- within Criminal Law topic(s)

- in European Union

A. INTRODUCTION

New laws have recently been enacted in Cyprus, effecting important changes to the Income Tax Law and Capital Gains Tax Law.

In addition, a serious change has been effected on the procedure followed by the Income Tax Authorities in issuing tax residency certificates with the aim to secure that the management and control of the tax resident companies is indeed exercised in Cyprus.

The changes are of major importance for the international investor who must seriously consider them for future tax planning.

The summary of the new laws and the new Income Tax procedure as to the issuing of tax residency certificates is herein below analysed.

B. INCOME TAX LAW - CHANGES

1. Profit from foreign exchange differences

Any profit derived from currency exchange differences which is due to the fluctuation of currency exchange rates will be tax exempt. The exemption will not apply for companies engaging in currency trading activities (i.e. Forex Companies).

Any person which is engage in the trading of currency may irrevocably elect that the non - realised currency exchange differences will not be subject to income tax and will not be deducted from the taxable income, if they relate to profits or losses, respectively.

The above change is applicable as from 1st of January 2015.

2. Limitation of loss carried forward on IP activities

The Cyprus IP tax regime provides that 80% of royalty profit (royalty income less related expenses) will be regarded as deemed expense. Therefore, only 20% of the royalty profit will be taxed at 12.5% corporation tax and in this respect the maximum effective tax rate is 2.5%.

The law as existed did not clarify what percentage of losses will be taken into account in case the company had losses instead of profits.

With the new changes the law clarifies that only 20% of the losses can be set off or carried forward and the loss is calculated on the same principles as the profit.

The above changes are considered to be applicable as from 1st of January 2012.

3. Extending the available exemptions of personal income tax for those taking up residency in Cyprus

As the Law existed, non - Cyprus tax resident individuals who were taking up employment in Cyprus were entitled to claim the following:

- 20% of their employment income to be

exempted from personal income tax for a period of 3 years or EURO

8.550,00 per year which one was the lower;

Or, subject to the applicability of the conditions mentioned below, - 50% of their employment income earned in Cyprus to be exempted from income tax for a period of 5 years, provided that their employment income earned was more than EURO 100.000,00 per year.

The new law extends the period of the first exemption from 3 to 5 years but this exemption will be abolished as from the year 2020 onwards and provided the employment started within or after 2012.

For the second exemption the years of exemption are extended from 5 to 10 years.

Further, the exemption will not be granted to a person who was Cyprus tax resident for any three out of the five years prior to the commencement of his/her employment and also it is not granted to a person who was a tax resident of Cyprus the year before his employment. This provision applies for employments after 1/1/2015.

The exemption will continue to be granted in case their employment income drops below EURO 100.000,00 after the year the exemption was granted, provided that the tax commissioner is satisfied that the increase/decrease was not made for the purpose of obtaining the exemption.

It should be noted that the law now clarifies that no one can be benefited from both exemptions.

The above changes are applicable as from 1st of January 2015.

4. Annual allowances for capital expenditure - extended to 2016

Under the current provisions of the law in the estimation of the taxable income of a person, a particular capital allowance, higher than the standard applicable rates, is granted for plant, machinery, industrial buildings and hotels redusing respectively the taxable income, provided, the capital expenditure for these items was made during the years 2012 - 2014.

The amended law has extended the increased capital allowances offered and for the years 2015 and 2016.

The rates that will continue to apply for 2015 and 2016, will be, for plant and machinery, 20% instead of 10% and for Industrial and Hotel buildings, 7% instead of 4%.

The above change is applicable as from 1st of January 2015.

5. Group relief

Under the current provisions of the law, taxable losses of one Cyprus Company, (the surrendering company), could be surrendered, to another Cyprus company (the claimant company) provided, they were both Cyprus tax resident companies belonging to the same group of companies.

Under the new provisions of the amending law, the surrendering company who will surrender the loss, may be a company which has its base and is tax resident of another member state, provided, it has exhausted all possibilities of setting off the loss or carrying it forward, in the member state of its residence or with any intermediary holding company existing between the surrendering company and the claimant company who will set off / accept the losses. The obligation which existed that both companies surrendering company and claimant must be tax residents of Cyprus has been abolished.

In effect, taxable losses can now be surrendered by a company which is tax resident and has its base, in another EU member state to the place of residence of the claimant company which will be Cyprus.

Such losses when surrendered to a Cyprus company must be calculated on the basis of Cyprus law.

Meaning of Group

As per the provisions of the law two companies are considered as members of the same group if the one is by 75% dependent on the other or both jointly or independently are by 75% dependant of a third company. In determining whether a Group existed it was not possible to establish the 75% link through companies that they were not Cyprus tax residents.

The link can now be established even if that other company is tax resident:

- In another EU member state;

- In jurisdictions where Cyprus has signed a double tax treaty; and

- In a country where Cyprus has signed a treaty for the exchange of information.

The above changes are applicable as from 1st of January 2015.

6. Taxation of Oil and gas activities

The definition of the term "Republic of Cyprus" was amended in order to include the territorial sea and any other area beyond the territorial sea, including the contiguous zone, the exclusive economic zone and the continental shelf of Cyprus.

