The year 2022 was pivotal for antitrust law enforcement in China, with a major legislative overhaul and series of proposed amendments to implementing regulations of China's Anti-Monopoly Law (AML). We also witnessed active enforcement by the State Administration for Market Regulation (SAMR). Against this backdrop, we consider what may lie ahead in 2023.

Legislative Developments

On 24 June 2022, the amendment of the AML was officially approved by the Chinese People's Congress, with the changes taking effect on 1 August 2022. This was the first overhaul of the AML since it was introduced in 2008.

On 24 March 2023, following a public consultation from 27 June 2022 to 27 July 2022, SAMR released four implementing regulations of AML that finalised with amendments, including the following (click):

- Regulations on the Review of Concentration of Undertakings (Merger Control Regulations)

- Regulations on the Prohibition of Monopolistic Agreements (Monopolistic Agreements Regulations)

- Regulations on the Prohibition of Abusing Dominant Market Positions (Abusing Dominant Market Positions Regulations)

- Regulations on the Prohibition of Abusing Administrative Power to Eliminate or Restrict Competition

The other two regulations remain being finalised with revision (click):

- Regulations on the Notification Threshold of Concentration of Undertakings (Draft for Consultation)

- Regulations on the Prohibition of Abusing Intellectual Property Rights to Eliminate or Restrict Competition (Draft for Consultation)

In addition to the above, on 18 November 2022, the Supreme People's Court of China (SPC) launched a consultation on draft Provisions of the SPC on Issues concerning the Application of the Law in the Trial of Monopoly-Related Civil Disputes (Draft Provisions) (click).

In a broader sense of competition regulation, the draft amendments to the China Anti-Unfair Competition Law (Draft AUCL) were published by SAMR for public comment on 22 November 2022 (click).

Overview of Antitrust Enforcement in China

- MERGER CONTROL

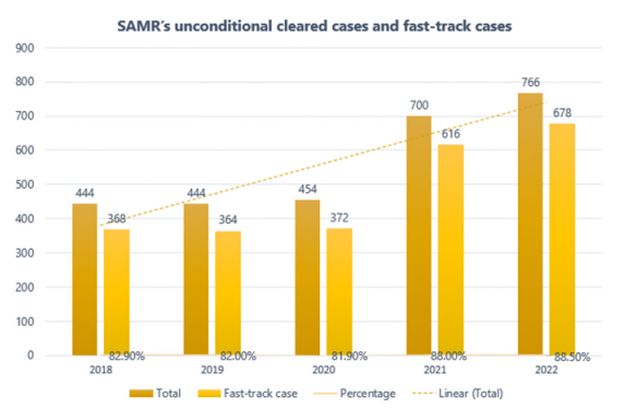

The year 2022 was also busy for merger activity, with SAMR unconditionally clearing a record number of 766 merger filing cases, comprising 678 'fast-track' cases and 88 normal cases. In addition, there were five cases cleared with remedies by SAMR, and one lapsed case due to expiration of the long-stop date.

Similar to previous years, SAMR still took around two weeks to conclude 'fast-track' cases, although it saw a slight slowdown in the review period. To complete the picture, there were also 45 cases where parties were punished by SAMR due to failure to fulfil notification obligations (a decrease compared to 107 cases in 2021).

Source: PaRR-Global (click)

Major developments in the realm of merger control include:

- Substantially increased fines

The amended AML has significantly increased the level of fines for failing to file or gun-jumping by 10 times. Where the unreported deal is found not to be anti-competitive, the maximum fine is increased from RMB 500,000 to RMB 5 million. In cases where the deal is anti-competitive, a fine may be levied up to 10% of the deal parties' group turnover in the last year.

- Introduction of the stop-the-clock scheme

Before the amendment of the AML, SAMR had a fixed term – maximum 180 days – to complete its merger review. When the deadline was not able to be met by SAMR, the deal parties usually had to withdraw and refile applications so that SAMR's review period could re-start. This has occurred most frequently in high-profile and complicated cases. The amended AML introduces a stop-the-clock mechanism, which was further elaborated on in the Merger Control Regulations. This new mechanism empowers SAMR to suspend its review at any point if one of the following scenarios occurs:

- The notifying party fails to submit the requisite materials or information rendering the review unable to proceed;

- New circumstances or facts having material impacts on review occur that result in the review being impossible to continue without SAMR's verification; or

- Remedies proposals are submitted to SAMR for evaluation, and the notifying party requests to pause the review.

Initially, concerns were raised that SAMR may use this mechanism arbitrarily to prolong its review period – making the filing period in China more unpredictable. However, looking back over the past few months since its implementation, the review system has become more transparent, given that rules are now in place to suspend and restart the review clock. Further, it reduces the burden on the notifying party to formally withdraw and refile in the event that the review period is close to expiry

Despite the above-mentioned positive effects, notifying parties should still submit a complete set of filing documents and respond to SAMR's requests in a timely and complete way to avoid an extended review period.

- SAMR is entitled to investigate below-threshold deals

The amended AML empowers SAMR to investigate otherwise unreportable or deals which have likely anti-competitive effects. Merger Control Regulations specify the procedure and reiterates the standing-still obligations of the deal parties to await the review decisions, in case their belowthreshold deal falls into the remit of SAMR.

This amendment is perceived to deal with so-called killer acquisitions often seen in the internet sector and medical industries, and to deal with high-profile but not reportable cases (e.g., Qualcomm/Arriver Business of Veoneer (2022)). However, it is not apparent if any below-threshold deals have been investigated since the amended AML entered into force.

- SAMR delegates review power to five local AMRs

On 15 July 2022, SAMR announced a pilot programme to delegate power to review fast-track deals to five local AMRs – in Beijing, Shanghai, Guangdong, Chongqing and Shaanxi (Local AMRs) (click). The pilot period is in effect from 1 August 2022 until 31 July 2025.

In addition to the requirement that delegated cases should be eligible to be reviewed under the simplified procedures, a local nexus associated with the respective Local AMR's designated area is also required. From 1 August 2022 to 31 December 2022, it is reported that Local AMRs cleared 4 Mayer Brown | China's Antitrust Enforcement: A Look Back on 2022 and What to Expect in 2023 102 fast-track cases unconditionally, against SAMR's 164 cleared fast-track cases over the same period.

To view the full article, click here.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2023. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.