INTRODUCTION

Mergers and acquisitions in line with company reorganisations and corporate restructuring are the main elements comprising the world corporate finance market. Accordingly, merger and acquisition transactions generally aim to either bring together two separate legal entities into forming a more powerful company, or, as the case may be, divide an existing company. Transactions involving mergers and acquisitions, if efficiently used, may turn vision into practice, and deliver results including among others the mitigation of risk and taxes. In line with the above, in order to derive the optimum results in such transactions, the jurisdiction to be used for the implementation of a wisely structured reorganisation plan would need to be carefully selected.

Cyprus has long been established as an ideal business center, among others due to its geographical position, its most favourable tax infrastructure and modernized legal system, its stable economy and well established banking sector and equally its EU Membership.

The EU Membership of Cyprus back in 2004 initiated various changes in the field of Mergers and Acquisitions and in particular in the public utility services sector. Harmonisation with the acquis communautaire initiated the need to enhance competition and as such eliminate monopolization. Due to the size of Cyprus as well as its distinctive market structure, public services such as the Cyprus Telecommunications Authority, Cyprus Electricity Authority, as well as Cyprus Airways being the National Airlines of Cyprus were based on monopolization. Accordingly, its EU Membership initiated the demonopolisation of public utility services. However, Mergers themselves are indeed a sign of monopolization.

Arguably, Cyprus' EU Membership also gave rise to a revision of the legislation of Cyprus, among others via the adoption and implementation of a number of EU Directives, providing for a harmonized and tax efficient regime within the Union.

CYPRUS COMPANIES – AN OVERVIEW

Cyprus Companies are treated as separate legal entities and are governed by the Cyprus Companies Law, Cap 113. Accordingly, companies may be registered as limited by guarantee or limited by shares. Companies limited by guarantee is a type commonly adopted by non-profit organizations, while the vast majority of Cyprus registered companies take the form of companies limited by shares. Companies limited by shares may be registered as public or private.

Fig. 1 Distinction between Public and Private Companies

|

Public Companies |

Private Companies |

|

|

Shareholders |

At least 7 |

From 1 up to 50 (excluding current and former employees) |

|

Share capital |

At least €25,629 (CY£15,000) |

No limitations |

|

Issue of shares under the par value |

Prohibited |

Allowed – subject to limitations |

|

Transfer of shares |

No limitations |

A provision should be included in the Articles of Association of the Company, limiting the right to transfer shares |

|

Invitation to the public for share/debenture subscription |

Obligatory |

Prohibited |

|

Directors |

At least 2 (certain limitations apply relating to the appointment of directors) |

At least 1 |

CYPRIOT INVOLVEMENT IN M&A TRANSACTIONS

From a Mergers and Acquisitions perspective, the applicable supporting legislation is fairly straight forward and easy to follow, interpret and apply. Further to the adoption of the EU Merger Directive under the Cypriot legislation, enabling company reorganizations, having both a local as well as a cross-border element, Cyprus has become a popular destination for M&A transactions.

The reorganization provisions under Cyprus law recognise mergers, divisions, partial divisions, transfers of assets and exchanges of shares.

Accordingly, reorganizations falling within the scope of the law result to profits that are exempt from Cyprus taxes, given that they do not lead to the acknowledgment of income neither at a Company nor at a Shareholder's level. Reorganizations fall outside the scope of VAT, and they are exempt from both capital gains tax as well as stamp duty.

The effectiveness of a merger depends upon the drafting of a reorganization plan, which requires approval by the Cypriot courts subject to the fulfillment of specific procedural matters and the passing of a shareholders' resolution to that extent.

From a tax perspective, a reorganization certificate would need to be issued by the Inland Revenue Department, confirming the exemption from the payment of taxes, upon completion of the respective application, accompanied by the reorganization plan as well as the required information on both receiving and transferring companies.

From an acquisitions perspective, Cyprus Companies tend to acquire local and international business either in the form of share acquisitions or direct asset acquisitions.

TAXATION

Cyprus Taxes and Residency principle

A company is taxed in Cyprus on its worldwide income if it is classified as a resident of Cyprus. Accordingly, corporate income tax in Cyprus is currently rated at 10%. Corporate income tax is imposed on all resident companies, irrespective of the residency of their shareholders.

Alternatively, if a Company has a permanent establishment in Cyprus, any Cyprussourced income, attributed to the said permanent establishment would be taxed at the level of Cyprus. The definition of a "permanent establishment" under Cyprus Law follows the definition provided under the OECD model tax convention with very slight diversions, and includes a place of management, an office, a branch, a factory, a workshop, a mine or other place used to extract natural resources, or a construction site for a project exceeding three months. Equally, profits derived by a Cyprus company, from a permanent establishment abroad may not be awarded the exemption from Corporate Income Tax, where BOTH more than 50% of the activities of the permanent establishment result in investment / passive income AND the tax imposed at the level of the permanent establishment is substantially lower than the Cyprus taxes, whereas substantially lower is deemed to include rates under 5% as clarified by the Cyprus Tax authorities.

