Along with the rapid development of Internet finance in China, the assets that feed into the creation of Internet Financial Product (IFP) are also expanding. Among these assets, note's specialty includes its abstract principle, formality requirement and literal interpretation principle. Note is also suitable to be structured, making it a very popular asset. As a result, numerous IFP with notes as supporting asset continuously ballooned. In light of our recent experience in executing many notes IFP, we have summarized some of heated legal issues as follows.

- Two Business Models

Currently, notes IPF's main business model consists of two categories:

Beneficiary rights transfer

It means creating a beneficiary right for all incomes received and generated from notes, and transferring such right in its entirety or via creating different layers to investors. More specifically, the aforementioned beneficiary right is a contractual right that possesses or has the nature of debt; generally includes: (a) any income under the note, including any payment reminder from the note holder; (b) any income generated via receivables factoring etc.; (c) any income generated via guarantees with the note (if applicable); (d) in case of note payment default, any income generated via claims against the endorser, note issuer or any other debtors; (e) any income generated via sale of or other dealings with rights under the note.

This business model is special because investor and originator only possess or have a contingent creditor-to-debtor relationship, while originator's payment obligation to investor is only limited to the extent of any income generated. When the note fails to generate income due to its riskiness, originator will not intervene with its creditability and, thus, becomes a debtor without guarantee to investor's principal payment and expected returns.

P2P transfer

It means creating a P2P relationship backed by notes. More specifically, creditor-to-debtor relationship is formed by investors acting as lenders and note holder acting as borrower. Within this creditor-to-debtor relationship, provision will stipulate any income generated from note shall be considered the first source of repayment and the note shall be pledged. In addition, a creditor-todebtor relationship also exists between SPV and note holder, provided the business model is the SPV transferring such creditors' right in its entirety or via creating different layers to investors.

This business model is special not only because it involves notes as pledged asset (mentioned in the following), but also because the legal relationship and business model is similar to regular P2P lending. As a result, P2P transfer will likely fall within the realm of P2P-related regulations.

- Two Types of Guarantee

Whether using receivables transfer method or P2P transfer method, by relying purely on creditor's right, it is difficult for investors to truly obtain the legal right under the note. As a result, using notes as pledged asset is vital to solidify the legal right to investors under both methods. Under limitations imposed by the Property Law and the Negotiable Instruments Law, payment under notes and pledge endorsement are absolutely necessary for the validity of such pledge. However, due to the sheer number of investors, it is impossible to realise note possession and endorsement for every single investor. In light of this problem, two solutions are provided.

Pledge delegate model

This model involves the following procedures: (a) investors lend to originator; (b) originator uses its bank acceptance drafts as pledge to platform company; and (c) the fi nancing document specifi es that originator and investors confi rm such platform company's role as a security agent to exercise creditor's rights on behalf of all investors, while holding the pledged asset and participating in the endorsement.

One of the lenders acting as the security agent happens frequently within syndication loans. The advantage is that there is no need to involve a company to act as security agent; while perfecting creditor's rights over the pledged asset among large group of investors without any change of parties in the underlying transaction. The platform company can act as pledgee under endorsement to exercise any right under the notes, to monetise and negotiate with pledgor on debt repayment with the monetised sum.

However, one thing worth mentioning is for syndication loans, the security agent will usually be one of the lenders. While this is not the case in note IFP, since the platform company is not one of the lenders. It still remains some uncertainties whether the platform company would be subject to the same treatment as security agent in syndication loans under judicial practice.

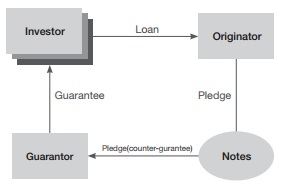

Counter-guarantee model

This model involves the following procedures: (a) investors lend to originator; (b) introduce third-party guarantor to provide guarantee for the loan; and (c) originator uses the notes as pledge to the platform company for counter-guarantee.

This model adopts counter-guarantee so as to allow large number of investors to gain more priority in their rights over notes. In comparison with the pledge delegate model, this model achieves more certainties and completeness.

More importantly, as mentioned before, under these models, originator's current source of repayment comes from the notes. Since notes under counterguarantee cannot monetise at maturity, such guarantee needs to be terminated before maturity or using short-term financing as bridge. Besides, introducing a guarantor company into the picture will more or less increase operating costs.

- Two Note Dealings

Beside civil litigation, it is essential to determine and understand the note dealings, so as to comprehend the business model and reduce legal risk. Among many dealings, two of them are particularly important and typical – pledge endorsement and delegate endorsement.

Pledge endorsement

Pledge endorsement means the endorser acting as the pledgor and the opposing party acting as pledgee, to specify the right of pledge. For notes pledge, its validity shall rely on the amended laws instead of the old ones. Such pledge shall become valid upon delivery in accordance with the Property Law, or preferring special law to common law, such pledge shall become valid upon endorsement in accordance with the Negotiable Instruments Law. There is still controversy over this issue. It is prudent to make endorsement a required step.

In practice, as mentioned above, since notes normally come from the note agents' readily collected notes, executing notes pledge endorsement will adopt the following two methods: (a) pledgor's endorsement is done before receiving the notes, after collecting the products, pledge endorsement is done by the security agent or counter-guarantor; or (b) upon receiving the notes, notes agent or platform company irrevocably delegate to endorse on behalf of the pledgor. The latter method will lead to the holder of the notes being different to the endorser, causing noncontinuity in the endorsement process and, thus, diminishing the power of the pledge endorsement.

Delegate endorsement

Delegate endorsement is one of the methods that involve using a delegate, the note document stipulates the right of pledge belongs to the delegate. This method of endorsement avoids concurrence of delegate relationship by which the Negotiable Instruments Law or the Civil Law shall govern.

Here a custodian bank will normally be the note service bank. Such delegate by note creditors is irrevocable. The custodian bank will exercise creditors' rights, including presentation for payment, collection, recovery, delivery and collection through another, and subsequently transfer such payments received to relevant custodian bank accounts.

- Litigation for two types of notes

Note IFP's essential source (and truthfully the only source) of repayment comes from the notes, so any litigation involving a note will cause severe impact on its exchangeability. In light of this, we hereby introduce the types of litigation and their basic contents:

Litigation over note itself

Litigation over note itself means any litigation resulting from the note itself and its contents. Such litigation is primarily based upon the notes itself, so litigation holds despite any change of legal relationships involved.

Generally speaking, litigation over note itself mainly includes the following situation: (i) note becomes void due to its content lacking legallyrequired format, such as lacking necessary provisions or including certain provisions that would make it void; (ii) litigation involving forged or altered notes; (iii) rights under notes has been terminated or become invalid, such as notes being fully repaid, offset as stated or exempted, exceeding the legal time frame for repayment claims etc; and (iv) for long-term notes, originator refuses to make payment as maturity has not been reached.

Litigation between parties

Litigation between parties means any litigation between debtors and specified creditors. This can be further categorised as follows: (a) originator fails to pay in situations (i) originator declared bankruptcy; and (ii) a non-delegate is exercising power over originator or a delegate is over-exercising its power over originator. (b) reasons for originator refusing to pay include: (i) note holders lost its power to execute the note; (ii) note holders obtained the note through illegal means, such as unlawful dealings, unlawful state of mind, or without paying (except for tax, inheritance or gifting); (iii) note holders knew about the origin of the notes, which originates from litigation between agent and originator.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.