In our previous article, we outlined the turbulent environment ahead for the Industrial Goods sector in 2024, buffeted by a swathe of volatile macroeconomic factors that will require companies to rapidly adjust to and strive for a more proactive, front-foot positioning when facing into these headwinds.

Our recent Industrial Goods study has highlighted six critical areas where companies are likely to be experiencing challenges, all of which can contribute to increased competitiveness and profitability if improvements are made.

Here we outline the key fields of action for sector players – where the pain-points lie within each, and how the implementation and application of new strategies could prove transformative for future business performance.

1. Pricing power

Cost pressures, with observable differences between industrial

segments, are generating the necessity to build up the power to

enforce price increases.

Prior the inflationary spikes of the past two years, pricing

largely focused on margin enhancement and optimizing sales prices

for customer categories or individual customers. Rises were

infrequent, usually only when triggered (e.g. by review of pricing

discrepancies across a portfolio), and there was limited

willingness to cooperate by customers as they were viewed as pure

profitability enhancements for suppliers.

Now, however, pricing is a key tool in mitigating cost pressures and – in some cases – protecting the going-concern of an overall business. Interaction with and suppliers or customers on this topic should be frequent, and adjustments must be flexible enough to respond to accelerating or decelerating cost developments.

Furthermore, it also has now become a vital tool for optionality – for example, in steering decision-making regarding global vs. local sourcing through these differing lenses:

- Availability: Cheaper prices with longer lead times and production abroad vs. higher prices with shorter lead times due to near-shored production.

- ESG compliance levels: Pricing used as tool to provide different levels of ESG criterial fulfilment, allowing customers to choose their optimal trade-off.

- Resilience: Higher prices leveraged as compensation for increased supply chain resilience, with suppliers ensuring a wider and more diversified footprint across the globe to avoid future potential supply chain disruptions.

2. Energy management

After a long period of stability in energy prices, the conflict in Ukraine signalled the beginning of sharp energy cost increases and a volatile environment regarding global security of supply. This has been a persistent threat to the operational capability and competitiveness of Industrial Goods companies, placing geopolitics at the top of their agenda, alongside the pursuit of more energy efficient, ESG-friendly strategies.

While energy intensity varies across the Industrial Goods value chain, at a macro level consumption and emissions levels plus pricing dynamics represent the two key challenges to overcome. Potential operational counter-measures for the former include:

- Optimization compressor load balancing

- Installation of energy recovery systems

- More efficient use of process heat (e.g. installation of waste heat recovery systems)

- Smart control systems, motion sensors etc.

- Installation of carbon capture and storage systems

- There is also potential to shift input products to less carbon

intensive alternatives and, of course, replace conventional fossil

energy with other green energy sources.

From an energy cost / pricing perspective, companies should consider the viability of:

- Changing rate models and shifting energy intensive process steps to more cost-effective consumption times

- Relocating production (steps) to more cost-efficient regions

- Direct contracts with energy producers

- Implementation of energy hedging

- Leveraging local subsidies

- Installing own energy production (e.g. PV)

3. Resilient supply chains

We are seeing the decoupling of global industrial supply chains, driven by macro disruptions such as the pandemic and Brexit, the emergence of automation and digitalization, geopolitical tensions and trade wars, and ESG regulations.

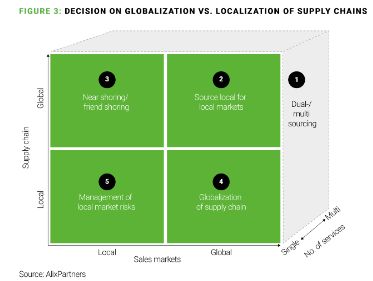

The relocation of supply chains is a strategic task, and different risk mitigation activities may be considered, depending on the degree of globalization of both supply chains and sales markets:

- Dual-/ multi sourcing is a key lever to be considered by all firms to reduce dependencies and supply chain risks.

