Introduction

The map of the insurance world is changing as rapidly as other industries, with established markets becoming increasingly saturated, so re/insurance businesses are being forced to look further afield for opportunities. As we talk to our clients, Asia Pacific is increasingly in their sights – the insurance industry across the region had the highest average rate of growth over the last decade – as it is in ours too.

2011 has seen Clyde & Co make a significant investment in our Asia Pacific Corporate Insurance Group in the region, with the appointment of three additional partners dedicated solely to the industry. As part of our focus on this part of world, we decided to get a better understanding of the views of the London market by undertaking a "straw poll" of underwriters and brokers based in the UK, and to collate those findings with some commentary from our regional experts in Asia.

Asia is a rich and diverse region comprising countries with distinct cultural, financial and regulatory environments, a point sometimes obscured when considering the region from afar. As a result, we have chosen to focus only on the emerging markets – China, Indonesia, Malaysia, The Philippines, Thailand and Vietnam – to provide some interesting comparisons between the view of both east and west.

However, one thing is crystal clear: insurers are operating in a complex environment. As they look to the developing economies to expand their businesses they are encountering a range of challenges – legal, regulatory and commercial – which require both local knowledge and industry expertise to capitalise on opportunities in Asia, and beyond.

Where are foreign investors looking?

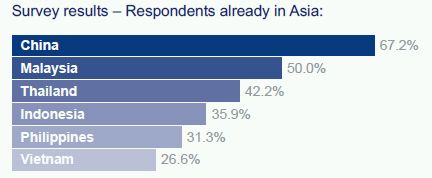

Respondents who were operating in Asia were asked where they were undertaking business. Unsurprisingly, given its rate of growth in recent years, China topped the list at just over 67% of respondents. There was then a significant gap, with Malaysia and Thailand in second and third place respectively.

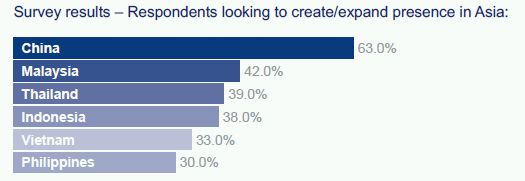

The ranking barely changes when respondents who are looking to create a presence in the region were asked their preferences. However, there was less enthusiasm for countries other than China, reinforcing the message that foreign investors see that market as the key first step to expanding in Asia.

The fact that China topped the list by some margin is to be expected. However, more surprising was that Indonesia was not higher. With a population of around 240 million, the perspective on the ground in Asia is that Indonesia is a country on which local businesses are focussing. One of the key drivers is that the local regulator has increased solvency requirements in order to deal with the issue of insurers being under-reserved. This will come into effect in 2012, and is likely to result in a trend towards consolidation and run-off opportunities, especially since it is a very fragmented market with the largest player only accounting for 5% of market share.

Survey respondents ranked Malaysia second, recognising the sophistication of its regulatory environment and the fact that the government has recently relaxed its shareholding rule to encourage foreign direct investment and particularly to create a takaful centre of excellence.

Anecdotal evidence also suggests that there is a lot of interest in Vietnam. A number of large multi-national players have been establishing a presence there over the last couple of years – licenses are relatively easy to obtain – however there is clearly over-capacity in the market.

The Philippines has a large population but concerns about the country's stability are impacting its attractiveness to insurers looking to expand in the region. However, despite regulatory hurdles that need to be overcome, insurers in Asia are looking to outsource their back office functions either to The Philippines or Malaysia, due to the quality of education and the level of spoken English of the population.

China

The attractions of the Chinese market are well understood by foreign insurers looking to expand their business internationally. As well as being the world's largest trading nation and second largest economy, it is already the seventh largest insurance market. In 2010, total premium income totalled Yuan 1.47 trillion (US$ 222 billion) – an increase of 33% from the previous year. Demand for insurance products is also forecast to increase by 2013, and projections for premium growth are optimistic.

However, there are a number of issues that concern foreign insurers who are either already present, or are looking to establish operations in the country.

