On 1 August 2008, the first PRC Anti-Monopoly Law came into effect. This article discusses important aspects of the law, including the unique feature of its enforcement by different government agencies, which was only clarified shortly before this date.

Monopolies and Monopolistic Behaviour

The Anti-Monopoly Law identifies three types of monopolistic behaviour:

- Monopolistic agreements between entities;

- Abuse of dominant market position by entities; and

- Concentration of entities that may eliminate or restrict competition.

"Entities" under the Anti-Monopoly Law are defined as natural persons, legal persons or other organisations that produce or trade goods, or that provide services.

Cartels

Monopolistic agreements or "cartels" under the Anti-Monopoly Law refer to agreements, decisions or other concerted behaviour that eliminates or restricts competition. The Anti-Monopoly Law identifies prohibited horizontal and vertical cartels.

Prohibited behaviour by horizontal cartels refers to agreements that:

- Fix or change the price of products;

- Restrict the output volume or sales volume of products;

- Restrict the purchase of new technology or new facilities or the development of new technology or new products;

- Divide the sales market or the raw material purchasing market; and

- Jointly boycott transactions.

Prohibited behaviour by vertical cartels refers to agreements that:

- fix the price for resale to a third party;

- restrict the minimum price for resale to a third party.

These definitions also cover other monopolistic agreements as determined by anti-monopoly enforcement authorities.

These prohibitions do not apply to situations where the entities can show that the behaviour allows them to:

- Improve techniques, conduct research and develop new products;

- Upgrade product quality, reduce costs, improve efficiency unify product models and standards or carry out professional labor distribution;

- Improve operational efficiency and enhance the competitiveness of small and medium-sized enterprises;

- Maintain the public welfare, such as through conserving energy, protecting the environment or providing disaster relief;

- Mitigate a severe decrease of sales volume or excessive overstock during an economic recession; or

- Protect the legitimate interests of international trade and foreign economic cooperation

Other cases may be stipulated by law or the State Council.

Abuse of Dominant Market Position

The Anti-Monopoly Law prohibits entities from abusing their "dominant market position" by:

- Selling products at unfairly high prices or buying products at unfairly low prices;

- Selling products at prices below cost without justification;

- Requiring parties to conduct transactions exclusively with them or designated parties without justification;

- Implementing tie-in sales without justification or imposing other unreasonable transaction terms;

- Applying discriminatory treatment in pricing or other terms to their transaction parties with equal standing without justification; and

- Other activities that abuse their dominant market position as recognised by the anti-monopoly enforcement authorities.

Determining "dominant market position"

"Dominant market position" under the Anti-Monopoly Law is defined as a market position held by entities that can control the price or quantity of products or other transaction conditions in the relevant market, or that can block or affect the access of other entities to the relevant market.

When assessing whether the market position of an entity is dominant, enforcement authorities will consider the following:

- The market share of the respective entity and its competitive status in the relevant market;

- The ability of the entity to control the sales market or the raw material purchasing market;

- The financial and technical status of the entity;

- The extent to which other parties rely on the entity during transactions;

- The degree of difficulty for other entities to enter the relevant market; and

- Other factors relevant to the entities' dominant market position.

Entities may be construed to have a dominant market position if any of the following conditions is fulfilled:

- One entity occupies one-half of the relevant market;

- Two entities occupy two-thirds of the relevant market; or

- Three entities occupy three-fourths of the relevant market.

When two entities occupy two-thirds or more of the market, or three entities occupy three-fourths or more, any of the entities that have a market share of less than 10% will not be considered as having a dominant market position. Also, entities with a construed dominant market position may provide evidence that demonstrates their lack of actual dominance in the market.

Concentrations of Entities

Under the Anti-Monopoly Law, parties who propose an arrangement that will result in a "concentration of entities" must submit an application for approval by the competent anti-monopoly enforcement authority.

A "concentration of entities" is defined under the Anti-Monopoly Law as the following:

- Merger conducted by entities;

- Controlling other entities by acquiring their shares or assets, or through other means;

- Acquiring control over other entities by contract or other means, or by obtaining the ability to exercise decisive influence over other entities through contract or other arrangements.

Concentrations that require approval

The entities must make a prior submission to the competent anti-monopoly authority (Ministry of Commerce) if one of the following criteria is met:

- The aggregate global turnover of all entities involved in the contemplated concentration for the preceding financial year exceeds RMB 10 billion, and there are at least two entities whose turnover in China for the preceding financial year each exceeds RMB 400 million;

- The aggregate turnover of all entities in China for the preceding financial year exceeds RMB 2 billion, and at least two of the entities have a turnover in China for the preceding financial year that exceeds RMB 400 million.

Entities do not need to make a prior filing under either of the following circumstances:

- One entity possesses more than 50% of the voting shares or assets of each entity involved in the concentration;

- An entity not involved in the concentration possesses more than 50% of the voting shares or assets of each entity that is involved in the concentration.

What is contained in the submission?