Under Cyprus Law, the residency of a company is determined by whether its management and control is exercised in Cyprus, and as such, the mere incorporation of a company in Cyprus would not suffice in establishing tax residency.

The absence of any formal definition of the term "management and control" under the Cypriot legislation, the principles laid down under the English Common Law tend to apply, primarily due to the fact that Cyprus is too a Common Law jurisdiction.

Conventionally, management and control is said to be established in Cyprus where:

- The majority of the Directors of the Company are residents in Cyprus, and

- Important Company decisions are taken in Cyprus by the local directors,

- The Company maintains real offices in Cyprus, with distinct telephone/fax lines, domain names, etc. and the employment of professional staff;

- The Company has an economic substance, i.e. commercial and economic activities in Cyprus.

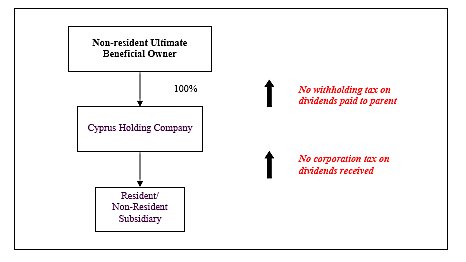

CYPRUS HOLDING COMPANY STRUCTURES AND RELATED TAX TREATMENT OF INCOME

Intermediary Cyprus Holding Companies are commonly used for international tax structuring purposes, and their main purpose is to hold shares in local or international companies. Holding Company structures are intended to minimize and/or eliminate taxes on income and gains resulting from the said local and overseas holding.

Cyprus holding companies are subject to 10% Corporate Income Tax on their worldwide income, subject to the abovementioned residency provisions being fulfilled.

Income from Dividends paid out of the profits of subsidiaries

Incoming dividends are exempt from Cypriot Corporate Income Tax. Instead, they may be subject to 15% defence tax unless a holding of at least 1% can be established between the holding and subsidiary company. The exemption though may not be allowed where BOTH:

- more than 50% of the activities of the subsidiary company result in investment / passive income; AND

- the foreign tax imposed on the income of the subsidiary company is substantially lower that the Cyprus taxes, i.e. under 5% as aforementioned.

Dividend payments between Cyprus resident Companies are exempt from defence tax.

Anti – Avoidance Provisions: Cyprus Controlled Foreign Company (CFC) Rules and Substance-Over-Form Test

Cypriot Tax legislation provides for specific anti-abuse provisions in the form of "controlled foreign company" (CFC) provisions which are intended to prevent the inflow of passive income from low taxed jurisdictions into Cypriot Holding Companies, which would in turn be converted into exempt dividend income.

The Cypriot CFC rules are generally applicable in order to preserve neutrality and fairness between the domestic tax legislation and the international tax market, by targeting passive / investment income, coming from low taxed jurisdictions.

Further to the above, Cyprus applies the substance-over-form test in order to trigger abusive and artificial transactions, while at the same time the right of a taxpayer to arrange his affairs in a tax efficient way is recognized.

Capital gains tax

Capital Gains tax is only intended to attract gains deriving from the disposal of immovable property situated within Cyprus or gains from the disposal of shares in Companies in possession of immovable property situated in Cyprus. As such, capital gains deriving from the sale of immoveable property which is situated outside Cyprus fall outside the scope of capital gains tax.

Most importantly, the disposal of securities is exempt both under the Cyprus Income Tax Law, as well as under the Cyprus Capital Gains Tax Law. As far as the definition of securities is concerned, this was fairly limited, up until recently, whereby it was announced by the Commissioner of Income Tax by way of the issue of a circular, that for the purpose of interpreting the term "securities", the following instruments are deemed to qualify as securities within the meaning of the law:

- Ordinary shares;

- Founder's shares;

- Preference shares;

- Options on titles;

- Debentures;

- Bonds;

- Short positions on titles;

- Futures/forwards on titles;

- Swaps on titles;

- Depositary receipts on titles, such as ADRs and GDRs;

- Rights of claim on bonds and debentures, excluding the rights on interest of these instruments;

- Index participations only if they result in titles;

- Repurchase agreements or Repos on titles;

- Participations in companies; such as Russian OOO and ZAO, US LLC provided that they are subject to tax on their profits, Romanian SA and SRL and Bulgarian AD and OOD;

- Units in open-end or closed-end collective investment schemes having been incorporated, registered and operating in accordance with the provisions of the relevant legislation of their country of incorporation.

