Introduction

The Reserve Bank of India ('RBI') introduced the Liberalized Remittance Scheme ('LRS') back in February 2004. The LRS allows resident individuals to remit money abroad for various permissible purposes, such as education, medical treatment, travel, investments, gifting, etc. At the same time, there are limits on the amount of money an individual can remit outside of India in one financial year.

Simply put, LRS was introduced by India's central bank, also known as the Banker's Bank, to rationalize and streamline the process of outward remittances for resident individuals in the country. Corporate entities, partnership firms, Trusts, HUFs, etc. are not eligible for LRS. Further, outward remittances under the LRS were to facilitate only permissible transactions that are wide-ranging. Impermissible transactions under the LRS would be remittances for speculative activities such as trading in foreign exchange derivatives, lottery winnings, all such transactions that are otherwise prohibited by FEMA and those that are in the nature of margin calls or remittances for margins to foreign exchanges or counterparties.

While the LRS made it easier for resident individuals in India to carry out remittances without obtaining prior approval from the RBI for each such transaction, concurrently, the LRS limits were periodically revised and boosted to accommodate the changing needs.

Legal Framework of the LRS

The legal aspects of schemes such as LRS vary significantly from country to country depending on multiple factors. Therefore, it is important to refer to the specific rules and regulations of the country in question to fully understand the contours of its outward remittance scheme. Such contours generally include a regulatory framework that sets out rules, guidelines, and limitations for individuals or entities, within which the outward remittance scheme may operate. Permissible purposes, remittance limits, and eligibility criteria constitute the basic building blocks for such a scheme in any country. Further, reporting and documentation requirements usually operate parallelly with anti-money laundering and know-your-customer ('KYC') compliances to ensure regulatory oversight, enforcement, and responsible monitoring. For instance, the USA has regulations in the form of the Foreign Account Tax Compliance Act, 2010 ('FATCA') and reporting requirements of certain foreign financial accounts to the Internal Revenue Service ('IRS') in connection with international remittances. The UK and Canada, on the other hand, permit residents to transfer money abroad freely without specific limits or requirements. However, transactions involving large sums of money may be subject to reporting requirements and anti-money laundering regulations.

Brief Timeline & Key Features of LRS in India

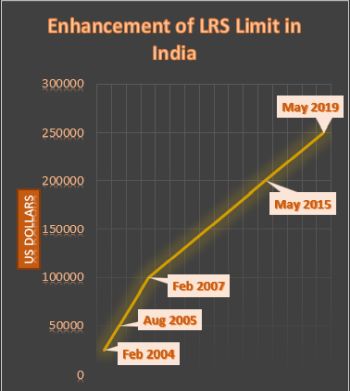

What the RBI started in February 2004 with an initial limit of USD 25,000 per resident per financial year, went on to parade up to USD 250,000 per resident per financial year by May 2019. In other words, resident individuals in India were permitted to release such amounts for legitimate transactions without seeking prior approval from the RBI.

The key years that marked the enhancement of the LRS limits were:

- 2005: the LRS limit was doubled from USD 25,000 to USD 50,000,

- 2007: The LRS limit was further doubled from USD 50,000 to USD 100,000, and resident individuals were also allowed to open foreign currency accounts with banks outside India.

- 2015: The LRS limit was again doubled and raised to USD 200,000.

- 2019: This year witnessed a 25% raise in the LRS limit to the current level of USD 250,000.

The enhancement of the LRS limit was done in order to:

- Facilitate the flow of remittances from India to other countries,

- Promote trade and investment between India and other countries,

- Support the government's economic development goals.

With such enhancements, came the need for better regulation and hence, in June 2018, the RBI brought in the Single-Line-Reporting System ('SLRS') which was a compliance requirement for banks to submit all transaction details under the LRS on a common server.

On the one hand, resident individuals can make multiple remittances throughout the year under the LRS so long as the total amount does not exceed the prescribed limit. On the other hand, they need to comply with income tax regulations, as far as any income earned from foreign investments or assets, acquired through LRS remittances. Correspondingly, the banks are required to report all remittance transactions undertaken under the LRS to the RBI through SLRS for monitoring purposes.

Importance of Compliance under the LRS

It is essential for individuals engaging in foreign currency transactions, whether for personal or professional purposes, to remain updated with the changes pertaining to LRS. This is because the LRS is intrinsically linked to the provisions of the Income Tax Act, 1961, and the Foreign Exchange Management Act, 1999, while also being associated with the Prevention of Money Laundering Act, 2002, and the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015. Non-disclosure of income and engaging in impermissible transactions under the LRS may often result in criminal charges being filed by prosecuting agencies against such individuals.

