On April 12, 2013, the State Administration of Taxation ("SAT") released Shuizonghan [2013] No. 165 ("Circular 165") to further clarify the beneficiary ownership rules with respect to dividends received by Hong Kong holding companies pursuant to the Mainland China-Hong Kong double taxation agreement. Previously, the SAT issued Guoshuihan [2009] No. 601 ("Circular 601") to define the term "beneficiary owner" with respect to the tax treaty treatment of dividends, interests, and royalties.Subsequently, the SAT issued Notice [2012] No. 30 ("Notice 30") to explain the application of the beneficiary ownership rules.

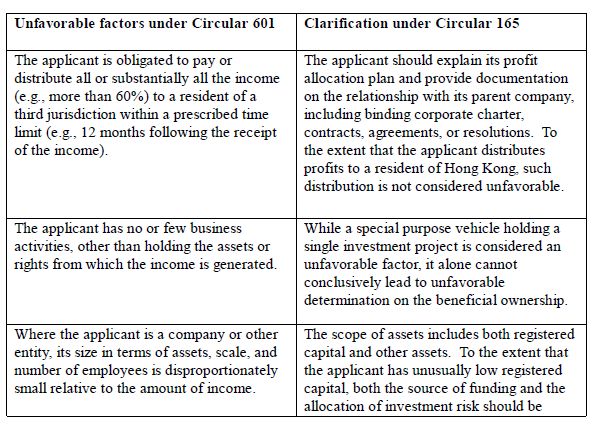

Circular 601 expressly lists seven factors, which generally lead to unfavorable results, in determining beneficiary owners in the process of reviewing such applications by foreign holding companies. Circular 165 seeks to soften these unfavorable factors in regard to dividends received by Hong Kong holding companies. Below is a chart as to the respective positions of Circulars 601 and 165 in the context of dividends.

Notice 30 has provided safe harbor to qualified publicly traded companies in the beneficial ownership determination. Circular 165 stresses that circumstances out of safe harbor will not automatically lead to an unfavorable determination on the beneficial ownership status. Instead, all factors are still to be examined. To the extent that one applicant has multiple investment activities in various locations, Circular 165 calls for a uniform beneficial ownership determination across the locations.

Circular 165 only applies to Hong Kong holding companies receiving dividends from subsidiaries in China. Apparently, the SAT is retreating a bit on its ultra-aggressive position regarding the beneficial ownership determination, at least in the context of dividends. The question now is whether the logic of Circular 165 will expand to other jurisdictions or sources of incomes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.