What is Russian Controlled Foreign Company (CFC) legislation?

Russian Controlled Foreign Company (CFC) legislation can be defined as the measures adopted by Russian government to promote transparency and to combat tax avoidance by Russian taxpayers using foreign company structures. The Federal Law No 376-FZ dated 24 November 2014 "was entered into force on 1 January 2015 with the aim to tax participation interests by Russian tax residents in controlled foreign companies (CFCs) at the rate applicable in Russia currently 20 per cent for legal persons and 13 per cent for natural persons.

Russian Controlled Foreign Company (CFC) rules: Main aspects

Russian shareholders will be required to pay taxes in Russia on the retained earnings of foreign companies in which they hold a controlling stake the same way as Russian Companies. Any tax already paid by foreign companies will be given as a tax credit. A Russian shareholder is considered to be a legal/physical person holding more than 25% of shares in foreign company or more than 10% if together with affiliated persons hold more than 50%.

Exemptions form the Russian Controlled Foreign Company (CFC) new rules

There are a number of exemptions from the taxation of Russian Controlled Foreign Company (CFC) new rules on:

– Profits of up to 10 million RUB as from 1st of January 2017 or,

– Active foreign companies with at least 80% of active business income as mentioned in clause 4 of Article 309.1 of the Russian Tax Code or,

– Foreign companies controlled and managed by Russian residents which:

- Russia has signed a double tax treaty or;

- Meet the effective tax rate test (75% of the average weighted tax rate (calculated on the basis of the formula) or;

- There is an exchange of information between Russia and foreign country or;

- Is a Tax resident of the Russian "white list" ((States or territories not included in "offshore list" according to the Order of the Russian Ministry of Finance № 108n dated 13.11.2007 (with amendments))

– Other exemptions

For Foreign companies controlled and managed by Russian residents with which Russia has signed a double tax treaty emphasis will be given on:

- Tax residency. The tax residency of both the Russian shareholder and the foreign country.

- Effective management. The company's place of effective management.

- Beneficial ownership. The ability of the controlling person to exert power over the usage and distribution of income.

Tax Residency

Tax residency will apply for Russian residents who hold shares in foreign companies which are tax residents in foreign country. Reference can be made to the provisions of Double Tax Treaty concluded between Russia and the foreign country.

Effective management

A foreign company is to be regarded as tax resident company in Russia if the place of effective management is in Russia. The effective management is in Russia if:

- The majority of meetings are held in Russia

- Operational management is taking place often in Russia

- The operational management main offices are in Russia

(Different rules apply on the disposal of Russian property rich companies and on foreign companies managed and controlled from Russia.)

Beneficial Owner/controlling person1

Income earned by foreign company which is derived from activities or investments in Russia will lose the benefit of reduced withholding tax provided for in the double tax treaties with Russia, if such foreign company is not the beneficial owner of such income. The beneficial owner should be person who has power over the usage and distribution of such income.

1A person who exercises control over an organization, for instance, exerts, or has the ability to exert, a decisive influence on decisions adopted by that organization in relation to the distribution of profit (income) earned by the organization after taxation by virtue of direct or indirect participation in that organization, participation in an agreement (accord) concerning management of that organization or other arrangements between a person and the organization and (or) other persons)

A) Those companies who meet any of the criteria of Control Foreign Company (CFC) rules exemptions

Foreign companies controlled and managed by Russian residents should meet any of the criteria of Control Foreign Company (CFC) rules exemptions i.e.

– Double tax treaty should exist (Cyprus has signed a double tax treaty with Russia)

– Must meet the effective tax rate test

– There is an exchange of information between Russia and the foreign country

– The above exemptions plus exemptions according to the Russian Tax Code. In brief non-commercial organizations, permanent establishments in Eurasian Economic Unions, banks or insurance organizations, issuers of circulated bonds where an agreement with Russia exists and not included on a "offshore list", participates in mineral extraction projects with Russia, operators or direct shareholdings in a new offshore hydrocarbon deposits.

– Foreign companies that can demonstrate that the company is an active foreign company as stated in clause 4 of Article 309.1 of the Russian Tax Code and demonstrate business substance in that foreign country by:

+ Establish independent offices i.e. purchasing or renting office space etc.

+ Maintain group head offices thus having fully fledged offices with business telephone lines, domains etc.

+ Own valuable intangibles i.e. intellectual property, performing the most important functions within the corporate structure and demonstrate economic business reason

+ Proper allocation of group assets

+ Recruit staff to administer the day to day management work of the company

+ Appoint qualified directors who will have the ability to make decisions and really understand the nature of business

+ Maintain business records, minutes of conferences, general meetings, accounting function, bank account administration etc.

