There's an industry adage that says "when you've seen one family office ... you've seen one family office." This is especially true in the current environment where many group structures either avoid the label "family office" or have grown complex so quickly that they don't realise this is what they've become.

The vision of an original wealth-creator may have allowed for a streamlined management process in the initial period of asset accumulation, however this becomes challenging when there are transitions of leadership to the next generation. As wealth increases and younger generations become decision makers, there is often an increased push for the business operations to become more institutionalised and professionally managed. This transfer of responsibilities, management and governance to outside service providers, directors, and board members is a primary indicator that a group structure has truly become a "family office."

Family offices have unique challenges compared to other entities. The up-front decisions made when creating a family office structure have important consequences, but every day decisions and oversight can be just as impactful. Whether it's creating a new family office, structuring the family office to be separate from the family business, or shepherding an existing family office, it is important to consider if the right policies and procedures are in place to help secure the financial future and legacy for the next generations.

We see five key areas of focus that can mean the difference between merely existing in the current state and truly achieving future success. These are: family office design and setup, risk review, strategic planning, technology and leading-practice review.

FAMILY OFFICE DESIGN AND SETUP

The reasons for setting up a family office vary, some common considerations being:

- Both the family and business are growing and the business staff is not able to meet the family needs, or is significantly distracted from the business by doing so.

- There is a liquidity event, such as sale of the business or segment, and a significant portfolio of non-business assets to be managed.

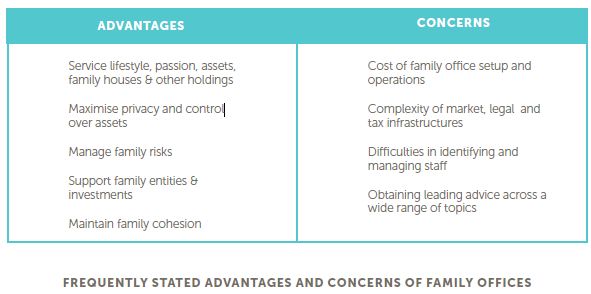

Whatever the reason for contemplating setting up a family office it's important to consider the advantages as well as the concerns when making this decision.

RISK REVIEW

Risk can arise from various sources such as business, investment, technology or operations. Making certain that the family office is protected from damage or loss, whether financial, physical and reputational is a key objective. A family office can assess and prioritise its risks through the use of a comprehensive risk model tailored to the family office - categories of focus include vision and legacy, management, operations, technology, succession, investments and tax and

regulatory. Within each category the key strengths and weaknesses should be determined to highlight areas requiring investment or focus.

Risks are also categorised according to how the family office addresses them:

- Transfer — risks with high potential impact but limited ability for family control are generally financed, ie. transferred to an insurance policy (ie. natural hazard or liability)

- Management — risks with high impact and complex control requirements should be addressed at the executive level and through a well-designed governance process (ie. succession planning)

- Monitoring — risks with lower impact and limited opportunities for control should be watched and monitored (ie. external regulation)

- Process - risks with high impact that are readily controlled should be staffed and subject to policy and procedure (ie. wire transfer policy). By conducting a risk analysis a family office can look to address specific areas in order to minimise the potential impact.

TECHNOLOGY

Having a single technology platform to support their accounting, reporting and operational needs is often described by family offices as the Holy Grail, but in practice this is often not practical.

Technology solutions for a family office are fragmented, both due to the limited scale of the market, and to the fact that family offices are not a one size fits all type of structure.

The challenges can include the following:

- Managing information and applications both inside and outside the office

- Differing types of investment holdings

- Differing stability, complexity and purpose of legal structures, including jurisdictional issues

- Limited staff size with varying levels of skill

- Varying complexity of offices and privacy concerns about outsourcing and cloud tools.

Family offices often must take a "system of systems" approach to meet their needs — the priority then is that these systems interface with one another to allow for seamless integration, and limited duplication of data. This requires finding the correct balance from robust technology, efficient processes and ease of use through the latest electronic tools and devices, well-trained and qualified staff. In determining what technology is best suited for a particular family office the following issues should be considered:

- What types of investments do you have?

- What types of accounting management and compliance systems do you need?

- What are the reporting needs of the family, external advisors, trustees, etc?

- Are you properly staffed to manage your operations now?

- What about five years from now?

- Are you prepared to respond to cybersecurity intrusions or other breach or loss?

Having the answers to these questions will allow a family office to better determine the technology tools best suited for their specific needs.

STRATEGIC PLANNING

A consistent theme with most family offices is that they are diligent about strategic planning for their business, yet the family office, being stretched with daily demands, often finds little time to focus on longer-term planning. This planning must be intentional, especially given the complexity and size of many families, if the desired legacy is to be achieved. We feel there are three key items to address in this area:

- Family charter — this is the foundation of your strategy and should be a 100-year plan outlining the family's purpose, values, vision for governance, and how wealth will support its legacy. Even if a charter is currently in place, it should be reviewed periodically to see that it remains relevant and viable.

- Strategic plans — this is a 5-10 year plan which outlines a strategy to train the next generation so that the family is prepared for business, technology, and long-term business changes, as well as investment and development opportunities.

- Business plans — this is a 1-5 year plan which serves to support the strategic plan. This would detail any key initiatives for meeting the family's short-term goals as well as the 10 year plan.

Another key component of strategic planning is succession planning and we see four dimensions of focus in this area: leadership, ownership, legacy and value, and wealth transition.

These form the basis of any successful succession plan, and are the key considerations for the three primary stakeholder groups — owners, families, and the business and investments.Timely implementation and adherence to a family office's strategic plan can not only help unlock the potential of a family and its future, but support its legacy for generations to come.

Leading practice review — businesses around the world typically look to benchmark their practices to peers in effort to see how they compare to the industry leaders. Given the private nature of family offices this type of comparison can be difficult at best.

Larger service providers are often able to utilise their client base of global family offices to create a database of leading practices which can then be used to perform leading practice reviews.

These types of reviews can provide valuable insights to family offices on:

- Recommendations for operating strategy and process enhancements,

- Organisational and management structuring,

- Talent and resource alignment, and

- Functionality of processes and controls.

This kind of review can go even further into more detailed service areas such as financial planning, strategy, governance, and advisory.

Ultimately a leading practice review can highlight for the family office its present status and what should be considered to achieve the desired future position, along with a gap analysis and suggested actions for achieving the change and improvement. In the current environment the suggested threshold where setting up a family office becomes truly viable is $200 million in net assets.

For families at this wealth level priorities should be set, around confidentiality, security and preservation of assets for future generations. Today's plans for your family office can mean the difference between surviving and thriving in the future

Chris Larkin is a Executive Director in the Financial Services Organisation of EY in the Bahamas, Bermuda, British Virgin Islands and Cayman Islands region. He has 18 years of experience with the firm including with EY Philadelphia, USA; EY Bermuda and over 7 years with EY Cayman.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.