- within Finance and Banking, Tax, Litigation and Mediation & Arbitration topic(s)

- in United States

Hong Kong is a premier centre for hedge fund management in Asia, boasting easy access to North Asia deal flow, world-class infrastructure, an internationally regarded regulatory framework and a relatively benign tax environment. This article provides the portfolio manager with an overview of the key legal issues that are likely to arise when establishing and managing a hedge fund in Hong Kong, covering the choice of fund structure, business licensing requirements and capital raising.

For the portfolio manager intent on establishing and managing a hedge fund in Asia, Hong Kong remains a leading choice. The reasons include:

- Hong Kong is the leading financial market for the Greater China Region. It has an open, developed and sophisticated foreign exchange, banking and securities infrastructure and serves as the Asian hub for many of the world's leading prime brokers, custodians and administrators.

- Hong Kong has an established legal system with a stable and business oriented government and an independent judiciary.

- Hong Kong offers a favourable low-tax environment which can accommodate tax efficient structures for hedge funds and hedge fund managers.

- Hong Kong has a rigorous regulatory environment offering, for those who comply with its standards, international credibility. At the same time, Hong Kong provides flexibility for hedge fund managers to select from the full range of global options for fund structuring to facilitate fund raising and, except to protect market integrity, does not restrict hedge fund managers in the strategies they deploy in the management of institutional money.

This article provides guidance to the portfolio manager on establishing and managing a hedge fund from Hong Kong.

Fund Structure

The target investor base often determines the basic structure of the fund, regardless of the location of the portfolio manager.

Each jurisdiction has its own securities, tax and other regulatory requirements. As a result, subject to costs, it is generally preferable at the outset to seek advice from legal counsel in each jurisdiction where the manager expects to raise significant capital to minimize the risk that the manager will be unable to market the fund as a result of legal prohibitions.

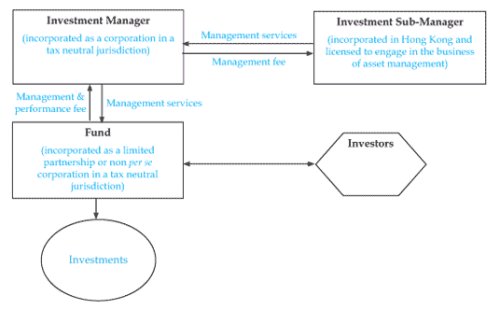

Simple Fund

In a simple fund, there is a single fund vehicle which accepts investments from investors around the world. A common form of a simple fund is described in Illustration 1 below.

Illustration 1 - Simple Fund Managed from Hong Kong

As there is only 1 fund vehicle, a simple fund generally has less flexibility to cater to different requirements of different investors. In particular, if the portfolio manager intends to target U.S. investors, a simple fund cannot cater simultaneously to U.S. taxable investors and U.S. tax exempt investors, such as pension funds.

U.S. Taxable Investors

U.S. taxable investors investing in a hedge fund may be subject to onerous tax rules applicable to investments in a passive foreign investment company ("PFIC"). These rules penalize the sheltering of passive investment income in a PFIC to defer tax. To avoid these rules, U.S. taxable investors prefer to invest in flow-through entities such as partnerships or corporations that make an election to be treated as a partnership for U.S. tax purposes.

U.S. Tax Exempt Investors

U.S. tax exempt investors investing in flow-through entities on the other hand may be subject to tax on unrelated business taxable income ("UBTI"). UBTI may arise where the fund earns income using leverage. As a result, U.S. tax exempt investors prefer to avoid flow-through entities.

Master-Feeder Fund

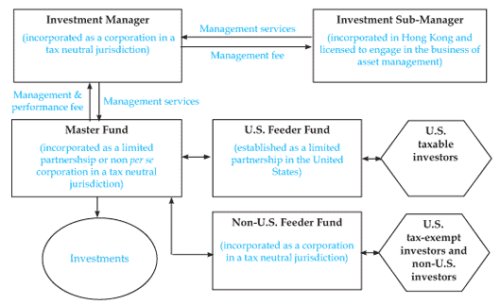

A master-feeder fund is often the structure of choice where the manager expects to raise significant amounts of capital from both U.S. taxable and U.S. tax exempt investors in the United States and investors outside the United States ("non-U.S. investors").

