We are often asked to explain why a significant proportion of the world's alternative investment funds, including hedge funds and private equity funds, are set up in the Cayman Islands and other off shore jurisdictions. Some policymakers and members of the press assume it must be to evade tax or hide assets, but this article seeks to provide the real answers. We also opine on the prospects for the Alternative Investment Fund Managers Directive (AIFMD) passport being extended to Cayman funds.

COLLECTIVE INVESTMENT IS GOOD FOR INVESTORS

Investors such as pension funds, sovereign wealth funds, not-for-profit organisations, charities and other similar entities (often called "sophisticated investors") can either make alternative investments directly or invest via a collective investment scheme - a fund that pools monies from a number of sophisticated investors and then manages those monies on their behalf. The use of such a collective investment scheme gives investors significant benefits including (i) professional management with specific industry expertise, (ii) the ability to diversify their portfolios across a broad range of alternative investment strategies, (iii) sharing of investment expenses and (iv) access to alternative investment types which are outside the scope of even sophisticated investors acting alone. However, collective investment can also bring legal, regulatory and tax complications, which sophisticated investors wish to minimise in order to maximise returns to their stakeholders.

OFFSHORE FUNDS ARE "TAX NEUTRAL"

Tax neutrality essentially means that the country where the fund is formed, such as the Cayman Islands, does not impose its own duplicative layer of taxes on the fund. However, that does not mean that investors in tax neutral funds registered in off shore jurisdictions such as the Cayman Islands do not pay taxes.

Tax neutral status is not unique to off shore funds. There are tax neutral fund categories in the UK and the USA, for example. What sets apart off shore funds – and particularly, off shore alternative funds such as those domiciled in Cayman - is the combination of tax neutrality, investment flexibility and sophistication allowed by off shore alternative fund structures. This is what makes off shore alternative funds so attractive to sophisticated investors.

As funds are often set up as a company or a partnership, those companies and partnerships can be subject to a separate tax charge in the place where they are formed. This means that investors could effectively (and unfairly) be taxed twice on the same income and capital gains. Such double taxation would render most funds uneconomic and defeat their purpose of assisting investors. Tax neutral funds provide an answer to this problem by removing this unfair "Layer 2" of tax.

Tax neutrality in the jurisdiction where the fund is established – whether onshore or off shore – ensures that such duplication of taxation does not occur, preserving the attributes that an investor would have if investing directly in the underlying assets rather than through an alternative fund. A fund should be seen as an aggregation of capital rather than a discrete taxable entity and such characterisation underpins many of the rules allowing exemption for funds in general.

OFFSHORE FUNDS ARE TRANSPARENT

As regulation has evolved, particularly since the global financial crisis of 2008, the scope of "know your customer" (KYC) rules and standards has been expanded. Today, the identity of investors in Cayman funds and other off shore funds is reported to international tax authorities such as the IRS and HMRC. As a matter of US and Cayman law implementing FATCA, the alternative fund must register and provide this data. If it does not, it will face penalties but also in practice will not be able to trade with market counterparties (who are required to confirm the FATCA compliance of firms or funds they deal with). Ultimately, funds will likely expel investors who refuse to disclose sufficient information about their identity.

OFFSHORE FUNDS ARE DESIGNED FOR SOPHISTICATED INVESTORS

Off shore alternative funds are primarily designed as investment products for sophisticated investors. Such sophisticated investors usually employ experienced internal teams, or external consultants, who know how best to navigate the more flexible environment that off shore alternative funds operate in. Simply put, managers of off shore alternative funds face fewer restrictions - for instance, in their ability to leverage investments with borrowed money, to hedge their positions by going 'short' as well as 'long', or to impose restrictions on withdrawals (redemptions) – than managers of onshore funds authorised to raise money from retail investors. Some onshore fund locations, including Ireland and Luxembourg, do have fund regimes with similar flexibility aimed at certain types of sophisticated investors, but the Cayman Islands remains the leading alternative fund jurisdiction because a Cayman Islands alternative fund is what US sophisticated investors in particular expect to invest in.

