- within Employment and HR and Accounting and Audit topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

India has always followed a physical presence test to determine the tax residency of individuals in India. In respect of Indian Citizens visiting India, a presence of 182 days was provided to ensure that they can attend to personal and social affairs in India without being regarded as a resident. However, recently, vide Indian Budget 2020 and Budget 2021, certain amendments have been made in Indian residency rules, which may impact Indian citizens, especially the ones living in countries where there is no personal tax. Determining the right residential status is extremely important since the taxability of various incomes of an individual – Indian as well as overseas – depends on the residential status.

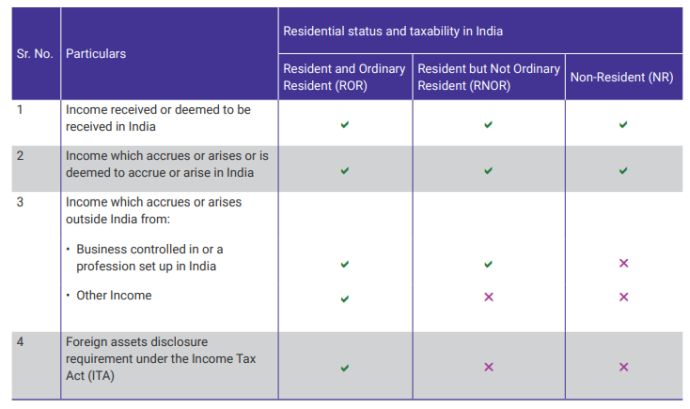

We have summarized below the taxability of in case of different types of residents:

Download >> New residency rules for Indian citizens staying abroad: Are you impacted?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.