- Global players, having both global sales markets and supply chains, can synchronize their sourcing and sales markets to reduce supply chain risks.

- Local players sourcing from global markets can reduce supply chain risks by bringing sources closer to their sales markets or at least to 'friendly' locations.

- Companies exporting from one or few production hubs (e.g. in best cost countries) into the rest of the world may consider a broader supply chain footprint to reduce dependency from single markets.

- Firms sourcing local for local demand need to manage and mitigate market risks, through strategic partnerships, for example.

4. Cash conversion cycle efficiency

A consequence of making supply chains more resilient is the cost

of an increasing cash conversion cycle (CCC) – primarily

driven by machinery and components segments. For example, the

Industrial Components CCC has grown with a 3% CAGR from 2020-22,

while the Industrial Machinery segment has seen an increase of

working capital, and the CCC has increased by 3.9% in the same

period, almost only driven by inventory to ensure resilience.

To increase the financial stability, an effective capital

deployment strategy plays a pivotal role. High capital costs demand

that companies find the right balance between driving for

efficiency and resilient safety buffers to deal with unforeseeable

threats, as well as focusing on core elements to use capital

effectively.

To better control capital employed, companies must pay close attention to investment allocation prioritization, optimizing supply chain networks – and measuring related performance, and optimizing working capital. A demand-calibrated approach for production, rather than a capacity utilization approach, will also help further reduce capital employed and improve financial stability.

5. ESG as a competitive advantage

Pressure from customers, financial institutions, and competitors is accelerating the importance of the three ESG pillars. ESG risk events are now a huge threat to company value.

While there is evidence to suggest that companies are still lagging behind in preparation for the future ESG demands of customers, regulators, and investors, many Industrial Goods companies have lighthouse projects that provide an encouraging glimpse of what the future can hold.

Amidst the challenges of increasing CO2 pricing, tightening EU climate policy and the push for neutrality, and growing demand for energy efficient production solutions, a tightly defined, realistic, and actionable sustainability strategy can set the path for positive progress.

It can directly address the regulatory pressure with regard to reporting and compliance, and provide clear articulation of ESG performance and credentials in light of increasing requirements for this as part of overall financing criteria.

Culturally, a strong sustainability strategy can positively impact the attraction and retention of talent within the Industrial Goods sector, particular given the issues highlighted below, and act as a long-term value creation and competitiveness tool – focusing on cost reduction, ROI, and brand reputation.

6. A highly-skilled workforce

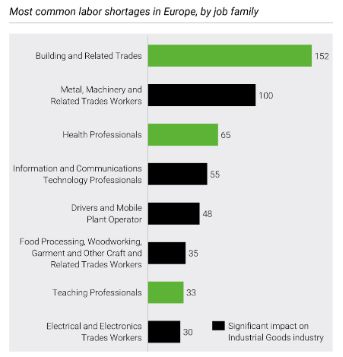

Successfully executing on all of the factors above is only possible with the highest quality human capital at a company's disposal. However, the Industrial Goods sector is highly impacted by a shortage of (skilled) labor, as it relies heavily on several job families showing high shortages.

Therefore, a critical success factor lies in the upskilling of

existing employees and transitioning staff to future growth roles,

avoiding costly recruiting efforts and ramp-up periods.

However, this will unlikely be applicable to all job profiles, particularly in newer role territories. A balanced set of strategies should therefore be deployed, including greater levels of automation for repeatable tasks, outsourcing/contracting where new skills can be quickly accessible (ideally at the right cost), and other workforce adjustments to reshape a business for the identified future state.

On that latter point, AI will, of course, play a huge role. From automation augmentation to product design to knowledge capture and transfer, AI will no doubt play a key role in mitigating staff shortages along the end-to-end value chain. It also provides another high-profile example of the levels of global disruption that Industrial Goods companies must harnesses in order to remain competitive during the challenging economic period on the immediate horizon, and beyond.

Please contact us to discuss in more detail any of the themes explored in this article and the broader findings from our Industrial Goods study.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.