On February 3, 2011, the PRC State Council (the "State Council") promulgated the long awaited Circular on the Establishment of Security Review Mechanisms for Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (《国务院办公厅关于建立外 国投资 者并购境内企业安全审查制度的通知》) (the "State Council SR Circular"), which took effect on March 5, 2011. As a follow up to the State Council SR Circular, the Ministry of Commerce ("MOFCOM") issued the Interim Provisions on Issues Related to the Implementation of the Security Review Mechanisms for Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (《商务部实施外国投资者并购 境内 企业安全审查制度有关事项的暂行规定》) (the "Interim SR Rules") on March 4, 2011.

I. SUMMARY AND BACKGROUND

In summary, under the State Council SR Circular, the National Development and Reform Commission ("NDRC") and MOFCOM, along with other PRC governmental authorities that regulate the relevant industrial sectors, will establish a joint committee ("Joint Committee") to conduct the security review under the leadership and supervision of the State Council. Similar to the Committee on Foreign Investment in the United States ("CFIUS"), the Joint Committee will review foreign takeovers of PRC domestic businesses for national security issues.

In recent years, Chinese authorities have rejected several high profile proposed acquisitions of domestic companies by foreign investors, such as a US$2.4 billion bid by Coca-Cola for the Chinese company Huiyuan Juice in 2009 and Carlyle's US$375 million bid for construction equipment maker Xugong in 2008. Nevertheless, no proposed acquisition by a foreign investor has yet been blocked explicitly on "national security" grounds due to a lack of published legal guidelines.

On the other hand, several recent strategic efforts of outbound acquisitions of foreign companies by PRC leading private companies and State-owned enterprises have encountered hurdles or difficulties under the security review mechanisms of other foreign countries. In 2005, Stateowned oil group China National Offshore Oil Corporation suffered a huge setback when it had to abandon its US$18.5 billion bid for Unocal in the United States due to what it called "unprecedented political opposition." i Also, CFIUS intensely scrutinized the acquisition of IBM's PC division by Lenovo (a leading Chinese computer company), approving it only after conducting a forty-five (45) day review and concluding a mitigation agreement. In 2008, the proposed investment in U.S. network security company 3Com by Huawei Technologies Inc. (one of China's leading global companies) was thwarted when objections were raised by CFIUS. Furthermore, in 2009, the State-owned China Non-Ferrous Metal Mining (Group) Co. dropped a US$400 million bid for 50.6% of Lynas Corp, owner of the world's richest deposit of rare-earth minerals based in Australia, saying the conditions set by the Foreign Investment Review Board of Australia were too stiff. In mid-2010, CFIUS scuttled another proposed investment by Huawei, this time in mobile communications companies 2Wire and Motorola. As a consequence, it has been anticipated by foreign investment experts and international transactional lawyers that the PRC governmental authorities might adopt stricter security review standards to review inbound acquisitions by foreign investments.

II. OUR OBSERVATIONS

The State Council SR Circular took effect March 5, 2011 and the Interim SR Rules have a limited validity period from March 5 to August 31, 2011. However, considerable uncertainties still remain before the security review can be effectively enforced. Below are our preliminary observations on the Interim SR Rules.

A. Specific Scope of Industries for Security Review

Although the State Council SR Circular includes a list of strategic and sensitive industries, terms such as "important agricultural products, important energy and resources, key infrastructure, important transportation services, key technology and important equipment manufacturing" appear to be too broad and generic if no specific or further guidelines will be issued. It is important that the State Council and MOFCOM clarify the specific industries or products that will be applicable to security review, such as specifying what specific equipment and resources will be regarded as "important equipment" and "important resources" for security review.

It is also important that the State Council issue implementing rules of the State Council SR Circular to specify the particular industries that would be covered under the security review. However, the real concern is that lawmakers and relevant administrative authorities prefer to issue regulations using vague language or general provisions rather than specific requirements so that the governmental authorities in charge of the interpretation and implementation of the regulations will have broader administrative leverage and discretion to enforce the regulations. Accordingly, while further clarity will be welcomed in the form of written regulations, it is not likely.

B. Different Attitudes by National and Local Approval Authorities

In practice, MOFCOM's local counterparts have always welcomed foreign investments in local industries and markets. If the State Council and MOFCOM do not specify which industries will be subject to the security review, it is very likely that the local approval authorities, in order to promote the local economy, will approve a foreign investor's acquisition of a domestic enterprise which might, in MOFCOM's view, engage in an industry that is subject to security review. Without specifying the scope and definition of the above terms, both the foreign and domestic partners of an acquisition or merger project will suffer significant economic and reputational losses if the local approval authority supports and approves the project, but MOFCOM challenges the project on the ground of security concern and cracks down after the project has been set up.

A key issue is whether MOFCOM or the State Council will establish a compensation system to indemnify the losses of any foreign and domestic investors whose acquisition and merger project was approved by the local authorities but later suspended or stopped by MOFCOM on security grounds.