Existing operations

Foreign firms account for around 5% of the life market and a smaller share of the general insurance market. Before the financial crisis hit the west, predictions for growth in China had suggested that market share would be taken closer to 10%, however there is no doubt that foreign insurance companies continue to find this a tough market to operate in, gain traction and increase their market share. Established domestic insurers, and the aggressive geographic expansion of the smaller insurers, are giving the foreign players a run for their money. This, combined with the highly regulated nature of the market, is forcing foreign insurers to review their business models and re-examine their positions.

With a number of foreign players, who have been in the market some time, failing to generate satisfactory profits, many are taking a long, hard look at the future feasibility of their relationships with the local partners. Despite the challenges, foreign insurers are not about to quit the Chinese market. They see China as an underinsured market with huge upside potential. One area of optimism for existing insurers is the motor market. China's insurance regulator is considering whether to open the market for compulsory motor insurance to foreign firms, allowing overseas insurers to boost their business in the world's largest car market.

Businesses looking to expand

When talking to foreign insurers about their Chinese strategy, a number have found a mismatch between intention and action. The credit crunch and resulting economic slowdown has meant that some were distracted by domestic issues – boards were concentrating on dealing with problems elsewhere and their eye was off the Chinese ball. In the interim, local insurers have been cementing their positions and growing their businesses – market share that it may be hard for newcomers to win from them.

Understanding the culture is frequently cited by those talking of moving into new markets, but China is a destination where this really matters. It is not simply about understanding the language but also the way in which people think. There is a real need for foreign expertise to help develop the market — and to enhance client understanding of risk management. With its history of communism, the Chinese population largely expects the state to look after it. If a building collapses, is burnt down or destroyed by an earthquake, the state will rebuild it — why would anyone need insurance? Change this culture and the rewards could be substantial.

Another concern that was expressed was the issue of finding the right experience and talent to build a successful business in China. The relative immaturity of the industry means that there is a not a huge pool of local talent, and language issues will always be a barrier for staff looking to move to the country. As well as internal demand, a number of recent circulars have either imposed regulations concerning required roles, appropriate qualifications or new boards and committees that will drastically increase the need for experienced staff, and further fuel the battle for talent in the Chinese market.

Malaysia

Although everyone is talking about China at the moment, it is by no means the whole story in Asia Pacific. Malaysia is a key economy at the heart of the region. Projections foresee growth in 2011 topping 12% across the Malaysian insurance industry.

The appeal of Malaysia is twofold. First, as with many other emerging market economies, there is a low insurance penetration rate in the country coupled with increasing consumer knowledge. This is in addition to growing bancassurance and takaful businesses.

Secondly, in 2009 the limit on foreign equity participation in conventional Malaysian insurers and takaful operators was lifted from 49% to 70%. This enabled foreign insurers with an existing minority interest to increase their equity interest in, and gain majority control of, them. In addition, more operational flexibility for locally incorporated subsidiaries of foreign insurers and takaful operators has been introduced, with the aim of strengthening the resilience and competitiveness of the Malaysian conventional insurance and takaful industries.

The Philippines

The Philippines is the world's twelfth most populous country – home to almost 95 million people. With such a significant population it is surprising that it often seems to be overlooked – certainly by our survey respondents, but also by insurance companies already operating in the region. Part of the reason for this may be that it is considered to be less stable than some of its neighbours. However, like other countries in the region, The Philippines potentially offers insurers significant increases in written premiums as improvements in wealth levels within a growing middle class population take place. The country has suffered little impact from the global recession in GDP terms with growth of 6.0% in 2010. Insurance premium growth rates for last year are estimated to have been 14% for non-life and 20% for life, assisted by economic growth in 2010 of over 6%.

There are an usually large number of insurance companies operating in The Philippines and the non-life market in particular has been saturated for some years with too many under-capitalised companies chasing too little business – another factor that is likely to make foreign insurers considering the market a little wary.

