INTRODUCTION

In a significant move to enhance transparency and disclosures amongst foreign and domestic investors, the Indian Ministry of Corporate Affairs ("MCA") has introduced the requirement of mandatory dematerialization of securities for Private Limited Companies by way of the Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023 ("Amendment") dated October 27, 2023. This Amendment introduced Rule 9B ("Rule") thereby mandating the issuance of securities in dematerialized form and facilitating dematerialization of all its securities by Private Limited Companies.

As a result, all Private Limited Companies, other than Small Companies and Government Companies, are now required to convert their securities into dematerialized form by September 30, 2024, in accordance with the provisions outlined in the Depositories Act, 1996, and other allied laws. This is not limited to only shares, each and every kind of "securities" shall be dematerialized.

Previously, only public limited companies were required to issue these securities in dematerialized form and private limited companies were exempted and hence could issue their securities in the form of a physical document.

APPLICABILITY

It is applicable on any Private limited company which is incorporated in India and has any Subsidiary Company outside India and any Private Limited Company which is a Subsidiary Company of any Company Incorporated/ Registered outside India other than Small Companies and Government Companies

In this regard, "Small Company" means a company, other than a Public Limited Company, having Paid-up Share Capital not exceeding Rs. 4 crores; and having a Turnover not exceeding Rs. 40 crores.

However, the following companies are excluded from the definition of "Small Company":

i. Holding and Subsidiary Company

ii. Companies and Body Corporates governed under the Special Act

iii. Section 8 Company

It is to be noted that the Companies in India having the status of a holding, or a subsidiary are excluded from the definition of a Small Company irrespective of their paid-up share capital and turnover.

Therefore, this amendment applies to all such holding and subsidiary companies including a holding or subsidiary company of a foreign company.

Holding Company means a company (whether incorporated in India or outside India) which holds more than 50% shares or voting power of the other company.

Subsidiary Company means a company in which a holding company holds more than 50% of shares or voting power or has the power to appoint or remove all or a majority of the Board of Directors.

UNDERSTANDING THE COMPLIANCES

- For Every Private Company

- For Every Security Holder

Every Private Company on which the amendment is applicable shall mandatorily have to undertake the following compliances:

i. Facilitate dematerialisation of all existing securities and secure International Securities Identification Number (ISIN) for such securities, by 30th September 2024 (18 months from 31st March 2023).

ii. Not issue securities, or buyback its securities unless the entire holding of its promoters, directors, and key managerial personnel have been dematerialised,

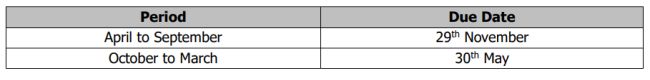

iii. Such Companies shall file Form PAS-6 to ROC within 60 days from the conclusion of every 6 months.

Every Security Holder of any private company on which the amendment is applicable shall mandatorily have to:

i. Get a demat account opened with the authorized depository for holding the dematerialized securities therein.

ii. Ensure that their existing securities in (a) private limited company(ies) are dematerialized before transferring them or subscribing for new shares, after 30 September 2024.

Note: Every security holder shall not transfer his/ her securities or subscribe to any security issued by a Private Limited Company which needs to comply with the provision of this Rule, unless their securities are dematerialised.

CONSEQUENCES OF NON-COMPLIANCE

In the absence of any specific penalty outlined for non-compliance, Section 450 of the Companies Act, 2013 is automatically invoked, which becomes applicable to penalize any violation of the newly introduced Rule 9B. Consequently, in instances of non-compliance of provisions of Rule 9B, the company and every officer in default will be subject to a penalty of Rs. 10,000/- (Rupees Ten Thousand Only), in cases of continuing default, an additional penalty of Rs. 1,000/- per day will be imposed, subject to maximum Rs. 2,00,000/- (Rupees Two Lakhs Only) for the company and Rs. 50,000/- (Rupees Fifty Thousand Only) for any officer in default.

ANALYSING THE PROCESS AND THE IMPACT

1. ISIN Acquisition and Facilitating Dematerialization:

(a) This amendment mandates all Private Limited Companies other than Small Companies and Government Companies to mandatorily obtain an International Securities Identification Number (ISIN) for each class of its securities. This unique identifier ensures accurate tracking and identification of securities across international markets, enhancing transparency and facilitating cross-border transactions.

(b) Additionally, all securities of the company, except for permitted exceptions, must be dematerialized. This involves converting existing physical certificates into electronic form and maintaining ownership records electronically through depositories. This process generally involves submitting a Dematerialisation Request Form (DRF) through a Depository Participant (DP) to the Depository. It also needs a tripartite agreement with the Depository and the Registrar to Transfer Agent. Information is exchanged by the Depository and RTA until the physical certificates are extinguished

(c) Upon completion of the required formalities, the Depository credits the dematerialized securities to the relevant Demat accounts, notifying both the security holder and the Company/ RTA.

2. Impact on Foreign Investors:

Compulsory dematerialisation necessitates all foreign investors with securities in Indian companies to open demat accounts with the Indian depositories. This involves fulfilling certain procedural requirements, including, but not limited to:

i. Obtaining a Permanent Account Number (PAN).

ii. Complying with Know Your Customer (KYC) norms.

iii. Potentially incurring financial charges.

iv. Authenticating of certain documents

3. Role of Custodian in case of sale/purchase of shares by Non-resident investors:

Non-resident investors shall appoint a custodian to manage their Demat account and handle trade settlements. The custodian acts as a nominee through whom trades are executed and holds shares on behalf of the non-resident investor. This simplifies the process for non-residents, ensuring compliance with regulations and facilitating smooth transactions.

The annual fee levied by the custodian varies among different custodians.

CONCLUSION

The Amendment heralds a significant transformation for Private Limited Companies in India. By way of mandating the dematerialization of shares, the Ministry aims at modernizing the existing regulatory regime and addressing the persisting issues of fraud, transparency, and operational inefficiencies. Further, it is noteworthy that subsidiaries of foreign companies, fulfilling the qualification criteria, are compelled to comply with the statutory requirement.

This strategic move signifies a crucial step towards enhancing transparency, strengthening regulatory compliance, and fostering a modernized, digitized ecosystem, especially, within Private Limited Companies. This is particularly relevant in eliminating fraudulent transactions and benami shareholders. It is a significant stride towards aligning India's existing corporate landscape with contemporary global standards.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.