record and the High Court has to address a specific question of law.

One hopes that to enable a smooth implementation of the Faceless ITAT Scheme, the Government, in this year's budget, introduces the scheme in phases with low effect appeal matters or covered matters that have already been decided in the case of the taxpayer in any previous year, and then once things settle larger cases can gradually be covered.

Timeline for disposing appeals before CIT(A)

Presently, there is a huge backlog of appeals pending resolution at CIT(A) and ITAT level. As on 31st March 2022, the number of cases pending with National Faceless Appeal Centre as per Central Action Plan for FY 2022-23 is above 5 lakhs. Certain appeals which go through the entire litigation cycle, i.e., from the CIT(A) to the Hon'ble Supreme Court may take around 20-25 years to achieve finality. Thus, significant amount of funds remains stuck in litigation for a substantial period.

As per Central Action plan for the current Financial Year, i.e., 2022-23, CBDT has fixed an annual target of 400 disposals by each appeal unit and has also decided the priority of cases. In view of the above, the Government could prescribe binding timelines for disposal of appeals which shall help in clearing the huge pile of cases at CIT(A) levels.

Inspiration may be drawn from the Dispute Resolution Panel process under Section 144C wherein all such cases are duly disposed off within nine months. Additionally, the Dispute Resolution Panel process should be extended beyond cases involving transfer pricing, leading to a substantial number of disputes being resolved at the assessment level.

Functionality of Board for Advance Rulings (BAR)

The Government notified three BAR benches in September 2021. However, due to a lack of clarity on procedural aspects, these benches are not yet functional.

Assessees have an apprehension that since BAR is led by departmental officers, it may be difficult for them to take an unbiased and independent view. Further, the non-binding nature of the advance ruling proposal will lead to further burdening the already overburdened HCs as the applicant as well as the the tax department may file appeal in almost every case where the outcome of advance ruling is not in their favor.

The Government is expected to introduce further clarifications for the legal validity of the orders of the BAR and provide guidelines on its functionality. One hopes that these clarifications provide a definitive framework going forward.

High pitched assessments

An assessment made far beyond returned income is considered as a high-pitched assessment. Currently, under various criteria, demands of taxes, penalties, recovery, and prosecution are launched after segregating the normal cases from the high-pitched assessments. However, the Income Tax Act, 1961 fails to define 'high-pitched assessment'.

The CBDT vide various instructions, has set up Local Committees to deal with Taxpayers' Grievances from High-Pitched Assessments. The Local Committee comprises of 3 members of PCIT/CIT rank. Local Committees constituted in each PCCIT region and PCCIT (Exemption) consist of a PCIT (AU) of the region. Till date however, the number of grievances where assessment was found to be high-pitched has been substantially low.

It is expected that the Government may set up certain thresholds to determine such high-pitched assessments. The Government may also introduce equal representation of tax authorities and taxpayers in the Local Committee to ensure independence and neutrality. Including a technical member to determine such high value cases would boost the functioning of the Committee.

Making alternate claim, fresh claim during assessment

Many times, out of abundant caution and also to avoid certain penalty provisions, the assessee refrains from taking certain aggressive positions in its Return of Income irrespective of the fact that there are many supporting/ favorable judgements available to him at that point of time.

Considering that the time limit for filing revised return has also been reduced from one year (from end of assessment year) to 9 months (from end of relevant Financial Year), there are greater chances of assessees missing out on putting forth additional claims in the return of income.

In these cases, the assessee prefers to make such claims before the assessing officer during the course of assessment proceedings. In most cases, assessing officers disallow such claims by stating that those were not made in the return of income - relying upon the Hon'ble Supreme Court decision in the case of Goetze,3 wherein it was held that an assessee can claim a deduction only by filing a revised return. This jeopardies the assessee's position, resulting in an increased number of appeals.

In order to provide a smooth resolution to the assessee, one hopes that the union budget will introduce clarifications that may empower the assessing officer to admit fresh claims at the assessment stage also.

Clarity on reassessment

Finance Act, 2021 amended the reassessment scheme of the Income Tax Act substantially w.e.f. 1 April 2021. The new reassessment regime has extended the period of reassessment to 10 years from the end of the relevant assessment year. Further, reassessment can now be initiated only after conducting inquiry and providing the assessee an opportunity of being heard. Despite the enactment of the new reassessment regime, CBDT, vide The Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act 2020 permitted tax authorities to issue notice for reassessment till 30 June 2021 for the years which were getting time barred as on 31 March 2020 or 31 March 2021. Such notices could be issued following the procedure under the old reassessment scheme as effective till 31 March 2021. This led to significant litigation with regard to the reassessment provisions applicable to notices issued during 1 April 2021 to 30 June 2021.

