In August 2015, the Organisation for Economic Co-operation and Development (OECD) published the first edition of the Common Reporting Standard (CRS) Implementation Handbook to provide practical guidance to assist government officials in implementing the Standard for Automatic Exchange of Financial Account Information in Tax Matters (AEOI). The AEOI and CRS represent a significant step towards the automatic exchange of information on individual and entities between financial institutions and government. As of April 2016, over 90 jurisdictions have committed to implement CRS by 2017 or 2018.

On the other hand, in November 2015, the G-20 endorsed the 15 Actions (the Actions) finalized and released by the OECD on its Base Erosion and Profits Shifting (BEPS) Project. And now, where applicable, the Actions are awaiting implementation within the legislative and regulatory bodies of each participating country.

Among the 15 Actions, one of the Actions intended to be implemented most quickly is Action 13 – Guidance on Transfer Pricing (TP) Documentation and Country-by-Country (CbC) Reporting. A "three-tiered standardised approach"to TP documentation has been developed. Specifically, Action 13 requires all multinational enterprises (MNEs) to prepare both a master file providing a high-level overview of their global operations and a local file of TP documentation specific to each country relevant to its tax return. In addition, MNEs with revenue equal to or exceeding €750 million will need to prepare a CbC report to summarize by jurisdiction the revenue, pre-tax income, income tax paid and accrued, employees, stated capital, retained earnings, and tangible assets. Action 13 recommends countries which require CbC reporting to start with the 2016 tax year, with those initial reports being filed in 2017.

In this Tax Flash, we aim to provide you with a summary of the major development in regulations in various countries in relation to CRS / AEOI and CbC reporting.

I. AEOI / CRS

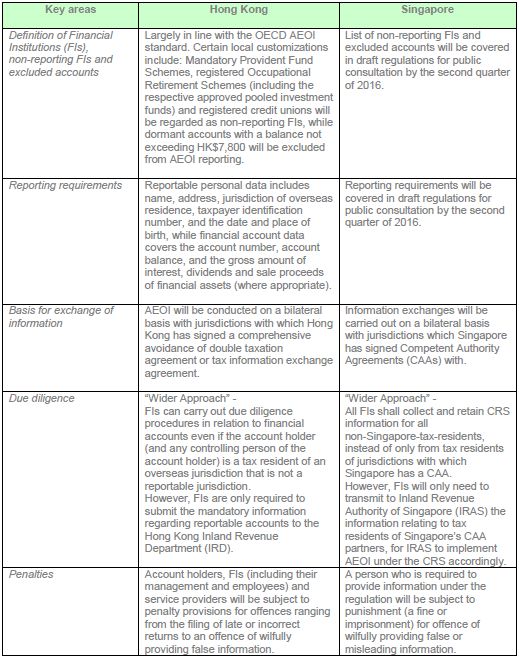

Most Asian jurisdictions have committed to adopt CRS by 1 January 2017 and undertake the first exchange of information in 2018. To implement the CRS as committed, Hong Kong and Singapore have prepared draft Inland Revenue / Income Tax (Amendment) Bill for public consultation and legislative process recently. The key areas of the respective legislative framework on AEOI are summarized below:

The full Inland Revenue (Amendment) Bill 2016 may be found here.

The full Income Tax (Amendment) Bill 2016 may be found here.

II. CbC Reporting

Following the release of "TP Documentation and CbC Reporting, Action 13 2015 Final Report" (Action 13 Report) on 5 October 2015 as part of the BEPS Project carried out by OECD and G20, many jurisdictions have announced revision of existing TP reporting regulations or introduction of new reporting rules. The regulations / rules are consistent with the OECD's BEPS measures in general. A comparison of the BEPS, US proposed rules and Japan tax reform proposal on CbC reporting is as follows:

China's State Administration of Taxation has also released a discussion draft of "Special Tax Adjustment Implementation Measures" on 17 September 2015 to revise existing guidance and introduce the CbC reporting requirement. China-based group with revenue of RMB5 billion or more will be required to provide information for CbC reporting. The documents shall be filed by China-based group or China subsidiary of MNEs together with annual tax return. The final version of the guidelines on TP documentation is expected to be released soon.

Further, the European Commission (EC) has indicated its view of an EC version of CbC reporting as appropriate in addition to the CbC reporting regimes its Member States will enact as part of BEPS. On 12 April 2016, the EU released a proposal to ensure that MNEs disclose the profit and tax accrued and paid in each Member State on a CbC basis. The proposal is designed to cover both the EU country in which a company is active and the so-called tax havens. That is, aggregate figures will also have to be provided for operations in other tax jurisdictions outside the EU. However, such proposal for a directive by the EC will require unanimous approval by all EU member countries in order to become effective and, it would be limited to MNEs that operate within the EU.

III. Suggested Actions

Several countries have taken steps to begin implementation of CbC Reporting over the past few months and this trend is expected to continue and accelerate. MNE groups should ensure the information technology and related reporting systems for all group constituents are capable of producing the necessary information in an appropriate form for the CbC reporting. It is also recommended that companies should commence preparation of TP documentation well in advance of the reporting deadlines, in order to allow sufficient time to collect and analyze the necessary information.

Businesses with international operations should be prepared for the introduction of similar CbC reporting requirements by tax administrations which may affect their current and future business operational arrangements.

RSM Tax Advisory (Hong Kong) Limited

RSM Hong Kong's dedicated and experienced tax specialists can:

- Advise on tax efficient holding and operational structures for new cross-border investment, including the formation of Hong Kong and Chinese business entities

- Review existing cross-border investment structures, advise on identified deficiencies, quantify any potential exposure from such deficiencies, and further advise on restructuring approach and procedures

- Assist clients to discuss and clarify matters with tax officials, including transfer pricing and advance rulings

- Act as client representative in tax audits and tax investigations

- Provide transaction support services on mergers and acquisitions, including tax due diligence, deal structure advice, tax health checks, related human resources arrangements and other tax compliance and consultation services

- Advise on human resources and structuring employment arrangements in a tax-efficient manner

- Advise on tax equalization schemes

- Provide tax compliance services for individual and corporate clients in Hong Kong and China

The aim of Tax Flash is to alert readers to recent developments. The information is general in nature and it is not to be taken as a substitute for specific advice. Accordingly RSM Hong Kong accepts no responsibility for any loss that occurs to any party who acts on information contained herein without further consultation with us.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.