Examples of such collective investments schemes are:

- Investment Trusts, Investment Funds, Mutual Funds, Unit Trusts, Real Estate Investment Trusts;

- International Collective Investment Schemes – ICIS;

- Undertakings for Collective Investments in Transferable Securities or UCITS;

- Other similar financial/investment institutions.

The tax treatment and respective application of the favourable Cyprus law provisions on the gains from the disposal of any other instrument not expressly mentioned in the above list may be sought by way of a request for a tax ruling, submitted to the Commissioner of Income Tax.

The extended list of instruments falling within the definition of securities increases the competitiveness of the Cypriot jurisdiction from a tax planning perspective even further given that the ability of investors to reduce or even eliminate their tax liability by the use of a Cyprus holding company in their structure is further enhanced.

Dividends Distributed to beneficial owners

The distribution of dividends to shareholders that are classified as tax residents of Cyprus are subject to a 15% defence tax, which is withheld at the time of distribution. Deemed dividend distribution provisions apply in cases of profits not distributed within a 2-year period following the end of the tax year in which they arose. Accordingly, 70% of the non-distributed profits are taxed at the rate of 15%.

Equally, an exemption from defence tax is granted to non resident shareholders, which is also extended to the deemed dividend distribution provisions.

Apart from the most favourable domestic law provisions, Cyprus Holding Companies may also benefit from the wide network of Double Tax Treaties Cyprus has concluded, and derive dividend payments from its subsidiaries with low or no withholding taxes. Equally, the provisions of the EU Parent - Subsidiary Directive have application where the Cyprus Company receives dividend income from an associated company established in another EU-Member State, thus providing for an elimination of withholding taxes over the dividend distributed.

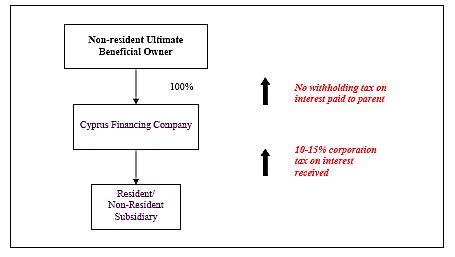

CYPRUS FINANCING COMPANY STRUCTURES AND RELATED TAX TREATMENT OF INCOME

Cyprus Financing Companies commonly take the form of Group Financing Companies and as such they generally undertake to finance group companies by way of debt or working capital, accumulate interest income tax efficiently, and to that extent obtain external debt finance in order to perform its functions.

Cyprus financing companies are subject to 10% Corporate Income Tax on their worldwide income, subject to the abovementioned residency provisions being fulfilled.

Interest Income Received

Under Cyprus tax legislation, the taxability of interest income received differs between interest income received in or being closely related to the ordinary course of business of the Company and interest income earned outside the ordinary course of business of the Company.

In accordance with the above, interest income earned in or being closely related to the ordinary course of business is taxed with Cyprus Corporate Income Tax at the rate of 10%. On the other hand, interest income earned outside the ordinary course of business of a company is subject to 10% corporate income tax on 50% of the said interest income and also to a special contribution for the defence of the Republic, rated at 10%, effectively leading to a 15% tax.

Accordingly, it should be noted that based on the above provisions, interest income deriving from the ordinary activities of the business of a person, including interest which is closely connected to the said activities, is not treated as interest for tax purposes but rather as income deriving from trading activities.

Equally, further to a circular issued by the department of Inland Revenue interest income earned in the ordinary course of business of the company is deemed to be the said interest income deriving from:

- Banking Enterprises (incl. all banks and co-operatives and businesses whose main activity is to provide loans).

- Financing Businesses engaged in hire purchase or leasing or other types of financing.

In line with the above interest closely connected to the ordinary course of business of a company is deemed to be interest income deriving from:

- Trade debtors (i.e. relating to businesses whose ordinary activities include the acquisition, disposal and development of land and/or businesses engaged in the sale and resale of cars or other vehicles)

- Insurance companies

- Retail banking accounts (current accounts) and

- Group financing companies (i.e. a parent, subsidiary or in any other way related company borrowing money and subsequently lending it to other group companies).

Further to the above, it should be noted that interest deriving either from the provision of loans by a company to third parties or from deposits or bonds, and given that they do not fall within the categories mentioned above hereto, is not deemed to be interest earned from the ordinary course of business of the company nor interest closely related to the ordinary course of business of the company, and it is thus subject to Special Contribution for the defence.

Thin capitalization rules

Generally, no thin capitalisation rules apply in Cyprus, essentially by way of debt-toequity restrictions. In line with the above though, it should be noted that as per the provisions of the Cyprus Income Tax legislation, loans advanced by the Cyprus Company to its shareholders or directors, with no or low interest rates, may be subject to a deemed yearly interest rate of 9% on the loan amount. Otherwise such advances cannot be treated as expenses incurred wholly and exclusively for the production of income.