+ Demonstrate additional reasons for presence. I.e. to control activity risks, to improve costs control etc.

+ Consider other factors that might affect adversely Cyprus business substance like:

– Majority of board of Directors' meetings are held in Russia.

– Management is effectively performed from Russia and mostly by Russian employees.

– Accounting and office administration is performed in Russia

– Important documentation is drafted and performed in Russia

– Russian ultimate beneficial owner involvement in management of the Company

– Russian ultimate beneficial owner involvement in bank accounts management and on instructions given

B) Russians obtaining tax residency in another country(Cyprus) (Citizens of the Russian Federation who are not the Russian tax residents)

Russians that will obtain tax residency in another country like Cyprus and forgo Russian tax residency may not be affected. It is considered that a Russian is not considered a tax resident of Russia if stays in Russia for less than 183 days during 365 consecutive months and stays more than 183 days in another country (Cyprus). Russian individuals ready to move to Cyprus and spend at least 183 days in Cyprus can qualify for tax residency in Cyprus and be taxed in Cyprus on their worldwide income. This can be achieved with the aid of obtaining visa (permanent residency) or citizenship (passport) in Cyprus.

Cyprus is also encouraging High-net worth individuals including Russian individuals to move to Cyprus by giving personal taxation incentives like exempting Russian individuals from personal taxes. Russian individuals will need to declare Cyprus as their taxable jurisdiction and receive an exemption from Cyprus personal taxes (Special Contribution for Defense) on rents (3% on 75% on rent income), interest (30%) and dividends (17%) which are applicable to Cyprus domiciled individuals. The exemption on Russian individuals will apply for 17 years as from the date of declaring Cyprus as their taxable jurisdiction.

C) International Trust (Cyprus International Trust)

International discretionary trust (Cyprus International trust) in which Settlor / beneficiary demonstrates that he does not influence profit distribution and has no rights to revoke assets after their transfer to the trust (except by inheritance etc). However Russian Settlor/founder must report participation in such structure irrespective of the residence status of the beneficiary; Other important considerations.

– a settlor and a beneficiary of a trust should not be the same person,

– In the event of termination / liquidation of the trust, the settlor of the trust should not be entitled to the assets originally contributed to the trust,

– the settlor should not have the right to receive income from the trust, to give orders/instructions on income distribution or dispose of the trust income.

– A beneficiary should not receive income from the trust regularly/permanently, and the beneficiary and settlor should not be linked with each other

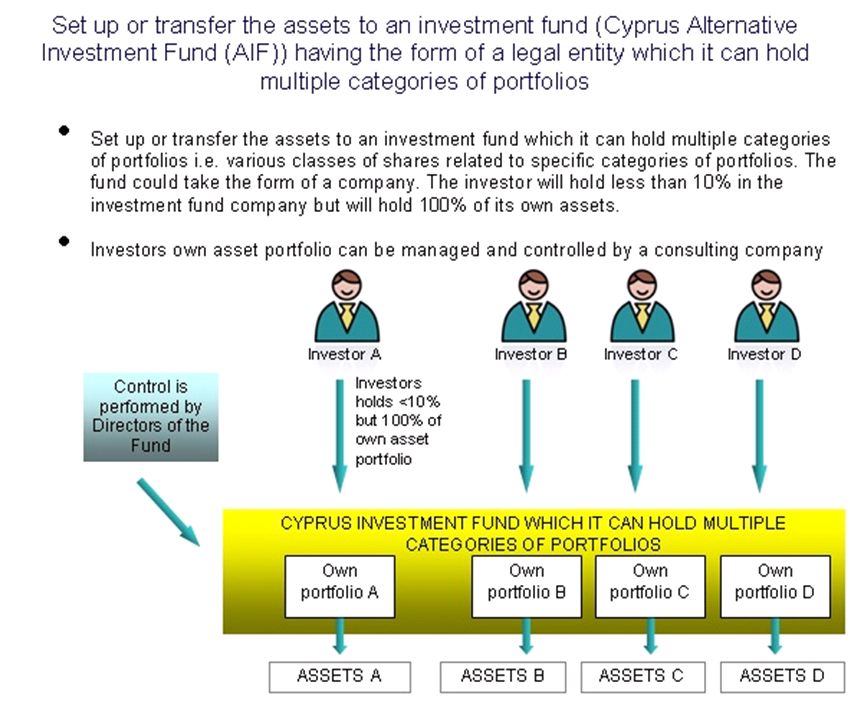

D) Investment funds (Cyprus Alternative Investment Funds (AIFs)) having the form of a legal entity

