I. INTRODUCTION

The Constitution of India enlists labour-related legislation under the concurrent list, which means both the Central Government and the State Government are equally competent and permitted to enact labour legislations. At present, more than 45 central legislations and over 100 state legislations have been enacted for labour welfare, frequently on overlapping matters.

The Central Government has notified four labour codes to consolidate and simplify labour legislations in the country,: (i) code on wages; (ii) code on industrial relations; (iii) code on social security and welfare; and (iv) code on occupational safety, health and working conditions. This is the first of a four part series of each of these codes.

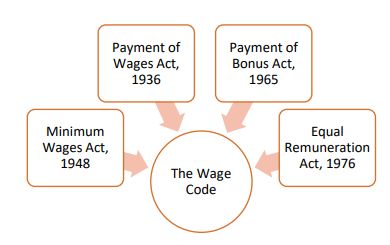

Codes on Wages, 2019 ("Wage Code" or "Code") awaits the notification of its effective date. The objective of the Wage Code is to consolidate the 4 existing labour laws relating to wages, into one integrated code.

Since all four legislations govern various aspects of the same subject, i.e. wages, the Government's objective is to combine and cover all four under one statute, the Wage Code. The Wage Code is thus the first step towards implementation, enforcement, and harmonisation of the country's labour laws.

II. CODE ON WAGES: STRUCTURE

The Code is divided into separate chapters dealing with minimum wages, payment of wages, and provisions relating to the bonus.

III. COVERAGE AND APPLICABILITY

The Code will apply to employees, both in the organised and the un-organised sector. Provisions relating to payment of wages under the Code will extend to all employees, irrespective of their wage ceiling and type of employment, whereas the Payment of Wages Act, 1936 was only applicable to factories, certain specified establishments, and to employees who drew monthly wages up to INR 24,000, while the Minimum Wages Act, 1948 applied only to scheduled employments.

Under this Code, the Central Government will make wage-related decisions for employments in the railway, mines, and oil fields, among others, whereas the State Government will make decisions for all the other sectors. The definition of 'employee' now includes contractors as well, which will ensure that even contractors are entitled to be paid minimum wages as per the Code.

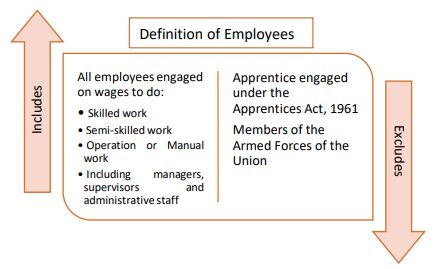

IV. EMPLOYEES VIS-À-VIS WORKERS

The Code prescribes two separate definitions of 'employees' and 'workers'. The definition of an 'employee' includes individuals in supervisory, managerial, and administrative roles, whereas the definition of 'workers' excludes such individuals, and excludes indiviuals who are employed in a supervisory capacity drawing a monthly salary exceeding INR 15,000 while specifically including sales promotion employees and working journalists. Since the definition of employees is wide, it implies that such categories of employees will also fall under the Wage Code, unlike the Minimum Wages Act, 1948, which defined 'employee' as any person who is employed for hire or reward to do any work, skilled or unskilled, manual or clerical, in scheduled employment in respect of which minimum rates of wages have been fixed.

There are however, inconsistencies with respect to the wages of 'employees' and 'workers' under the Code. For example, under the Section 6(6) of the Code, for the fixation of minimum rates of wages, only 'workers' are mentioned and not 'employees'.

Definition of Worker

Any person employed in any industry for hire or reward to do:

- Any manual, unskilled, technical, operational, clerical or supervisory work

- 'Working journalist' and 'sale promotion employees'

- For purposes of Industrial Dispute, such person who has been dismissed, discharged or reterenched or otherwise terminated, or has a consequence of the above has led to the dispute

Any such person:

- Employed mainly in managerial or administrative capacity

- Employed in a supervisory capacity drawing a wage exceeding INR 15,000 per month

- Apprentice under the Apprentices Act, 1961

- Subject to the Air Force Act, 1950, the Army Act, 1950, and the Navy Act, 1957

- Employed in the police service or as an officer or other employee of a prison

The Code prohibits gender discrimination in matters related to wages and recruitment of employees for the same work or work of similar nature, except in cases where employment of women in such work places is prohibited/restricted under the laws. 'Work of similar nature' is defined as 'work for which the skill, effort, experience and responsibility required are the same'.

