AIFMD

AIFMD Transition in EEA Member States

Iceland, Liechtenstein and Norway

On 30 September 2016, the EEA Joint Committee formally incorporated AIFMD into the EEA Agreement. The Agreement brings the EU Member States and the three EEA EFTA States (namely Iceland, Liechtenstein and Norway) together in a single market and the incorporation fully implements AIFMD in Iceland, Liechtenstein and Norway into national law.

ESMA Q&A on AIFMD

On 6 October, 16 November and 16 December 2016, ESMA published updated Q&As on the application of AIFMD and its implementing measures. The Q&As clarify certain AIFMD rules and subscribe common approaches and practices to be undertaken by EU Member State supervisory authorities.

In particular, the 6 October 2016 update covers the commencement of periodical reporting under Article 13 of Regulation (EU) 2015/2365 on the transparency of securities financing transactions1. The 16 November 2016 update covers the reporting of material changes to existing Article 32 cross-border notifications2. It also covers the delegation of functions by an AIFM to AIFs or third parties and the AIFM's associated responsibilities3. The 16 December 2016 update covers reporting obligations by non-EU AIFMs under Article 42 and clarifies when information on EU master AIFs is required to be reported to national competent authorities authorities4.

The Netherlands

On 22 November 2016, the Dutch Minister of Finance published a consultation on the revision of the Financial Supervision Act (the "Amendment Act"). The Amendment Act, amongst other things, exempts an AIFM from the retail 'top-up' rules prescribed under the Financial Supervision Act when an initial value of at least €100,000 is invested per retail investor.

The consultation invites responses on how the Amendment Act can be more accessible to stakeholders and discusses the implementation of EU legislation under the Amendment Act. The consultation ends on 1 March 2017.

Europe

Denmark: Annual Regulatory Fees

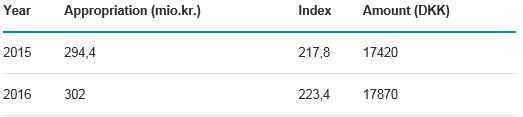

The annual regulatory fees payable to the Danish FSA by foreign UCITS marketing to Danish investors for the period 1 January 2016 to 31 December 2016 have been increased as follows:

Please see the relevant section of the Finanstilsynet website and please contact us for further details on the calculation of the fee payable.

Ireland: CBI Q&A on UCITS

On 19 December 2016, the CBI published updated Q&As on UCITS. The Q&As clarify the regulatory requirements for Irish UCITS seeking to acquire Chinese shares through the Shangai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect (ID 1015). They also confirm the requirement for sub-funds of an umbrella ICAV to appoint the same auditor (ID 1073).

Please see our December 2016 update providing an overview of the Renminbi Qualified Foreign Institutional Investor License now available to Irish fund managers.

Germany: Suspension of Ban on Retail Distribution of Credit Linked Notes

On 16 December 2016, BaFIN suspended its ban on the retail distribution of credit linked notes which has been in force since 28 July 2016. This is in response to certain investor protection proposals raised by industry (as represented by the German Banking industry Committee and the German Derivatives Association) In June 2017, BaFIN will assess whether industry's proposals are effective.

Asia Pacific

Australia: Repeal of Class Orders for Foreign FSPs

On 28 September 2016, ASIC granted a two year extension of certain class orders applicable to regulated foreign financial service providers ("FSPs") from the UK, the US, Singapore, Hong Kong and Germany5. The Class Orders exempt the foreign FSPs from holding an Australian financial services license when promoting and distributing financial services and products to wholesale clients in Australia. The exemption was due to expire between 1 October 2016 and 1 April 2017. During the extension period, ASIC plans to consult with industry to assess whether the Class Orders should be repealed going forward.

On 28 September 2016, ASIC also announced its intention to repeal Class Order 03/824, which provides licensing relief to financial services providers whose limited connection to Australia is the inducement of wholesale clients in Australia. ASIC is of the view that the Class Order is no longer relevant as the relief it provides is replicated in section 911A(2E) of the Corporations Act 2001. ASIC's consultation period on the repeal of the Class Order ended on 2 December 2016 and the Class Order is due to expire on 1 April 2017.