Transfer pricing

Cyprus does not have specific transfer pricing legislation. However, the income tax law provisions have been amended as to provide for the application of the arm's length principle, as defined by the OECD, in transactions between related / associated parties.

In line with the above, interest rates imposed on loan agreements between related parties should be in line with those imposed between unrelated parties. Equally, the market rates should also be considered to that extent. Generally speaking, the applicable interest rate to be imposed is to be determined on a case-by-case basis.

Further to the above, the Commissioner of Income Tax has recently expanded on this matter in saying that generally speaking, a minimum margin of 0.125 – 0.35% on the loan amount received between related parties may be included in the taxable income of a Company. Equally, he proceeded in saying that interest free back-to-back loans are deemed to give rise to interest income amounting to 0.35% on the loan amount.

Interest Paid by the Cyprus Financing Company to Creditors

No withholding taxes are provided for on the payment of interest to creditors.

Cyprus Financing Companies may also benefit from the wide network of Double Tax Treaties Cyprus has concluded, and derive interest payments from other group companies with low or no withholding taxes. Equally, the provisions of the EU Interest and Royalties Directive have application where the Cyprus Company receives interest payments from an associated company established in another EU-Member State, thus providing for an elimination of withholding taxes over the interest payments.

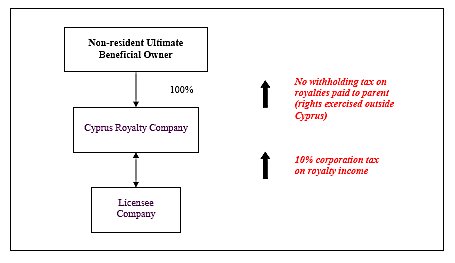

CYPRUS ROYALTY COMPANY STRUCTURES AND RELATED TAX TREATMENT OF INCOME

Cyprus Royalty Companies generally undertake the ownership of royalties and licensing rights for intellectual property.

Cyprus royalty companies are subject to 10% Corporate Income Tax on their worldwide income, subject to the abovementioned residency provisions being fulfilled.

Royalties received in Cyprus

Profits derived by a Cyprus Royalty Company with respect to income from royalties are subject to 10% Corporate Income tax. In line with the above, it should be noted that tax is imposed after the deduction of any royalty payments as well as expenses incurred wholly and exclusively for the production of income. Equally, Cyprus Income Tax law provides for a unilateral tax credit with respect to foreign tax paid on the said income.

Gains on the sale of Intellectual Property

Gains deriving from the sale of intellectual property may arguably be exempt from Corporate Income Tax, unless the said gain is deemed to be a result of the trading activities of the Company.

Royalties paid

Cyprus does not provide for a withholding tax on royalty payments given that the rights are exercised outside Cyprus.

The extensive network of double tax treaties concluded by Cyprus, enables the imposition of low or no withholding taxes at the level of the licensee, upon payment of the royalties to the Cyprus Company. Equally, the provisions of the EU Interest and Royalties Directive have application where the Cyprus Company receives royalty payments from an associated company established in another EU-Member State, thus providing for an elimination of withholding taxes over the royalty payments.

CONCLUSION

Cyprus, due to its most favourable tax and legal regime as well as the recent changes in its legislation, is becoming more and more popular in the field of mergers and acquisitions. Through the process of harmonization of the Cypriot domestic legislation with the EU acquis communautaire, Cyprus has come to create an ideal jurisdiction for hosting the investments of international businesses.

The Cypriot jurisdiction is widely used for tax structuring purposes primarily by way of establishing intermediary holding companies, as well as financing and royalty companies Accordingly, apart from its favourable corporate tax regime of 10%, its EU Membership and respective adoption of the EU Directives, and its wide Double Tax Treaty network which is further expanding due to the enactment of the exchange of information provisions into the Cypriot legislation, the following advantages are also inherent into the legislation of Cyprus:

- No withholding taxes on dividends, interest or royalties paid from the Cyprus Company to the non-resident beneficiaries;

- No Corporate Income Tax on inbound dividends;

- Exemption from defence tax on inbound dividends in most cases;

- No Capital Gains Tax on the disposal of securities;

- Unilateral tax credit allowed with respect to foreign taxes paid;

- Deductibility of expenses given that they have incurred wholly and exclusively for the production of income;

- No thin capitalization rules;

- Limited transfer pricing rules

- Tax neutral corporate reorganizations.

The constant updating and revision of the Cypriot legislation along with the stability of the Cypriot economy and banking sector further enhance the positioning of Cyprus as a leading international business centre.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.