Foreign investors are permitted to invest in China's stock markets1, provided that an investor is a Qualified Foreign Institutional Investor ("QFII"). Previously, applying for QFII status took as long as one to two years, and in some cases the entire process took even longer. However, recent reforms and policy adjustments will reduce this processing time to approximately six (6) months or less if the application is prepared correctly. Therefore, this policy change provides foreign financial institutions with a window of opportunity to qualify as a QFII and to deploy capital to invest in China's burgeoning stock market when the timing is right.

This alert summaries the QFII statutory framework, and gives a comparison between the old timetable and the now revised timetable.

The QFII Scheme in the PRC

A QFII refers to any overseas (i.e. non-Chinese) fund manger, insurance company, commercial bank, securities firm, or asset management firm (generally referred to as "financial institutions") approved by the China Security Regulatory Commission ("CSRC") to invest in the Chinese stock market within an investment quota set forth by the State Administration on Foreign Exchange ("SAFE").

On 5th November 2002, the Provisional Measures on the Administration of Domestic Securities Investments by Qualified Foreign Institutional Investor were jointly promulgated by the CSRC and PBoC, officially launching the QFII scheme in China. Four years later on 24th August 2006, the Measures on the Administration of Domestic Securities Investments by Qualified Foreign Institutional Investors were issued by the CSRC, PBoC and SAFE, which, together with the Regulations on Foreign Exchange Administration of Domestic Securities Investments by Qualified Foreign Investors promulgated by SAFE on 29th September 2009, set forth the foundation for the supervision of QFIIs by the PRC.

The Application for QFIIs: A Comparison Between the Old and the Recently Enacted Reforms

While foreign investors were allowed to invest in China's stock market, they often encountered long wait times in the application process. Previously, applicants had to wait years to receive a decision on their application. However, new reforms introduced by the new Chairman of the CSRC at the end of 2011 will accelerate the application process. The faster application process reflects China's policy to encourage more foreign investment in light of recent decreases in Chinese foreign reserve holdings.2

Historically, the timetable for approval of a QFII application submitted through a PRC domestic bank was one to two years. However, the recent policy change has reduced this approval time from nearly two years to six (6) months or possibly shorter for banks and firms capable of managing such an accelerated timetable. In December of 2011, 14 applicants obtained QFII approvals from the CSRC, while another 7 were approved in January 2012. However, we expect this window of opportunity to be short, as we have seen a surge in QFII applications in response to these new developments. We therefore suggest that an application be filed sooner rather than later with the CRSC before the waiting time becomes too long again.

QFII Qualification and Requirements

Under the QFII scheme, foreign investors may invest in 'A' shares3, bonds and warrants listed on China's domestic stock exchanges, securities investment funds, and other instruments permitted by the CSRC. A QFII must entrust either a domestic commercial bank or a foreignfunded bank operating inside China qualified and approved by both the CSRC and SAFE, to act as the custodian of its assets.4 An individual QFII may not hold more than 10% of the total outstanding shares of a single listed company while the total combined shares held by all QFIIs may not exceed 20% of the total outstanding shares of a single listed company5. The maximum investment quota that a single QFII can obtain is USD $1 billion, while the minimum is USD $50 million.

1. In order to qualify as a QFII, an applicant must satisfy the following requirements:

- The applicant is financially sound, creditworthy, honest and meets the minimum asset requirements set forth by the CSRC;

- The applicant must meet the requirement set forth by the authority in its own country or area with respect to its staffing numbers;

- The applicant must have a healthy governing structure, a complete internal control system, and must not have received any significant penalties by a regulatory organization during the past three (3) years;

- The applicant must have a complete legal and supervision system in its home country, which has signed an Alert of Understanding with the CSRC, and must maintain effective supervision and control of its organization; and

- The applicant must meet any other criteria as stipulated by the CSRC pursuant to prudent regulation principles.

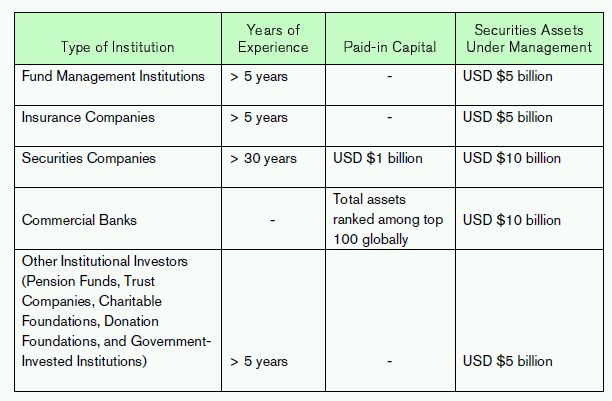

The following table details certain requirements such as minimum assets under management and minimum years of business operations for different types of institutions.6

2. The following are some factors important to the CSRC when evaluating an application:

- Long-term investment commitment is preferred; Diversity of investment by types and geography;

- Quality of investment and the investment management team; and

- A QFII is favored when the domestic stock market is trending downward.

3. In order to encourage middle and long-term investments, promote the steady growth of capital markets, and consider the effect of reciprocity between the PRC and other countries, preference is given to applicants in any of the following three circumstances:

- An application from a country who is applying for the first time;

- Applicants from Taiwan, for the purposes of encouraging cross-strait QFII investments;

- An application from world known enterprises, meaning financial conglomerates in banking, insurance funds, securities, church pension funds, charity funds and government investment management companies. Examples include Citibank, HSBC, Morgan Stanley etc., but not general operating companies like Coca Cola and McDonalds. In order to accelerate approval, applicants should not only provide complete documents to the CSRC stating the scale of their enterprise and its popularity throughout the world, but also ensure that the representative of their custodian communicate these details to the CSRC as well.

There has not been a better time for foreign fund managers and financial institutions to become a QFII to invest in China's stock markets or in Chinese securities. However, foreign investors should apply for QFII status as soon as possible to avoid queues that might develop from an increase in applications. Given the complexities and the time-sensitive nature of the application process, we recommend that any foreign investors interested in applying for QFII status retain experienced legal counsel.

Footnotes

1 QFIIs are permitted to invest in China's stock markets in both the A-Share Exchange on the Shanghai (上海证券交易所)and the Shenzhen Stock Exchange (深圳证券交易所)

2 For example, pursuant to figures from the People's Bank of China, in October 2011 China recorded its first year-onyear quarterly decrease in its foreign exchange holdings. The decrease is due to China's own "going global" initiative encouraging overseas investment and a recent entrenchment in foreign money inflows.

3 'A' shares refer to the RMB-denominated ordinary shares issued by mainland China-incorporated shareholding companies and traded on the Shanghai and Shenzhen Stock Exchange.

4 Measures on the Administration of Domestic Securities Investments by Qualified Foreign Institutional Investors, promulgated by CSRC, PBoC, and SAFE on 24th August 2006.

5 Notice on Issues concerning the Implementation of the Measures on the Administration of Domestic Securities Investments by Qualified Foreign Institutional Investors, issued by CSRC on 24 August 2006.

6 These figures are general and subject to change based on the type of firm applying for the QFII, the location of the firm, the types of investments the firm proposes to make in China, the duration of the investment, the firm's management capabilities, and the reputation of the firm, among other factors.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.