V. EMPLOYER

The Code has detailed the definition of 'employer' to include an occupier or manager of a factory, a person having ultimate control over the company affairs, managing director, contractor, and legal representative of a deceased employer in addition to the regular definition of a person who employs employees in its establishments.

The existing law did not include such a definition, or only defined it in relation to factories and establishments where authorities have ultimate control over the company. This was insufficient and therefore created ambiguity with determining the nature of an employer.

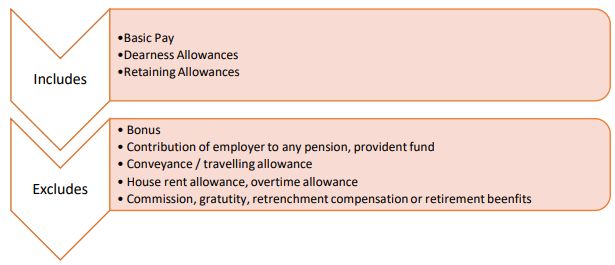

VI. WAGE

The definition of 'wages' has been included within the Code to include all remuneration that can be expressed in terms of money, including salaries, allowances, etc.

VII. FIXING THE MINIMUM WAGE

The Code prohibits employers from paying wages lesser than the prescribed minimum wage. Minimum wages will be notified by the Central and State Governments. These minimum wages shall be determined taking into account the skills of workers, geographical areas, hours of work or piece of work, arduousness of work such as temperature, humidity, hazardous occupations, or processes etc. The Code uniformly applies to all employees across an organisation.

The minimum wages will be revised and reviewed by the Central or State Governments at intervals of not more than 5 years.

The new concept of 'floor wages' is introduced through this Code. According to the Code, the Central Government will fix a floor wage, considering the living standards of workers as well as the geographical areas. Based on the floor wage rate, the appropriate Government (Central or State) can fix the minimum wage rates. The minimum wages prescribed by the appropriate government cannot be lesser than the floor wage. In case the existing minimum wages fixed by the appropriate government are higher than the floor wage, they cannot reduce the minimum wages.

VIII. PAYMENT OF WAGES

A new clause on payment of wages has been introduced, which allows payment to be made in current coin, currency notes, by cheque, by crediting the wages in the bank account of the employee or by electronic mode.

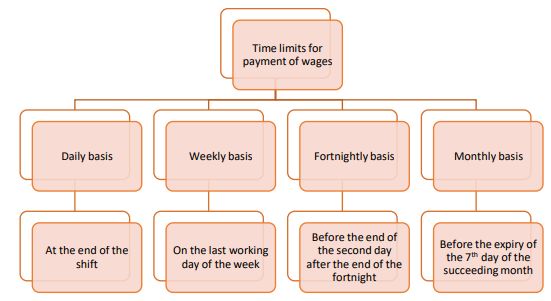

Under the Code, the wage period is now fixed by the employer either as daily or weekly or fortnightly or monthly, in order to ensure that the wage period does not exceed 1 month.

The time limit for payment of wages has also been prescribed. In a case where an employee is removed, dismissed, retrenched, resigns, or becomes unemployed due to closure of an establishment, the wages shall be paid within 2 working days of such removal, retrenchment, or resignation. This definition now also includes 'resignation' which is an important consideration for the employer to keep in mind.

The appropriate government may fix the number of hours that constitute a normal working day. In case the employees work in excess hours of a normal working day, they will be entitled to overtime wage, which must be at least twice the normal rate of wages.

Under the Code, an employee's wage may be deducted on certain grounds including: (i) fines; (ii) absence from duty; (iii) accommodation given by the employer; or (iv) recovery of advances given to the employee, among others. These deductions shall not exceed 50% of the employee's total wage. In case the deductions exceed 50%, the excess can be recovered, as provided in the rules formulated under the Wage Code. In case the deductions made by the employer are not deposited with the trust or in a Government fund, the employee cannot be held responsible for such default of the employer.

