- within Environment topic(s)

On 21 September 2012, the Ministry of Commerce ("MOFCOM") promulgated the Interim Provisions of the Ministry of Commerce on Capital Contribution in the Form of Equity Interests Relating to Foreign-Invested Enterprises ("Interim Provisions"). The Interim Provisions came into force on 22 October 2012.

Background

Under the PRC Company Law, shareholders may make capital contributions in kind, which is defined as non-monetary assets such as material goods, intellectual property rights and land use right that can be valued and legally transferred.

In 2009, the State Administration for Industry and Commerce (SAIC) promulgated the Measures of Administration of Registration of Capital Contribution in the Form of Equity Interests ("Registration Measures"), which set out the rules for the registration of capital contributions in the form of equity interests ("Equity Interest Contribution"). In the meantime, the Registration Measures provide that if the transfer of equity interests involved in the Equity Interest Contribution needs to be otherwise approved in accordance with Chinese law, then such approval shall be obtained in advance.

On 18 January 2010, the State Administration of Foreign Exchange (SAFE) issued the operational rules for its local offices to handle the foreign exchange formalities in relation to Equity Interest Contributions made by foreign investors. The prior approval from the MOFCOM is also required for this foreign exchange registration purpose.

There were no specific rules dealing with the MOFCOM's approval for Equity Interest Contribution until the promulgation of the Interim Provisions in September 2012.

Scope of application

If a foreign investor uses its equity interests held in a company incorporated in China ("Equity Company") as capital contributions to a foreign invested enterprise ("Invested FIE"), which includes:

- a new FIE to be established;

- a FIE transformed from an existing non-foreign invested enterprise by way of capital increase; and

- an existing FIE whose shareholding structure is changed due to the increase of its capital,

then it shall be subject to the Interim Provisions.

All Equity Interest Contribution needs to be approved by the MOFCOM or its local office at the provincial level which is in charge of the Invested FIE.

Evaluation requirements and restrictions

Equity interests to be contributed by the foreign investor must be evaluated by an evaluation institution duly registered in China. The amount of the Equity Interest Contribution may be negotiated and agreed by the investors of the Invested FIE but it shall in no event exceed the value assessed by the evaluation institution.

Equity interests are prohibited from being contributed by foreign investors in the following circumstances:

- the registered capital of the Equity Company has not been fully contributed;

- the equity interests have been pledged or frozen;

- the equity interests are not transferable in accordance with the Equity Company's Articles of Association or shareholders' agreement;

- the Equity Company is a FIE which did not apply for or failed to pass the annual inspection for the previous year;

- the Equity Company is a real estate company, a foreign invested holding company or a foreign invested venture capital company;

- the transfer of the equity interests needs to be otherwise approved but such approval has not been obtained;

- other circumstances where the equity interests are not transferable in accordance with law.

A legal opinion issued by a law firm in China confirming the Equity Interest Contribution complies with these restrictions must be submitted together with other application documents.

Procedures

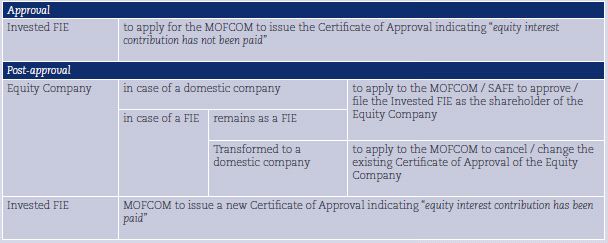

The below table sets out the steps to be gone through in different circumstances:

Conclusion

The Interim Provisions clarify the rules to be followed with respect to the approval from the MOFCOM and will no doubt provide more flexibility to foreign investors for their business restructuring in China.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.