In the case of Srinidhi Karti Chidambaram v. Principal Chief Commissioner of Income Tax (Tamil Nadu & Puducherry) & Ors.(MANU/TN/6800/2018), the High Court of Madras held that the Principal Director of Income Tax is authorized to approve prosecution or file a prosecution complaint for offences under section 50 of the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015.

Therefore, factors such as verifying the individual's resident status, ensuring the purpose of outward remittance is permissible, involving Authorized Dealers ('AD') to initiate such remittance processes, adhering to the prescribed remittance limits, and complying with documentation requirements become crucial considerations for individuals seeking the protection afforded by the LRS.

Interesting Statistics on LRS in India

RBI publishes data on outward remittances under the LRS in its monthly bulletin. The data shows that over 50% of remittances from India are for travel and education. Remittances for the purpose of investments and purchase of immovable property are also on the rise.

The same has also been recorded by the Ministry of External Affairs ('MEA') in its report for the financial year 2019-20. The report found that remittances for education-related purposes accounted for about 54% of the total remittances under the LRS. After travel and education, another 30% of remittances are for gifts and maintenance of close relatives. However, remittances fell by almost one-third in the pandemic year 2020-21 but they started improving as soon as travel restrictions were eased.

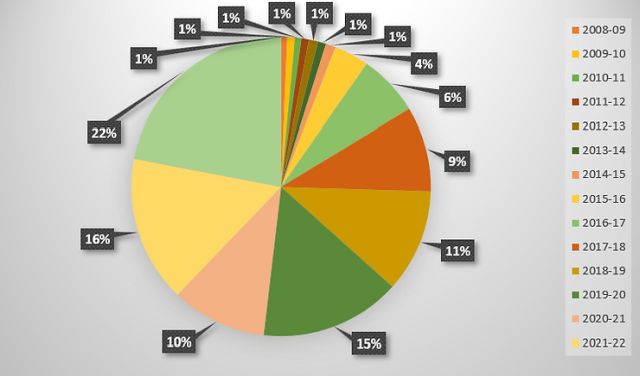

Total Outward Remittances under LRS for Indian Residents – Yearly (USD Million)

(Data Source: RBI) (Database on Indian Economy. RBI's Data Warehouse, Outward Remittances under the Liberalised Remittance Scheme for Resident Individuals - Yearly. https://dbie.rbi.org.in/DBIE/dbie.rbi?site=statistics)

The pie chart clearly shows the percentage distribution of remittances since the inception of LRS in India. The maximum amount of funds released outside the country under the scheme was in FY 2022-23 accounting for 22% of the total outward remittances till date. Second in line was FY 2021-22, closely followed by FY 2019-20. The least amount of outward remittances under LRS was seen during its formative years, from FY 2008-09 to FY 2014-15.

It is, however, interesting to note that the remittances data of the RBI and the Global Knowledge Partnership on Migration and Development ('KNOMAD'), a unit of the World Bank, do not match. It is, no doubt, difficult to arrive at exact figures when calculating the total outward remittances due to transactions taking place through unofficial channels. However, the data published by the RBI and KNOMAD often do not match. This could be due to variations in fiscal or calendar year, reporting periods and methodologies for data collection.

It can be seen from the recent trend of outward remittances under the LRS by resident individuals in India that travel takes away most of the money remitted abroad. Competing for the second place are payments remitted abroad for studies and maintenance of close relatives, followed closely by gifting. While outward remittances for travel purposes saw a spike in January 2023, outward remittances for the purposes of donations have remained negligible amongst other purposes. It is noteworthy that the intent behind comparing 2023 trends with previous years is to show the shifts after the recent changes in LRS announced on 01.02.2023 by the Indian Government in the Union Budget 2023-24.

Conclusion

As the name suggests, the LRS liberalizes the existing foreign exchange regulations and facilitates the smooth transfer of funds to other countries by resident Indians. However, direct, or indirect capital account transactions with countries that have been identified by the Financial Action Task Force (FATF) as 'non-cooperative countries and territories,' are either not permissible or highly monitored. The FATF, a Paris-based global watchdog, identifies countries that do not effectively combat money laundering and terrorist financing and then classifies them under either the Blacklist or the Grey List. As on February 2023, the FATF has blacklisted the Democratic People's Republic of Korea, Iran, and Myanmar. It would be interesting for some to note that the United Arab Emirates currently finds mention in the Grey List of FATF. Thus, while the LRS practically makes things easier for resident individuals, legally, it is an instrument for heavy monitoring, both nationally and internationally.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.