Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up of new manufacturing units in the state. Such incentives are in the form of capital subsidies, interest subsidies, subsidized electricity tariffs, and more. The purpose of such incentive schemes is to attract investment thereby enabling infrastructure development, generating employment, developing focus sectors, and largely facilitating the overall economic development of the state.

To enable the availability of a quick summary of such general incentives offered by various Indian states, Nexdigm is releasing a series of documents focusing on providing a brief overview of such incentives offered by respective State Governments in India. This document covers information about incentives offered by Karnataka under the 'Industrial Policy 2020-2025'.

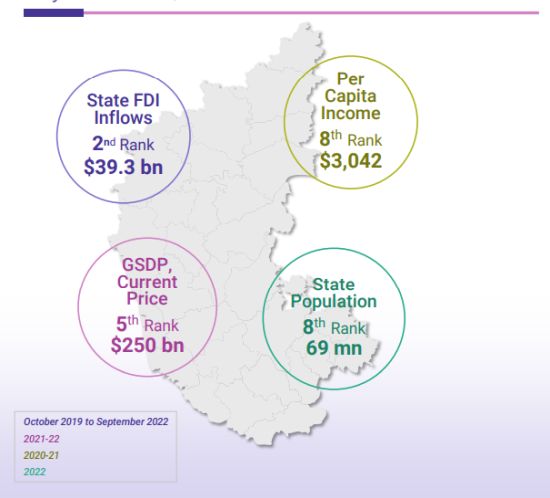

Key Statistics | Karnataka

To facilitate the vision of establishing Karnataka as a competitive and favored investment destination, alongside focusing on investment promotion, the Government of Karnataka has released 'Industrial Policy 2020-25', valid from 13 August 2020 to 12 August 2025 for all manufacturing industries.

The policy aims to attract investment of ~USD 62 billion by encouraging entrepreneurs to innovate and generate employment for ~2 million people in Karnataka by enhancing manufacturing opportunities.

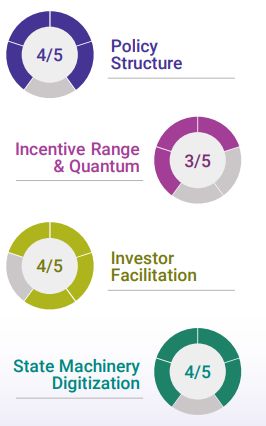

Nexdigm Ratings and Observations

- The industrial policy is framed to attract manufacturers to set up their manufacturing units, especially in developing regions (Zone 1 & 2) of the state, thereby providing higher incentives for such investments.

- This policy comes with notable fiscal, labor, and land reforms that focus on facilitating investments by providing fresh incentives and easing regulatory processes.

- Investment Promotion Subsidy is one of the major incentives provided under the scheme which is linked to the turnover and value of investment.

- The policy places a special emphasis on business growth and development of the Micro, Small, and Medium Enterprises (MSME) and also offers attractive incentives to this sector.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.