IX. PAYMENT OF BONUS

Provisions on payment of bonus under the Code are applicable to all employees whose wages do not exceed a specific monthly amount as notified by the appropriate government. Bonus will be paid out of allocable surplus (calculated in respect of any accounting year, after deductions for depreciation, direct taxes or such other sums prescribed by Central Government from gross profits for that year), which is at least: (i) 8.33% of wages; or (ii) Rs. 100, whichever is higher.

Bonus payable shall be equal to 60% of the allocable surplus in the case of banking companies, and 67% of the allocable surplus in the case of other establishments.

An employee can receive a maximum bonus of 20% of his annual wages, in a financial year. The Code also lays down the calculation of set on and set off for the allocable surplus post the 5 th accounting year in which the employer sells the goods produced or manufactured or services provided. All departments or undertakings or branches of an establishment shall be treated as part of the same establishment for the purposes of computation of bonus under the Code.

The bonus shall be proportionately reduced in the event the employee has not worked for all working days in an accounting year, by adjusting the minimum bonus if such bonus is higher than 8.33% of the salary or wage of the days such employee has worked in that accounting year.

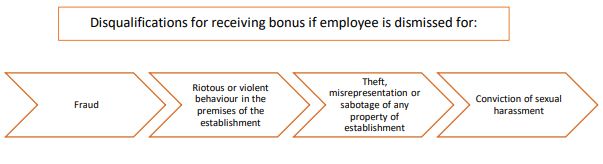

As a step forward, the disqualification for conviction of sexual harassment is now an additional provision, which did not exist under the repealed laws. All eligible employees will need to be paid bonus within 8 months from the close of an accounting year.

X. INSPECTOR-CUM-FACILITATOR

The Code provides for the appointment of an Inspector-cum-Facilitator to carry out inspections of employers and employees for better compliance. Further, the Inspector-cum-Facilitator will also reserve the right to examine any person on the establishment premises and seize, search, or take copies of wages, as he/she may consider necessary if the employer has committed an offence. The inspection shall be conducted based on a scheme decided by the appropriate government.

The Inspector-cum-Facilitator can only initiate an action under the Code, after giving the employer an opportunity to comply with the provisions of the Code. If during the time period, the employer complies with the written instructions of the Inspector-cum-Facilitator, he/she cannot proceed against the employer. This will ensure that the employer has a right to be heard. However, in case of repetition of offence within 5 years of the first violation, such opportunity will not be provided.

Keeping in line with the digitisation initiatives of the Government, the Code now allows inspection electronically and calling of information relating to the inspection via a web-based platform.

XI. ADVISORY BOARDS

The Central and State governments will constitute advisory boards. The Central Advisory Board will consist of: (i) employers; (ii) employees (in equal number as employers); (iii) independent persons; and (iv) 5 representatives of the State government.

XII. COMPLIANCES UNDER THE CODE

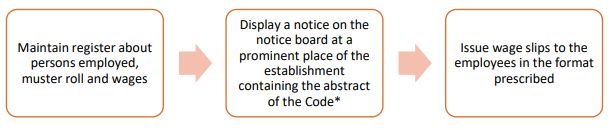

Every employer will need to comply with the following:

*The notice to contain category-wise wage rates of employees, wage period, day or date and time of payment of wages and the name and address of the Inspector-cum-Facilitator of the jurisdiction.

XIII. OFFENCES AND PENALTIES

The Code specifies the following penalties for offences committed by the employer, such as (i) paying less than the due wages; or (ii) contravening any provision of the Code. Penalties vary depending on the nature of the offence, with the maximum penalty being imprisonment for 3 months along with a fine of up to INR 1,00,000. The compensation payable for any default in payment of wages, minimum wages, bonus, etc. could be up to 10 times the claim amount as may be determined by the relevant authority.

In case of a subsequent offence, within 5 years from the first offence, the penalty will be imprisonment for 1 month or a fine up to INR 40,000 or both. If the offence is committed by a company, then every person who at the time of the commission of the offence was the in-charge and responsible for the conduct of the company, will be responsible and deemed to be guilty.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.