- within Technology topic(s)

In this overview, Heath Martorella of Collas Crill Trust and Angela Calnan of Collas Crill, Guernsey, look at the characteristics, potential uses and some practical considerations for Guernsey Foundations

1. BACKGROUND

The Foundations (Guernsey) Law, 2012 ('the Law') came into force on 8th January 2013. Foundations offer a new solution for clients wishing to have more directional power over assets, compared to traditional forms of trust structure, which only permit limited forms of control and influence.

Foundations have been established in civil law countries for many years, as the trust concept was not recognised. However in recent years, an increasing number of jurisdictions - including a number of common law international finance centres - have now enacted foundations legislation, enabling fiduciary service providers to broaden their geographic reach of business.

The Guernsey foundation will appeal particularly to clients in regions such as the Middle East, Asia and South America. The foundation concept can have a similar feel to a private family company setup; this compares to the considerable "leap of faith" for some clients to give away personal assets and control to a distant trustee.

2. WHAT IS A FOUNDATION?

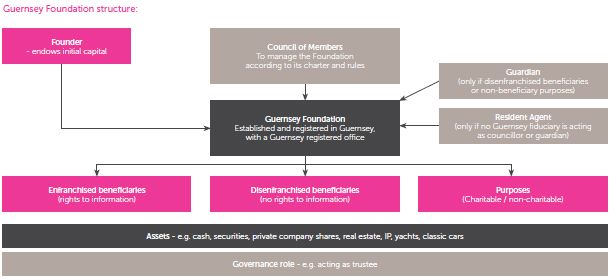

Quite simply, the founder will endow property (of any kind) onto the foundation either to benefit beneficiaries, or to support a purpose(s), or both. Like a company, the foundation enjoys separate legal personality and will own assets itself. As such, the beneficiaries will therefore have no rights over the assets; this contrasts with the beneficiaries' property rights over a trust.

Given that it is established with separate legal personality, a Guernsey foundation is also less likely to be subject to any hostile challenge as a "sham" entity.

It should be noted that a foundation itself cannot carry out commercial activities unless these are ancillary or incidental to its purposes (which must not be illegal). An underlying company can instead be incorporated for any separate commercial activities.

The foundation is managed by a council of members, pursuant to the foundation's constitutional documents - the Charter and Rules. There is no ownership of a foundation - no shares are issued - it is a selfcontained "orphan" structure.

3. ESTABLISHING A FOUNDATION

Under the Law, foundations are established with the Guernsey Registry. Only a licenced Guernsey fiduciary can register a foundation. The Registrar will need the following items:

- The Charter (see below)

- A declaration signed by the founder or resident agent, confirming the details contained in the Charter are correct and are an accurate reflection of the foundation's purposes

- A declaration if there are, or intended to be, any disenfranchised beneficiaries (see part 6)

- The names and addresses of the proposed councillors and guardian (if any), along with their written consent to act

- The name and address of the resident agent (only if no Guernseyregulated fiduciary is acting as a councillor or guardian)

- The address of the Guernsey registered office

- The applicable fee - this is currently £100 for 24 hour establishment, or £350 for 2 hour establishment

4. CONFIDENTIALITY

Only information on "Part A" of the foundations register is publically available. This is limited to:

- Name and registered number of the foundation

- Address of the registered office

- Names and addresses of councillors and any guardian

5. THE CHARTER AND RULES

Similar to the memorandum and articles of a company, a foundation must have a Charter and it will usually have separate Rules (although if all mandatory Rules are listed within the Charter, the foundation can exist simply with its Charter).

The Charter will be filed with the Guernsey Registry upon establishment. The Charter is not disclosed by the Registrar, except in certain circumstances (e.g. where a Court or competent authority has requested it).

The Charter must:

- Include the name of the foundation - which must include the word "foundation" or the abbreviation "Fdn". (Names including or suggesting royal or government connections e.g. "Imperial", "Royal", "Queen" or "Crown" cannot be used without the written permission of HM Procurer in Guernsey).

- The purpose of the foundation

- Describe the initial capital of the foundation, which can comprise any property

- State the duration of the foundation, if it is to last for a limited period only.