The submission to the Ministry of Commerce for the contemplated concentration includes the following:

- Application letter (indicating the name, address, business scope and description of the concentration);

- Explanation of the effect of the concentration on market competition;

- Concentration agreement;

- Entities' audited financial and accounting report for the preceding year;

- Other documents and information as required on a case-by-case basis.

Which concentrations are prohibited?

If the authority finds that the contemplated entities' concentration would or could eliminate or restrict market competition, it will prohibit the concentration and provide an explanation for its decision. The authority may allow the concentration if the entities can prove that either the advantages of implementing the concentration exceed the disadvantages, or that the concentration is in harmony with the public interest. In such cases the authority may subject the concentration to certain restrictions.

When examining the submission, the authority will consider the following factors:

- The involved entities' market share in the relevant market and their control over the market;

- The degree of concentration in the relevant market;

- The effect of the concentration on access to the market and technological advances, customers and other entities, and national economic development and;

- Other factors that affect market competition as determined by the authority.

Enforcement

Commentators have long discussed whether the Anti-Monopoly Law would play a significant role in regulating competition, or would serve as a toothless "paper tiger". Although the law was promulgated in July 2007, the late clarification of enforcement responsibilities contributed to doubts about enforceability.

Which authorities are in charge?

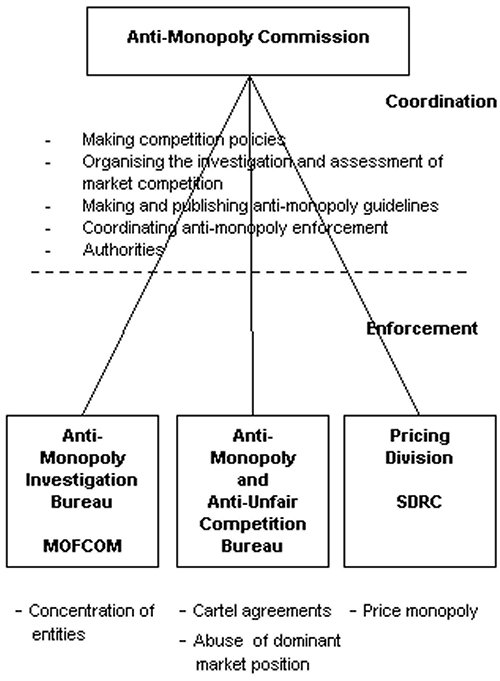

Although some other countries have designated a single government agency to control monopolistic practices, the PRC government has divided this responsibility among four agencies. The structure of the its anti-monopoly organisation is depicted below.

Investigations

When investigating suspected monopolistic conduct, individual anti-monopoly enforcement authorities can take the following measures (without having to involve the judicial system or other authorities in the PRC):

- Conduct on-the-spot inspection at the business location or other places that are relevant to the entities;

- Make inquiries with the entity under investigation, interested parties and other relevant organisations and individuals;

- Review or copy relevant documents, agreements, contracts, accounting books, business mail and electronic data submitted by the entity concerned, interested parties, and other relevant organisations or individuals;

- Seal and retain relevant evidence; and

- Inquire about the bank accounts of the entities concerned.

Impact on foreign companies

The Anti-Monopoly Law also applies to monopolistic conduct outside the PRC that eliminates or restricts domestic competition, and foreign companies may be subject to anti-monopoly investigations and punishment by PRC authorities regardless of regulatory treatment in their home jurisdiction. This should be of particular relevance to transactions that could lead to a "concentration of entities" as discussed above.

Impact on M&A

The Anti-Monopoly Law subjects both domestic and foreign-invested enterprises in the PRC to the regulation of contemplated concentration of entities. Such transactions must be reported to and approved by the anti-monopoly enforcement authorities.

Such regulation is not entirely new for foreign-invested enterprises. The Regulations on Merger of Domestic Enterprises by Foreign Investors promulgated in 2006, for example, required foreign investors to obtain the approval of the Anti-Monopoly Investigation Office of the Ministry of Commerce when attempting to acquire certain domestic enterprises.

The new legislation restructures the Anti-Monopoly Investigation Office into a new "Anti-Monopoly Investigation Bureau", and the officials at the Ministry of Commerce who have handled the approval procedures for M&A transactions in the past will generally continue to do so.

The law includes a "national security examination", but does not specify the relevant regulatory authority and criteria for assessment.

Penalties

Entities that have reached and subsequently implemented a monopolistic agreement, and entities that have abused their dominant market position, are subject to penalties. The relevant authority will order the entities to cease and desist such acts, confiscate the illegal gains and impose fines from 1% to 10% of the previous year's total sales volume in the relevant market. If monopolistic agreements have not been implemented, a fine of less than RMB 500,000 may be imposed.

If the entities' concentration is in violation of the law, the relevant authority will order the entities to eliminate the concentration by disposing all or part of its stock or assets within a specific time, transferring part of its business or adopting other measures necessary to restore the market situation before the concentration. It may also impose a fine of less than RMB 500,000.

If the entities concerned or other interested parties are dissatisfied with the penalty, their first recourse is applying for administrative reconsideration. If they remain dissatisfied, they may file an administrative suit. The law also allows third parties who have suffered losses from monopolistic conduct to claim damages.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.