Further the definition of the "permanent establishment" was also amended in order to include offshore activities for the excavation, investigation or exploitation of the shelf, the underground or the natural resources and the establishment and exploitation of pipelines or other installations to the seabed.

The gross income generated from services relating to oil and gas exploitation offered by a person who is not tax resident in the Republic but the services are offered within the Republic as defined above, is subject to 5% withholding rate on the gross income.

The above change is applicable as from 1st of January 2016.

7. Taxation of dividends

Dividends received by a Cyprus tax resident company or by a non - tax resident company but which has permanent establishment in the Republic, will not be exempted from income tax in Cyprus in case such dividends are tax deductible for the foreign paying company.

For example, in some countries, dividends paid on preference shares or other "hybrid" instruments are considered as interest expense for the foreign paying company and are tax deductible, whilst in Cyprus, are considered as dividends and were exempted from income tax.

In view of the mentioned amendments, in cases where dividends fall within the above provisions will be subject to income tax in Cyprus. In such a case, such dividends will be exempted from Special Defence Tax.

The above change is applicable as from 1st of January 2016.

8. Tax credit on foreign tax paid

In the event where dividends received from another EU member state are taxable in Cyprus with Income Tax, tax credit on taxes paid in that other member state will not be granted in cases where the group structure was set up without valid commercial reasons representing the economic reality.

Therefore, the tax authorities before accepting to grant a tax credit on tax liabilities generated from dividend income received from another member state, will examine the group structure. If the tax authorities do not identify commercial reasons for the setting up of the structure they will not allow the tax credit. In such cases, groups of companies which have real substance in each country will most probably be able to prove that the group structure has commercial reasons.

The above change is applicable as from 1st of January 2016.

9. Anti avoidance provisions for Re-organisation

The new law gives power to the Tax Commissioner not to accept the tax exemptions granted by law on the profit generated from re-organisations.

The tax exemptions apply retrospectively provided the Tax Commissioner, is satisfied that the re-organisation was made with real commercial or financial purpose.

The Tax Commissioner, may not grant the tax exemptions granted by law on the profit generated due to the re-organisation, if according to his opinion the main purpose or one of the purposes of the re-organisation was the avoidance or reduction or postponement of the payment of taxes or the direct or indirect distribution of assets of any business to any person without the payment of tax through its reduction or postponement of the payment of the tax.

In case the tax exemption for the non - payment of taxes is not granted then tax is due on the generated profit due to re-organisation.

The above change is applicable as from 1st of January 2016.

10. Arms' length principle

In case the Tax Commissioner will increase the profits or benefits of one business due to the implementation of the principle of Arms' length, then at the same time it is granted to the other participant of the transaction an analogous reduction which is considered as an expense and the rules as to allowable expenses apply.

The above change is applicable as from 1st of January 2015.

11. Reference Interest rate for Notional Interest Deduction

According to the recent law amendment that took place in July 2015 a company is allowed to claim Notional Interest Deduction (NID) on new equity introduced as from 2015. The NID will equal the multiple of the "Reference interest rate" and the "new equity".

"Reference interest rate" is defined as the 10 year government bond yield of the country in which the new equity is invested increased by 3% having however, as a lower limit the 10 year government bond yield of the Republic of Cyprus increased by 3%. The rate used will be the rate as at 31 December of the previous tax year, i.e. for the 2015 tax statements the 31 December 2014 rate will be used.

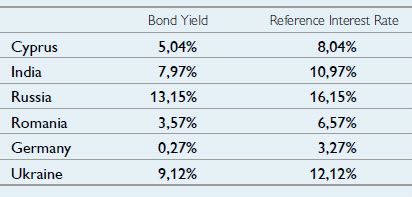

The tax authorities issued a circular stating the 10 year government bond yield as at 31/12/2014 for the countries below. These rates can be used in order to determine the "Reference interest rate":

It is important to note that the NID granted on new equity cannot exceed 80% of the company's taxable profits

Example

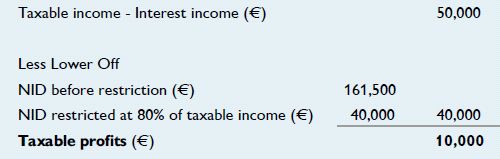

A Cyprus company issued new share capital on 1/1/2015 for EURO 1 million. These funds, received as new share capital, were used by the company in order to provide a loan to a Russian company with interest 5%.

The Notional Interest Deduction will be calculated as follows:

New equity = EURO 1,000,000

Reference interest rate = 13.15% + 3% = 16.15%

NID before restriction = 1,000,000 x 16.15% = EURO 161,500

Interest income/ Taxable income = 1,000,000 x 5% = EURO

50,000

NID restricted at 80% of taxable income = EURO 50,000 x 80% = EURO

40,000

Tax computation

C. CAPITAL GAINS TAX LAW - CHANGES

The current law provided that there will be capital gains tax on the profits from the disposal of immovable property situated in Cyprus or disposal of shares of a company which directly owns immovable property situated in Cyprus.

The new amended law provides that in addition to the above there will be capital gains tax on the profits from the disposal of the shares of a company which directly or indirectly participates in a company or companies which possess immovable in the Republic and at least 50% the market value of the shares sold is derived from the immovable property which is situated in the Republic.

The above change is applicable as from 17th of December 2015.

To read this article in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.