China: Amendment to Law on Wholly Foreign Owned Enterprises

On 8 October 2016, the Amendment to the Law of the People's Republic of China on Wholly Foreign-Owned Enterprises entered into force. It replaces the previous prior approval and examination procedures applicable to foreign invested enterprises ("FIEs") with a "negative list plus filing-for-records" system. Under the new system, the State Council issued a national catalogue of certain sectors into which foreign investments are restricted or prohibited, and prior approval will no longer be required for FIE's carrying on business outside of this "negative list".

Hong Kong: FAQ on Application Procedure for Authorisation of Unit Trusts and Mutual Funds under Revamped Process

On 2 December 2016, the SFC published updated FAQs on the application procedure for the authorisation of unit trusts and mutual funds under the revamped process.

In particular, the FAQs cover when the revamped process will apply (Question 1) and the SFC submissions required after authorisation has been granted (Question 12).

Singapore: Consultation Paper on CIS Code Amendments

On 10 November 2016, MAS published a Consultation Paper on proposed amendments to the CIS Code.

In particular, Question 4 proposes the extension of the disclosure requirements in the CIS Code to Recognised Funds. These requirements are currently only applicable to Authorised Funds. The extension would ensure that retail investors have access to the same quality of information when investing in both Authorised and Recognised Funds.

Question 5 of the Consultation Paper proposes requiring managers of both Authorised and Recognised funds to conduct advertisements in compliance with MAS's Guidance Note on Recommended Disclosures to Support the Presentation of Income Statistics in Advertisements and the Code of Best Practices in Advertising Collective Investment Schemes and Investment-Linked Life Insurance Policies. The provision of operational guidance on fund advertising purports to better protect retail investors.

MAS invited comments on the Consultation Paper by 12 December 2016.

Middle East

Israel: Investment Fund Regulations

On 5 November 2016, the Joint Investment Trust Regulations (Foreign Fund Unit Offerings) 2016 entered into force. Under the Regulations, foreign fund managers may apply to make public offerings in Israel upon registration with the ISA.

Please contact us for further details of the criteria registration.

United Arab Emirates: Regulations on Mutual Funds

In October 2016, the SCA Decision No. 9/R.M of 2016 concerning the Regulations of Mutual Funds entered into force.

They repeal Resolution No. 37 of 2012 concerning Mutual Funds Regulations and No. 13 of 2013 concerning Amending Investment Funds Regulations. They also impose significant restrictions on the marketing of foreign funds in the UAE whereby foreign funds may only be promoted inside the UAE once registered with the SCA and once an agreement with an SCA licensed promoter is concluded. The SCA registration is required to be renewed annually on 31 December. The SCA initial application fee is currently AED 35, 000 and the annual renewal fee is AED 7,500.

The Regulations provide for limited exemption from the above, further details of which are available on request.

How Maples can help

Maples Global Registration Services ("Maples GRS") supports UCITS i and AIFMs in their multi-market distribution strategies by providing an integrated global network of experts coordinated by a dedicated central team supporting all legal and regulatory aspects governing the cross border marketing of investment funds on both a private placement and public offer basis.

Should you require any further information or assistance in this regard, please do not hesitate to contact a member of the Maples GRS team.

Footnotes

1 Section XIII: Impact of Regulation (EU) 2015/2365 (SFTR) on AIFMD, Question 1

2 Section II: Notification of AIFs, Questions 6 and 7

3 Section VII: Delegation, Questions 2 and 3

4 Section III: Reporting to national competent authorities under Articles 3, 24 and 42, Question 1

5 Respectively Class Orders 03/1099, 03/1100, 03/1101, 03/1102, 03/1103, 04/829, 04/1313

i Domiciled in Ireland and Luxembourg

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.