- Contain a declaration from the founder that s/he wishes the councillors to comply with the terms of the Charter

The Rules are contained in a private document which is not filed with the Registrar. The Rules must:

- Prescribe the function of the Council

- Detail the procedures for the appointment, resignation and removal of councillors and any guardian

- Detail any remuneration provisions for the councillors or guardian - they will not be entitled to be paid unless expressly authorised to do so

Also, the Rules may:

- Prescribe the manner in which the property of the foundation may be distributed, accumulated or applied

- Detail whether, and if so how, further property may be endowed upon the foundation

- Provide for the addition or removal of beneficiaries, or for the exclusion from benefit of one or more beneficiaries, either revocably or irrevocably

- Detail any person's powers in relation to the foundation (including, but not limited to, the power to appoint or remove a foundation official, to take investment decisions or to approve the use of the foundation's assets)

- Impose obligations upon beneficiaries as a condition of benefit

- Make the interest of a beneficiary liable to termination, or subject to certain restrictions

- Provide details of a default (long-stop) beneficiary in the event of the termination of the foundation (otherwise the assets will go to the Crown)

Importantly, the rules can only be amended if provided for in the Constitution, otherwise it will be necessary to apply to the Royal Court in Guernsey for an amendment. As such, this is an important drafting point to bear in mind at the outset.

6. KEY PARTIES TO A FOUNDATION

Founder

The founder can be any person or corporate entity. The founder will endow the initial capital upon the foundation, but will acquire no automatic interest in the foundation simply by virtue of making a contribution of initial and any subsequent property. The founder can be given powers to amend, revoke or vary the Charter, Rules or purpose, or to terminate the foundation. Such powers can only be reserved during the period of the founder's life (if a person), or for up to 50 years from the date of establishment if the founder is a legal person (such as a company). If there are joint or multiple founders, they must exercise powers unanimously, unless the Charter provides otherwise. The founder can act as a councillor.

Council

The Council must ensure that the foundation is administered in accordance with the Charter, Rules and the Law. As with a company, the council owes its duty to the foundation, not the beneficiaries. The Law stipulates that councillors must act in good faith. It is possible for the foundation to have a sole council member, if this is set out in the constitutional documents. Unlike Jersey, there is no requirement for a licensed fiduciary to sit on the council - but if this is the case, a resident agent (see below) must be appointed

Beneficiaries - enfranchised and disenfranchised

Two classes of beneficiaries can exist - those which are enfranchised with rights to information about the foundation, and those which are disenfranchised with no rights. Section 31(5)(c) of the Law envisages promotion and demotion of beneficiaries between these classes. As an example, this will be useful for those founders wishing to distinguish between beneficiaries who may or may not play a role in the running of any family business or wealth that is owned by the foundation.

Guardian

A guardian will need to be appointed to the foundation if there are any disenfranchised beneficiaries, to represent their interests and hold the councillors to account. A guardian will also be required if the foundation has purposes in respect of which there are no beneficiaries. The role is similar to that of the enforcer of a purpose trust. The guardian must act in good faith ("en bon pere de famille") and owes duties to the founder and the disenfranchised beneficiaries. As such, the role is fiduciary in nature - there is no relief of liability for fraud, wilful misconduct or gross negligence. The position is different to Jersey where a guardian is always required. Importantly, the guardian cannot sit on the council.

Resident agent

A resident agent is only required where there is no Guernsey licensed fiduciary acting either as a councillor or a guardian. The resident agent must be a licenced fiduciary in Guernsey and has the power to inspect foundation documents and information - these must be maintained at the registered office in Guernsey (either originals or copies). The resident agent may request copies of any foundation records and other documentation/information to comply with its duties as a licensed fiduciary. The resident agent can inspect the accounting records of the foundation by giving 2 working days' written notice to the council.

7. MIGRATION OF FOUNDATIONS INTO GUERNSEY

The Law envisages the transfer of foreign foundations to Guernsey, so that clients can take advantage of Guernsey's excellent professional and legal services infrastructure, as well as the high quality of regulation and the island's courts. Schedule 2, Part I of the Law deals with migration in, where the main requirements are summarised as follows:

- The foreign foundation is permitted under its current law to re-register in Guernsey and has complied with any requirements under that law in order to re-register (in practice the Guernsey licenced fiduciary proposing to accept the foundation will want a legal opinion from the foreign jurisdiction to confirm compliance)

- The foreign foundation is not currently bankrupt or being wound up, neither is it subject to any court application for the same

8. ANNUAL RETURN

Each foundation will have to file an annual validation with the Guernsey Registry, the fee for which will be £500. The form of return has yet to be released at the time of writing, at which time the fee will be levied.

