Current progress of the VAT reform

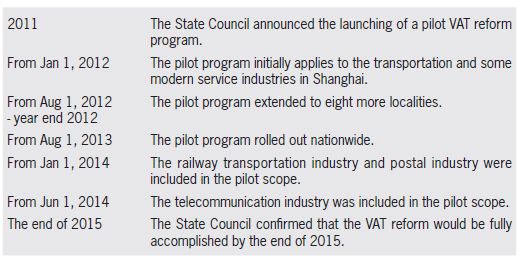

On 26 October 2011, the State Council announced the launching of a pilot VAT reform program from 1 January 2012. As an important part of fiscal and taxation system reform, the VAT reform program has been gradually rolled out both in scope and in geography for the past three years as illustrated below.

On May 18, 2015, the State Council further released in the Notice of National Development and Reform Commission's Opinion on 2015 In-depth Reform of Economic Regime to state that all industries shall be included in the VAT reform scope by the end of 2015.

Presently, most of industries have been included in the VAT reform scope, except the followings:

- Life service industry;

- Culture and sport industry;

- Construction industry;

- Real estate industry;

- and Financial industry.

Among the above industries, the VAT reform of real estate industry and financial industry has drawn most attentions due to the complexity, variability, importance and significant social influence of the industries. And there have been many speculations on the future reform direction in the industries.

To assist the real estate enterprises and financial institutions get prepared for and overcome the challenges, we have set out our observation and vision for VAT reform of real estate industry and financial industry as below.

Vision for VAT reform of real estate industry

Based on our observation, the finance and tax authorities have been studying to set the VAT reform policies for real estate industry since the end of 2013.

According to our study among the professionals, herein we have illustrated our vision for the VAT reform of real estate industry.

Possible tax rate for sale of immovable properties

- 11% for general VAT taxation method; And

- 3% for simplified VAT taxation method for contracts signed prior to the VAT reform.

Special consideration for input VAT deductible items

- Land cost could be regarded as non-deductible items due to the variety of land sources (i.e., gratuitous transfer, collective operation, share transfer, etc.) and the difficulty to obtain qualified tax invoices in practice;

- For new immovable properties to be constructed after the VAT reform, relevant input VAT may be entirely deductible by installment at the early reform stage (i.e., new input VAT may be deducted at 5% per annum over years with the rest deductible amount to be carried over to the next period.);

- For prior immovable properties not newly constructed after the VAT reform, relevant input tax may not be deducted;

- For contracts signed prior to the VAT reform, relevant input VAT may not be deducted.

Impacts and challenges:

To prepare the real estate enterprises, we herein summarize impacts and challenges they may encounter as following:

- The VAT reform would change the revenue and cost structure, leading to an impact on profits and business performance;

- Pressure of insufficient time between the introduction and formal implementation of the VAT reform for the companies to react;

- Input VAT is the significant impact factor for cash flow and costs;

- It is important whether or not the output VAT could be transferred downwards;

- How to balance each company's interests within the group is another issue for conglomerate;

- The treatment during transitional period is a critical;

- The business process needs to be adjusted under the VAT regime; and

- New tax compliance requirements will be raised with the implementation of VAT reform.

Vision for VAT reform of financial industry

Based on our observation, the Ministry of Finance, the State Administration of Taxation, the People's Bank of China, CBRC, CSRC and CIRC have been accelerating the pace of research and study on the VAT reform of financial industry as well as evaluating its impact on the industry since early 2014.

According to our study, herein we have illustrated our vision for the VAT reform of financial industry as following.

Impacts and challenges

To prepare the financial institutions, we herein summarize impacts and challenges financial industry may encounter as following:

- Uncertainty of the VAT reform policies for different financial businesses (i.e., tax rate, time for implementation, calculation method, tax incentives, etc.);

- Pressure of insufficient time between the introduction and formal implementation of the VAT reform for operational business system to react;

- Complex taxation treatment and mismatch of output and input VAT;

- Complex invoice management for output and input VAT invoices;

- Complex business and management systems needing huge workload to coordinate and integrate with the VAT reform; and

- Inadequate experience of both staff and tax officials.

How can Grant Thornton help you?

Based on the status of VAT reform implementation in other industries, generally, the regulations are released near the enforcement date, leaving between one to three months for companies to make any adjustment to regulatory changes. Needless to say, it is vital to plan ahead instead of taking hold and see approach towards the VAT reform for all real estate enterprises and financial institutions at this very moment.

Our seasoned advisors leverage our in-depth understanding of Chinese tax regulations and first-hand, real world experiences, when tailoring standalone or comprehensive solutions for different businesses under different circumstances for both planning and implementation phases.

Phase I: Preparation and assistance services before the VAT reform

- Review relevant agreements from PRC indirect tax perspective;

- Provide customized VAT training for relevant staff on all levels;

- Provide advice on VAT management system and internal control policies;

- Ad-hoc VAT reform advisory services;

- Provide advice on the potential tax impact of VAT reform; and

- Provide advice on the tax compliance difference.

Phase II: Implementation and supporting services after the VAT reform

Upon the issuance of the VAT reform regulations, we could assist the company to test, evaluate, and optimize the current VAT reform action plan. Specifically, we could provide our services as following:

- Modify and adjust the action plan;

- 2. Draw up guidance brochure for businesses involved in VAT reform;

- Provide technological support for internal tax management procedure;

- Establish VAT regulation database after the implement of VAT reform;

- Provide support in VAT compliance; and

- Assist in VAT filings and other tax compliance services.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.