The Philippines Insurance Commission has introduced new capital requirements that may begin a major rationalisation within the extremely fragmented non-life segment. Over the long-term, such a rationalisation will be essential if the industry is to grow. At the moment, the lack of local companies with the capital and scale and therefore the ability to develop new and innovative products is a significant constraint on the development of the entire market.

Thailand

The appeal of Thailand may have been muted by the recent political turmoil and the impact of the world financial crisis on foreign investment. Nevertheless, Thailand's insurance industry continues to demonstrate strong growth. Thailand's Office of Insurance Commission revealed that insurance business in the first quarter of 2011 grew by 13.52% on last year's quarterly figures, with total direct premium in the country now worth Baht 111.783 billion (US$ 3.7 billion). The country now hosts 72 licensed property and casualty insurers and 25 licensed life insurers registered with the OIC.

Foreign investors are looking for markets in which general economic prosperity will maximise the potential development of the insurance industry. Maintaining Thailand's 4% per annual average growth rate – achieved between 2000 and 2008 – will be challenging, but the actions being taken by the Thai government are aimed at providing economic stimulation with this target in mind. It is implementing further financial stimulus schemes, increasing exports and rapidly developing industrial activity, in order to boost the national economy. This in turn would be expected to drive up further demand and the purchasing power of insurance products in Thailand.

Thailand's insurance sector, though small, when compared to some of its Asian neighbours, boasts many possible avenues for growth. Much of the country, particularly in the rural regions outside the capital Bangkok, remains relatively untapped in terms of insurance penetration. This represents an opportunity for insurers to develop niche market products, such as micro-insurance and takaful coverage options.

Vietnam

In comparison to other Southeast Asian countries, Vietnam was impacted by three 'lost decades' of economic development due to war, but is now gaining ground on its fellow ASEAN members. Since the 1997 Asian economic crisis, the Vietnamese economy has boomed due to the Communist Party of Vietnam (CPV) changing its communist policies and central planning approach, adopted in the late 1980's, and applying its 'doi moi' (renovation) policy. The economic reforms have enabled the country to become one the fastest-growing economies in Asia, leaving it with the potential to rival the four "Asian Tigers" of Hong Kong, Singapore, South Korea and Taiwan.

Despite the global economic downturn of 2007 – 2009, the insurance market in Vietnam has been resilient; prompting many leading multinational insurance companies to increase their presence in this growth market. They will be further aided in this effort as the Law on Insurance Business has recently been amended (to take effect on 1 July 2011) to align current insurance legislation with international practices and to codify some of the commitments Vietnam made before its accession to the World Trade Organisation in 2007. The amended Law is expected to impose more rigorous regulation of foreign-invested companies and brokers that offer cross-border insurance services.

In the short-term, the growth in the life insurance market is expected to continue and generate significant profits for life insurers currently active in the Vietnamese market. The medium/long-term prospects are less clear, as a result of Vietnam's GDP deficit and possible implementation of austerity measures. However, insurance companies still remain focused on increasing business levels by taking advantage of the emerging growth in the economy.

There is also significant competition between insurance companies for increased market penetration in Vietnam and friction between the competitors as they seek consolidation of their presence in the fledgling insurance industry.

Indonesia

Indonesia has a population of 240 million people, achieved an average economic growth rate of 5.6% per year between 2007 and 2009 and has emerged from the economic downturn relatively unscathed. Reforms in the regulation of the Indonesian financial services industry, expansion of insurance distribution and a broader range of protection products are forecast to have a positive effect on the Indonesian insurance sector in the coming years to meet the demands of a population experiencing an improvement in individual wealth.

Nevertheless, a number of concerns have been expressed by foreign investors about the marketplace. The first is that the industry is relatively fragmented and, while the majority of the market is held by well established local firms, none has a dominant position in the life or non-life sectors. The market is also small, with product density per capita of US$15 in non-life and US$27 in life products.

Issues such as high levels of unemployment, the very real threat of terrorist attacks and a lack of institutional transparency create concerns for businesses considering operations in Indonesia.

To view this article in its entirety please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.