9. CODE OF PRACTICE FOR FOUNDATION SERVICE PROVIDERS

The Guernsey Financial Services Commission (GFSC) has released a Code of Practice for Foundation Service Providers (FSPs), which came into force on 2nd September 2013. The Code is largely modelled on existing GFSC codes for trust and corporate service providers and is intended as guidance for FSPs. Failure to comply with the Code will not render a FSP liable for sanctions or proceedings, but may be taken into account by the GFSC and the Courts in their decision-making.

There is emphasis in the Code on FSPs having good knowledge of the constitutional documentation of foundations, also on the importance of good information flow between the FSP and Council members. The FSP must be aware of the activities and assets of the foundation and any material changes. This is particularly relevant if the FSP acts as resident agent only, and is not a council member. Given the importance of being informed, it is likely that FSPs will usually insist on being a Councillor and will only act as resident agent in special circumstances.

10. USES FOR FOUNDATIONS - ASSET HOLDING

Foundations afford considerable flexibility - potential uses include the following:

Private clients

Those clients, particularly in civil law jurisdictions, seeking an alternative to trusts. The foundation will be more easily recognised in the home jurisdiction of the client, and can be used to hold family wealth and businesses. If desired, the Council of members can mirror the board(s) of family enterprises.

The ability for beneficiaries to have different entitlements will also be very useful for asset protection purposes e.g. should there be competing factions within a family, or as part of 'pre-nup' planning.

Also, the foundation is ideal for holding higher-risk, less diversified assets, since the Council will owe its duty to the foundation, not the beneficiaries (unlike trusts).

Charitable

The flexibility of foundations makes them ideal for charitable and philanthropic endeavours. The purposes of the foundation can also be hybrid and permit a non-charitable element - this avoids the need to set up a separate structure for this. The foundation has similar characteristics to the Islamic waqf structure.

SPV / corporate

The 'orphan' nature of a foundation, without ownership or beneficial interest constraints, makes it an useful SPV vehicle, also for use in the realm of corporate transactions. The foundation is an ideal vehicle to hold the shares of a private trust company ('PTC'), instead of a noncharitable purpose trust.

11. ALTERNATIVE USES FOR FOUNDATIONS - TRUSTEE AND GOVERNANCE ROLES

Private Trust Foundations

There has been increasing interest in the use of foundations to act in decision-making and governance roles, without holding assets in their own right. An example of this would be a "private trust foundation" ('PTF') which acts as trustee of family trusts in place of a PTC structure.

This avoids complications where (say) a client from a civil law jurisdiction has become comfortable with the concept of a PTC - and then struggles to grasp why a trust is still ultimately needed at the top of the structure to hold the PTC shares.

Where a PTF intends to charge fees to act as a trustee (to cover costs and expenses), this will require an exemption from the Guernsey Financial Services Commission. Following recent enquiries to the GFSC, it is understood their requirements for licensing PTFs will be as follows:

- That the PTF will only act as trustee of trusts for a specified family (as with a PTC)

- There will be at least one Guernsey corporate trustee with a full fiduciary licence sitting on the Council, and any individual Guernsey-resident councillors will also need to hold personal fiduciary licenses

- The foundation's constitutional documents must enshrine the requirement for councillors to comply with their fiduciary duties when acting as trustee

Other governance roles

It is also possible to foresee the use of foundations in governance roles, such as acting as a protector or enforcer. It could also be used to act in a "family advisory" function in certain structures, where the settlor/founder does not want to entrust family members with stewardship or dispositive powers, but instead provide an alternative mechanism to receive their input.

Whilst these types of roles can certainly be considered for new structures, it will be necessary to check the terms of documentation for existing structures. Some documents may require amendment to recognise the use of a foundation entity, as opposed to individuals or corporate entities.

12. TAXATION

Guernsey foundations will be Guernsey tax-neutral. It is prudent for relevant tax advice to be taken to consider how the foundation might be treated in the founder's and beneficiaries' own country of residence, also if there any taxation matters pertinent to the management and control of the foundation e.g. residency of council members.

It should be noted that HMRC's treatment of foundations for tax purposes is still somewhat unclear, so, for the time being, caution should be exercised for UK-centric clients.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.