C. Pre-Filing Consultation and Formal Filing

For foreign investors who are planning to invest in any sensitive industries in the PRC, it is recommended that they have a pre-filing consultation with MOFCOM on whether their proposed transaction may potentially trigger a security review before they actually submit a formal security review application. A pre-filing consultation arrangement is explicitly allowed under the Interim SR Rules. However, MOFCOM did not disclose to the public the contact numbers (telephone and fax numbers) and the name of the division of MOFCOM that is responsible for arranging pre-filing consultations. Furthermore, specific guidance is lacking regarding at which stage of establishing a project the foreign and Chinese partners should or can arrange the pre-filing consultation.

Specific unanswered questions on the prefiling consultation include the following:

- Can the investors approach MOFCOM for a pre-filing consultation once the parties sign a letter of intent or a memorandum of understanding for the acquisition?

- Can the foreign and Chinese parties apply for a pre-filing consultation after the completion of due diligence?

- What kinds of documents and information will MOFCOM require the parties to submit before and during the pre-filing consultation? Since the preparation and collection of certain documents for the formal filing will take time (such as the preparation of the notarized and apostilled incorporation certificate of the foreign investor and its legal representative), will MOFCOM provide a comparatively realistic and simple filing process for the pre-filing consultation?

D. Security Review and Anti-Monopoly Law ("AML") Merger Control Review

The security review under the State Council SR Circular and the merger control review under the PRC AML are two separate reviews and have different rules and requirements. It appears that if a foreign investor is to acquire a domestic enterprise that engages in an industry requiring security review and both the foreign and domestic investors meet the revenue thresholds for merger control review, the foreign and Chinese partners need to request security review first, and after obtaining the security concern clearance, the project must be submitted to the anti-monopoly bureau of MOFCOM for merger control review. These two reviews will significantly delay the timeline of a project. It will be important to know if MOFCOM can shorten the timeline for these two different reviews. For example, it would be helpful if the applicant can submit applications simultaneously for both security review and merger control review, and if MOFCOM could internally consolidate and coordinate both reviews to shorten the merger control review term. It is currently unclear whether this simultaneous review is possible.

E. Green Field Joint Venture

We understand that if a green field joint venture is to be established for the sole purpose of acquiring the equity or assets of a domestic company engaged in certain security-controlled industries, the establishment of the green field joint venture may be subject to security review. However, if a green field joint venture is to be established via cash investments by both foreign and Chinese investors for the manufacturing of imported equipment or for the development of new technology, it is unclear if the establishment of the green field joint venture will be subject to security review if the products to be produced by the new joint venture fall within the security-control category. We do not believe that the green field joint venture will be subject to security review control since the establishment of a new joint venture is not specified in the scope of merger and acquisition transactions for security control, but this remains unclear.

III. SUGGESTIONS

For foreign investors who are planning to invest in those industries that are likely to fall under security concerns in the PRC, it is advisable that such investors develop a coordinated strategy to address the various regulatory filings and approvals (such as security review filing, pre-merger anti-monopoly filing, and regular approval by MOFCOM's local counterparts).

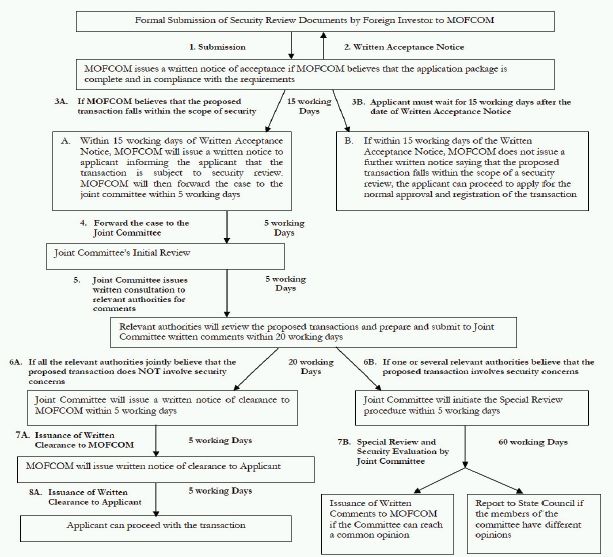

The Interim SR Rules stipulate a detailed timeline for the security review. Attached is a summary of the filing timeline for reference. When foreign investors determine the project schedule and closing time, they should take into account the time needed for the security review filings.

Parties involved in a merger or acquisition project in the PRC should seek legal advice on how to structure a transaction to meet the new requirements.

i Since then many U.S. commentators on the Unocal issue have criticized the U.S. congressional opposition to the purchase, which was largely focused on national security issues, and have suggested that the real basis for questioning the acquisition should have been on the basis of reciprocity, since a similar acquisition by a U.S. company in China would in all likelihood not be allowed.

The content of this article does not constitute legal advice and should not be relied on in that way. Specific advice should be sought about your specific circumstances.