The Hon'ble Supreme Court, in the case of Ashish Agarwal4 invoked extra-ordinary jurisdiction under Article 142 of the Constitution of India and upheld the validity of such notices and permitted the tax authorities to proceed further with the reassessment proceedings under the new regime.

Subsequently, CBDT vide its Instruction5, permitted reopening for AY 2013-14 and AY 2014-15 subject to satisfaction of the 6-year threshold for reassessment. This has led to ambiguity since notices for AY 2013-14 and AY 2014-15 got time barred on 31 March 2021 and consequently notices could not have been issued under new regime as well. The CBDT Instruction has been upheld by the Hon'ble Delhi High Court in the case of Touchstone Holdings Private Limited6.

It has been observed that, time and again, the Government has overturned the decision of the Hon'ble Supreme Court in its favor by making retroactive amendments through the Finance Act. One such judgement sought to be overturned here is Ashish Agarwal (supra). Though the reassessment for AY 2013-14 and AY 2014-15 has been held to be time-barred, in view of the CBDT Instruction, the Government may include provisions for reassessment of cases for AY 2013-14 and AY 2014-15 where notices were issued between April 2021 and June 2021 under the old regime.

Further, for reassessment of case, the Government has shifted from criteria of "reason to believe" that income chargeable to tax has escaped assessment to requirement of "information" which "suggests" that income chargeable to tax has escaped assessment. The term "information" has a wide scope, expanding the ambit of the reopening of proceedings. The Government may amend the definition of "information" to provide stringent conditions for reopening of proceedings under new regime.

Under the new regime, reassessment can be conducted at any time up to ten years from the end of the relevant assessment year. The "information" pertaining to the assessee is not put to rest for a decade. The assessee has a sword hanging over his head for a period of ten years, which is unreasonable and arbitrary since even under the Companies Act, 2013, the companies are not expected to maintain records of documents beyond 8 years.

Conclusion

On one hand, the Government is introducing and promoting various dispute settlement schemes to reduce litigation, while on the other hand the period for reassessment has been increased to ten years from the end of the assessment year. Ironically, the time limit for assessment has been reduced to 9 months after the end of the assessment year.

One of the conditions for reassessment is 'any audit objection to the effect that the assessment in the case of the assessee for the relevant assessment year has not been made in accordance with the provisions of this Act'. The assessee is under constant risk of being reassessed on account of such audit objections. Lately, it has been observed that reassessments are conducted arbitrarily and in violation of the principles of natural justice.

The only reasonable explanation for the change in timeline is that even though the Government intends to dispose assessments at the earliest, they are unconvinced by the quality of such assessments and hence do not want to miss a chance to reassess the assessee. This will only dilute the importance of the assessment proceedings and augment the litigation cycle.

The Government may consider introducing measures for rationalizing these two aspects of tax litigation by reducing the time limit for reassessment, increasing the time limit for assessment based on monetary limits, treating reassessment as an exception and introducing the concept of reassessing an assessee for a particular year only once. Needless to say, the new reassessment regime needs a revisit. It is only when all such provisions are in consonance with each other, will the Government be able to achieve its objective.

The Government may also contemplate introducing certain Alternate Dispute Resolution (ADR) methods considering the pressing priority of speedy disposal of tax cases, since the erstwhile alternate dispute resolution scheme under the Income-tax Act, 1961, the Income Tax Settlement Commission, has been abolished with effect from 1 February 2021.

ADR gives an opportunity to the parties to resolve their disputes outside the court with the assistance of a neutral third party. Unlike the Dispute Resolution Schemes where the taxpayers are required to pay a certain high percentage of tax for settling their tax matters, ADR methods can be tailor made for the assessees and decided on merits. Such mechanisms can be introduced to include high value cases, and eventually extended to all other issues. ADR will not only be cost effective and efficient but will also ensure confidentiality and fast track open cases. Lets hope Union Budget 2023-24 addresses some of these issues.

Footnotes

1. Urdu Education Society [2022] 145 taxmann.com 11 (Bombay)

2. [2023] 146 taxmann.com 53 (SC)

3. [2006] 157 Taxman 1 (SC)

4. [2022] 138 taxmann.com 64 (SC)

5. Instruction No. 1 of 2022 dated 11 May 2022

6. [2022] 142 taxmann.com 336 (Delhi)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.