Introduction

Between October 2022 and April 2023, AlixPartners and Norton Rose Fulbright surveyed business leaders from sectors including automotive, mechanical engineering, TMT, power generation, chemicals, retail and consumer goods. The majority of those we interviewed (69%) were individuals in executive positions, ranging from management roles and M&A, to strategy and corporate law. Of the corporations surveyed, 43% were active in up to 20 countries, with more than a fifth (22%) operating in more than 60 nations. The largest share of those participating was based in Germany (82%), with the remainder basing their operations in Switzerland and Austria.

To ensure our dataset provided the most accurate findings, we focused on individuals with experience in carve-out transactions. Almost half (46%) had been involved in up to three transactions, a further 31% in between four to nine transactions and 19% involved in at least ten transactions. Around 14% of participants were financial investors with a particular focus on carve-out situations. In each question, respondents were given the opportunity to provide multiple responses.

Key findings

Carve-out and M&A process are closely interlinked

and serve to focus on transformation

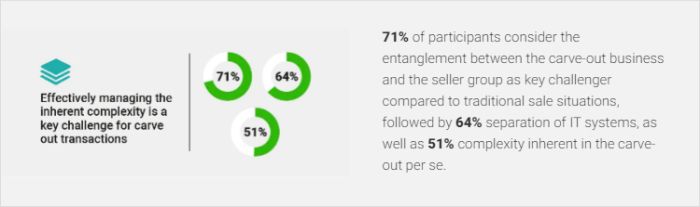

Effectively managing a carve-out's inherent complexity and realizing value enhancing-measures are key success factors

Disruption drives action and is underpinned by an expected increasing carve-out activity

Expert Videos

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.