Structure

While the precise structure of master-feeder funds will vary, in a classic master-feeder fund, there are 3 separate fund vehicles which comprise the hedge fund: (i) a U.S. feeder fund established as a limited partnership in the United States, (ii) a non-U.S. feeder fund established as a corporation in a tax neutral jurisdiction, and (iii) a master fund established in a tax neutral jurisdiction either as a limited partnership or as a non per se corporation that elects to be treated as a partnership for U.S. tax purposes.

Under these arrangements, U.S. taxable investors invest in the U.S. feeder fund and non-U.S. investors and U.S. tax exempt investors, such as pension funds, invest in the non-U.S. feeder fund. Both the U.S. feeder fund and the non-U.S. feeder fund then invest all their assets into the master fund. A common form of the master-feeder fund is shown in Illustration 2 below.

Illustration 2 - Master Feeder Fund Managed from Hong Kong

Whilst the appropriateness of a master-feeder structure will depend upon individual circumstances, the master-feeder can cater to both U.S. and non-U.S. investors.

U.S. Taxable Investors

U.S. taxable investors who invest in the hedge fund through the U.S. feeder fund may be able to avoid the more onerous PFIC regime. Assuming the hedge fund does not itself invest in PFICs and provided that the U.S. feeder fund is a flow-through entity such as a limited partnership and the master fund is a limited partnership or a non per se corporation which has made an election to be treated as a partnership for U.S. tax purposes even though it is a corporation, U.S. taxable investors should only be subject to tax on their pro rata share of the earnings and capital gains of the hedge fund, whether or not distributed.

At the same time, U.S. tax exempt investors may invest in the hedge fund without being subject to tax on UBTI even though the master fund is a limited partnership or a non per se corporation which has made an election to be treated as a partnership for U.S. tax purposes. As the non-U.S. feeder fund is a corporation and hence, is not a flow-through entity, the income which flows from the master fund to the non-U.S. feeder fund does not flow through down to the U.S. tax exempt investors and non-U.S. investors invested in the non-U.S. feeder fund.

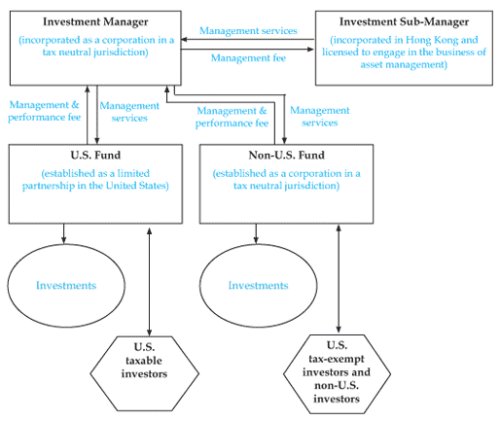

Parallel Fund

A parallel fund, also known as a side-by-side fund, comprises at least 2 fund vehicles, each catering to the requirements of different investors. For example, one fund vehicle may be designed for U.S. taxable investors and a different fund vehicle may be designed for U.S. tax exempt and non-U.S. investors.

In a parallel fund, each fund vehicle has its own portfolio but the fund generally shares similar investment strategies across these vehicles.

The disadvantages of a parallel fund are that the assets under management are split amongst different portfolios, necessitating separate accounts for each fund with each service provider (e.g. each fund would need to appoint a prime broker and an administrator) and splitting of deal tickets between those accounts. As a result, additional expenses may be incurred.

Illustration 3 – Sample Parallel Fund Managed From Hong Kong

Taxation

The portfolio manager will typically wish to minimize his or her own tax liabilities and, to facilitate capital raising, ensure that the fund's profits themselves are sheltered whenever possible from tax.

Structure

For portfolio managers based in Hong Kong, the traditional approach (as shown in the illustrations above) calls for the portfolio manager to establish an asset management company (the "investment manager") in a tax neutral jurisdiction and a sub-management company (the "sub-manager") based in Hong Kong. Under this arrangement:

- The investment manager delegates investment discretion to the sub-manager which in turn employs the portfolio manager to manage the fund.

- Investment management and performance fees accrue to the management company in the tax neutral jurisdiction. The investment manager pays the sub-manager a small fee which will cover the costs of the sub-manager plus a pre-determined markup.

Taxation of the Manager

Provided certain limits established under the law are respected, this structure shelters the investment management and performance fees from taxation. Hong Kong only taxes the sub-manager on the fees earned by it from the asset management company. The tax neutral jurisdiction is selected because it does not tax the investment management and performance fees earned by the investment manager.

Continue to Part 2 of this article on hedge fund creation in Hong Kong here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.