Investment funds (Cyprus Alternative Investment Funds (AIF)) having the form of a legal entity in the context of clause 2 of article 11 of the Russian Tax Code and If all persons – Russian tax residents (in the case of physical persons – together with spouses and minor-age children) own participating interests (directly or indirectly) in the fund, amounting to less than 50%, but at the same time every investor (contributor) – Russian tax resident owns participating interest, amounted to less than 10%

A Cyprus fund which is registered and governed by Cyprus Securities and Exchange Commission (CyCec) having LEI and ISIN number recognized worldwide as a traded security is considered a well regulated entity which is outside the control of any investor. Cyprus Investment funds are fully managed and controlled by its directors and they need to abide by the Cyprus Securities and Exchange Commission Laws and Regulations. A Cyprus fund having its units – shares adequately dispersed to investors might not be considered a foreign controlled company (CFC) under Russian Law.

E) Foreign entity (Cyprus Company) with two classes of shares

A foreign entity (Cyprus Company) with two classes of shares, the first class of shares is assigned the management and control of the company with no rights to receive dividends, and the second class of shares is with no rights of management and control but instead assigned rights to receive dividends. The second class of shares might not be considered control as defined by the Russian Law. Classes of shares shall be demonstrated in all companies' statute documents accordingly. Consideration must be taken for shares eligible to receive dividend, as they may indicate the existence of special relationship between the foreign – Cyprus company and the Russian shareholder

F) Issuance of preference shares by a foreign entity (Cyprus Company)

Issuance of preference shares by a foreign entity (Cyprus Company) purchased by a Russian company or an individual. Management and control of Cyprus Company rests with non Russian tax residents legal or physical persons. Russian persons (legal or physical) will have the right to receive dividend or interest on preference shares held. A Russian person holder of the preference shares might not be considered as controlling person as defined by the Russian Law. Issuance of preference shares shall be fully documented and demonstrated in all Cyprus Company's statute documents accordingly. Consideration must be taken for preference shares eligible to receive dividend, as they may indicate the existence of special relationship between the foreign – Cyprus company and the Russian shareholder

G) Issuance of registered private bond or issuance of bond listed in a recognized stock exchange (Cyprus Emerging Companies Market ("ECM")) by foreign entity (Cyprus Company)

Issuance of registered private bond or issuance of bond listed in a recognized stock exchange by foreign entity (Cyprus Company) and purchased by an independent Russian company or an individual. Such an instrument in the hands of the Russian investors is considered an investment and not granting of a loan. Management and control of Cyprus Company rests with non Russian tax residents legal or physical persons holding the controlling shares of the Cyprus Company. Russian persons (legal or physical) will have the right to receive bond interest. A Russian person holder of a bond might not be considered a controlling person as defined by the Russian Law. Bond enlistment or issuance of a registered private bond shall be fully documented and demonstrated in all companies' statute documents accordingly. Article 11 of Double Tax Treaty between Russia and Cyprus on bond interest must also be taken into consideration.

H) Foreign entity (Cyprus company) holds 100% of a Russian Company

Foreign entity (Cyprus company) holds 100% of the Russian company, the structure is not reportable under Russian Law but it should be considered that the Russian taxation authorities according to most double tax treaties concluded by Russia (Cyprus has concluded a double tax treaty with Russia), and based on the exchange of information clause, have the right to request information provided such information is foreseeable relevant. That is to provide for exchange of information in tax matters to the widest possible extent but at the same time not at liberty to engage in 'fishing expeditions' or to request information that is unlikely to be relevant.

Conclusion

It appears that a large number of Russian interest foreign companies are not covered by the exemptions of the Russian Controlled Foreign Company (CFC) rules, though the status of such companies will need to be clarified based on the above criteria. However it is important to emphasize that the double tax treaties with which Russia has concluded with foreign countries including Cyprus cannot be overwritten. Double taxation agreements demonstrate taxing rights between two contracting states which cannot be superseded by any domestic law of any state. Russian legislation therefore has effect only to the extent that it is in line with Russia's double taxation agreements. It should also be emphasized that for those financial centers, with which Russia has concluded a double tax treaty (Cyprus has concluded a double tax treaty with Russia) can be an opportunity provided they are transparent and well regulated.

How we can help

– We can help you to obtain visa or citizenship (passport) in another jurisdiction.

– We can assist you to move to Cyprus and obtain personal taxation incentives provided under Cyprus Laws

– We can review your corporate structure (holding, financing and trading) and propose changes to your structure.

http://www.pkf-cyprus-nicosia.com.cy/

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.