As explained in the January 2017 edition of Insights, the end of the year in France is always marked by a fiscal legislative process to amend the current year's finance law and to draft the law for the upcoming year.1

The present article summarizes the main changes to the individual and corporate tax regimes under both the Amended Finance Law for 2017 and the 2018 Finance Law2 – the first of French President Emmanuel Macron's five-year term – and recent case law relating to the treatment of trusts for French wealth tax purposes.

INDIVIDUALS

French Wealth Tax

The French wealth tax is currently applicable to the worldwide assets of French residents having a net worth in excess of €1.3 million and to certain French-situs assets belonging to nonresidents whose net worth is in excess of this threshold. As of January 1, 2018, the French wealth tax will only be applicable to real estate or certain real estate rights.

Individual Income Tax Rates

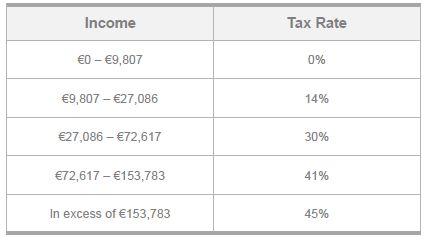

Individual income tax rates have been adjusted for inflation by 1%. The new income tax brackets will be as follows:

Withholding Tax and Flat Tax

The introduction of a withholding tax-based system – announced last year3

3 – has been delayed by one year, and will now come into effect on January 1, 2019.

In addition, a flat tax of 30% will be applied as of January 1, 2018, on financial income (i.e., dividends, interest, and capital gains realized on the disposition of assets generating such income). The components of the flat tax are broken down as follows:

- 12.8% of income tax

- 17.2% of social charges4

As a result, passive-type income that is subject to the flat tax is not taxed at graduate rates but at an overall 30% rate, no matter the tax bracket of the recipient. Taxpayers will be able to elect out of this regime and be subject to ordinary income tax rates as calculated under current law. This would enable them to take advantage of so-called abatements on dividends and share sales.

CORPORATIONS

Corporate Income Tax Rate

The current general French corporate income tax rate is 331/3%. It will be gradually decreased as follows:

- In 2018, the first €500,000 of taxable income will be subject to a 28% rate, with the excess still taxed at the current 331/3% rate.

- By 2019, the excess over €500,000 will be taxed at 31%.

- In 2020, all taxable income will be subject to a 28% rate. This will be further decreased to 26.5% in 2021 and to 25% in 2022.

The 15% tax rate applicable to small- and medium-sized entities will continue to be applicable.

Additional 3% Tax

Under Francois Hollande's presidency, French tax law provided for a 3% tax on dividend distributions made by corporations subject to French corporate income tax.5 The dividend amount subject to this tax included dividend distributions received from the distributing corporation's subsidiaries.

This provision was challenged several times both at the French Constitutional Court and the E.U. levels as being contrary to the French Constitution6 and to the European Parent-Subsidiary Directive,7 respectively.

As a result of the above decisions, the additional 3% tax has been repealed and French taxpayers are entitled to a reimbursement for amounts paid.

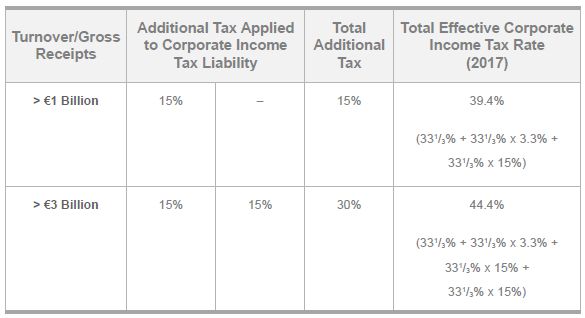

In order to counter the resulting tax loss, the Amended Tax Law for 2017 provides for a one-time additional corporate income tax on corporations with tax years ending between December 31, 2017, and December 30, 2018. The tax is computed as follows:

TRUSTS8

Article 885 G ter of the French Tax Code provides that, for purposes of the French wealth tax, trust assets and capitalized trust income must generally be included in the grantor's wealth tax basis. As a result, no distinction is made between various types of trust; the grantor is subject to wealth tax on the trust assets and capitalized income, even in the case of a discretionary and irrevocable trust.

The French Constitutional Court, in a decision dated December 15, 2017, confirmed that Article 885 G ter is valid and does not violate the French Constitution.9 However, it provided an important caveat: Article 885 G ter only sets a simple presumption that the trust assets and capitalized income are includable in the settlor's wealth tax basis. The burden is thus on settlors to prove that they are not the owners of the assets or the capitalized income and that they cannot benefit from such assets or income.

Footnotes

1 See, in detail, "News on the French Front: Tax Law Changes for Corporations and Individuals," Insights 1 (2017).

2 Additional changes are contained in both bills but will not be discussed for purposes of this article.

3 See Withholding Tax as of 2018 with 2017 Tax-Free for Certain Types of Income in "News on the French Front."

4 The 17.2% rate results from the increase of the Contribution Sociale Generalisee ("C.S.G.") from 15.5% to 17.2%.

5 Former first paragraph of Article 235 ter ZCA of the French Tax Code.

6 Case No. 2016-571 QPC, September 30, 2016; Case No. 2017-660 QPC, October 6, 2017.

7 CJEU, AFEP and others, Case C-365/16, May 17, 2017.

8 French corporations are also subject to a 3.3% social contribution on corporate income tax liabilities.

9 Decision No. 2017-679 QPC, December 15, 2017.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.