AIFMD PASSPORT

The Cayman Islands authorities are working hard with EU regulators to ensure Cayman alternative funds qualify for the third country marketing passport under AIFMD. We continue to believe that the European Securities and Markets Authority (ESMA) will provide positive advice to the European Commission (the "Commission") regarding the extension of the ability to passport to Cayman Islands managers and Cayman Islands funds and that the Commission will act on that advice to provide the necessary delegated act to extend the passport. The timing of the Commission's delegated act to extend the passport to managers and funds from any third country is currently unknown, opening the door to the possibility of ESMA providing positive advice regarding the Cayman Islands before the passport is extended with respect to any third country.

In the meantime, managers of Cayman Islands funds can continue to market those funds in EU countries that have an available national private placement regime. Those regimes, unless withdrawn by the individual Member State, will remain in effect for at least three years following the effective date of the Commission's delegated act extending the passport to any third country.

CONCLUSION

Decades of experience and extensive due diligence have shown investors, fund managers, counterparties, regulators and international authorities the benefits of doing business through off shore fund jurisdictions such as the Cayman Islands. For example, the Cayman Islands has the following attributes:

- An English-based legal system, established judiciary and absence of political or sovereign concerns.

- Well recognised legal concepts (including limited liability and separate corporate personality) underpinning the corporate, partnership and trust vehicles used as collective investment schemes, as well as the principles governing lending and granting security over assets, all of which have been tried and tested and found to be robust during the recent global financial crisis.

- The Cayman Islands is a well-known and trusted centre of excellence for its established and experienced financial services sector and professional service providers. That is a feature that grows on itself and having financial institutions, sophisticated investors, rating agencies and professional firms elsewhere used to and comfortable dealing with counterparts in the Cayman Islands may have become as big a reason as any for the use of Cayman Islands vehicles in many cases. There is a strong philosophy of government and industry cooperation and consultation. Indeed, a number of members of government are experienced finance experts who previously worked in the alternative fund industry.

- Professional and responsive procedures in place to establish Cayman Islands alternative fund vehicles.

- The Cayman alternative investment fund industry supports and encourages good corporate governance for its funds, including the extensive use of independent directors and administrators.

WHY ANY FUND SHOULD BE TAX NEUTRAL – THE THREE LAYERS OF TAX

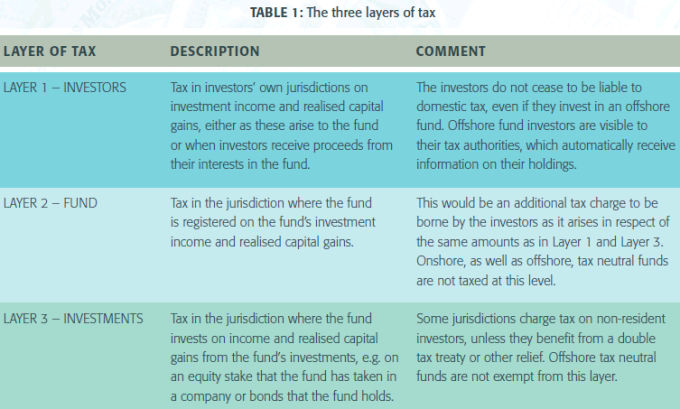

Investment through any alternative fund or other collective investment scheme adds a potential layer of tax over and above that which would be payable were the investors to own the underlying assets themselves. Ideally, alternative funds will be established with tax neutral status to prevent "Layer 2" tax being applied to the fund in addition to the taxes incurred (i) by the investors at "Layer 1" and (ii) on the investments at "Layer 3", as illustrated in Table 1.

About the Author

Jack became the Chief Executive Officer of AIMA in February 2014. He has been involved with hedge funds for 25 years and has held leadership positions in prime brokerage at both Morgan Stanley, where he served for 16 years, and Barclays, where he was prior to joining AIMA. From 2007 to 2010, he was CEO at the convertible bond specialist, Ferox Capital Management. He began his career in 1983 and has extensive experience across origination, distribution and trading across the capital markets. He holds a Master of Arts in Economics from Cambridge University.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.