Introduction

The Netherlands has always been one of the major locations which multinational enterprises have used to reduce the tax burden on their worldwide profits. The country offers a variety of possibilities which multinationals may use to either avoid double taxation of profits, or a considerable reduction of foreign withholding taxes on dividends, interest payments or royalty payments, plus the avoidance of foreign capital gains taxation on the sale of business divisions or stand-alone subsidiaries.

In fact, the Netherlands has been so successful in attracting foreign business in this manner that a large variety of countries have copied a number of the Dutch rules and provisions over the last 10-15 years. "Holding company" regimes are now also a popular play in countries like Cyprus, Ireland, Luxembourg, Switzerland, Malta, Spain, and Hungary to name just a few major ones.

Tax advisers in these countries may make you want to believe that the Netherlands has lost its edge as the preferred European "hub" in international tax planning, but the numbers tell a different story. The Dutch Central Bureau for Statistics has recently analysed and computed the aggregate money flows of such dividends, interest payments, royalty payments and capital gains which are routed through the Netherlands for tax purposes for the year 2007. Their findings were that the "Special Financial Institutions" sector of the Dutch economy handled an astonishing €8,000 billion (!) of aggregate cross-border payments of these four income categories in 2007 alone.

And these "SFI's" are only part of the story, because multinationals with regular business operations in the Netherlands have no obligation to file for SFI status with the Dutch Central Bank but will also act as conduits for dividends, interest, royalties and capital gains. So the annual "turnover" in the Netherlands of incoming and outgoing money flows for tax purposes is well over a €8,000 billion per year; adjust this for the immanent double count (most of the incoming money flows go out again and are therefore counted twice for Dutch balance of payments purposes) and we are left with an astonishing €5,000 billion which passes through the Netherlands for international tax reduction purposes per year.

The very size of the amounts at stake also implies that the various Dutch tax reduction routings are strictly legal and have been chosen by international tax advisers all over the world because they are also practically implementable.

Old roads close, new roads open up

In a series of five consecutive articles, to appear in this and the 2010 issues of World Commerce Review, I plan to take the readers through both old and tested tax reduction "roads" which the Netherlands has to offer, sometimes adding a number of new ideas to further improve them, but also to warn against the use of old techniques which are becoming outdated (but are sometimes still advised by international tax counsel). In addition, I will discuss "new roads" for international tax planning which have recently opened up in the Netherlands, either based on new Dutch corporate income tax legislation, or based on recent tax case law (interpretation of existing Dutch corporate income tax law by the Dutch Supreme Tax Court).

The latest thing in international tax planning

When I started my career in international tax as a profit determination specialist in the Dutch Ministry of Finance in 1980, the focus was mainly of profit deferrals: shifting income to future taxable years was the main focus at that point in time. And when I joined Ernst & Young in 1984, the latest thing was to shift income from high tax countries to low tax countries (because shifting income to the future does not really bring "earnings per share" because of the accounting rules for deferred taxes). This play is still being further developed, but transfer pricing has given a very serious boost to these international tax planning techniques over the last, say, five years, because transfer pricing is not just a defensive technique to keep the tax inspector from adjusting taxable corporate income upward, but also – if managed well – a technique to shift profits from high tax jurisdictions to low tax jurisdictions. After all, basic transfer pricing theory says that not only functions and tangible assets must be properly rewarded in the income computation of the members of a multi-nationally operating group, but also risks and intangible assets. These items can rather easily be moved to other (lower taxed) jurisdictions, however...

The last decade shows a further shifting of taxable income caused by so-called hybrid financing and hybrid entity tax planning. Hybrid financing occurs when one country sees a given "agreement to provide funding" as a loan agreement, whilst the other jurisdiction involved treats the agreement as a provision of (deemed) capital. Hybrid financing will be the subject of one of my upcoming contributions for 2010. For now, I should like to focus on international tax planning via Dutch hybrid entities. Before going into the details I should first like to offer readers some basic explanations with regard to this subject:

- Hybrid entities are legal or contractual entities which in the country of the parent of the multinational group are seen as legal entities, so they are considered to be subject to tax of their own accord, whilst the investment jurisdiction considers them as "partnerships" or "branch offices" so they are not subject to tax themselves but their shareholders (seen as "partners") are; or the other way around ("reverse hybrids"); many legal and contractual entities are able to be hybridized or are hybrid by nature, due to the differences in the tax classification rules for foreign entities between the tax laws of countries

- This may well lead to double taxation (one country taxes the entity, the other country taxes the partners on the same income). However, the opposite is also possible: the entity is not taxed by either tax authority of the countries it does business in because one country sees an entity abroad and will exempt its income whilst the other country sees a foreign investor which cannot be subjected to local tax as long as there is no taxable presence of that foreign "partner" in his country; this is especially true for Europe where many countries exempt foreign dividends from local tax (even the UK seems to now be going in that direction...);

- Countries do not normally take any foreign legal aspects into account when establishing their tax classification of foreign entities: they invariably use their own tax criteria. These criteria differ per country manifestly, however. There are no signs that countries are planning, or even willing, to align their entity tax classification rules with one another any time soon. The US offers a choice ("check the box") for most foreign entities; most other countries apply strict rules of their own (like the US did before the check-the-box rules were introduced in 1994); and "check the box" may well fall victim of the tax reform plans of the new Obama administration.

- My international tax planning techniques make deliberate use of "automatic" hybrids: no tax authority will consider them odd or artificial because they are widely used by others (most of the time in a non-hybrid way); " Tax authorities do not know, and usually do not care, what the tax treatment of a certain legal or contractual entity "abroad" is: they will treat it according to the rules of their own country. The fact that such an entity may escape taxation in both countries or may be forced to accept tax deductible expenses which are not taxed in the other country, is usually not their concern, because in order to understand this, one must have insight into foreign tax systems; in the 35 years of my career I have never come across any civil servant who took the trouble to even try and understand what the tax rules of other countries are;

- The tax reduction structures I will discuss below and in the next four issues of WCR make use of one or more Dutch hybrid entities. The Dutch corporate income tax system basically recognizes three types of legal entity which are fully open to hybridization from a German, French, Italian, Chinese, Australian etc. tax perspective including the present US "check-the-box" rules (or what may come to replace them):

-

- The regular Dutch limited liability company "BV": if such a (standard) entity becomes part of a Dutch tax consolidated group as a subsidiary, an optional event in Holland, it "ceases to exist" according to the Dutch corporate income tax act. In fact, it becomes a Dutch "branch office" of its parent. Obviously, if such a subsidiary has foreign operations, such as a branch office outside the Netherlands, the foreign tax authorities will continue to treat this Dutch entity as the tax payer; the BV only "disappears" in the Netherlands, not abroad;

- Certain forms of limited partnership (denominated as

"CV" entities in the Netherlands) are treated as entities

for Dutch corporate income tax purposes, subject to Dutch corporate

income tax, whilst other CV's are considered regular tax

partnerships whereby the entity itself is tax transparent and each

of the partners may, or may not, be subject to tax on his share of

the partnership's profits. Under the Dutch corporate income tax

system one may in fact freely choose for either the one or the

other format: the difference hinges on a rather minor difference in

the CV's incorporation document (with major consequences,

however).

Moreover, he Netherlands applies its own tax classification method to foreign limited partnerships. So "automatic mismatches" with limited partnerships are rather the rule than the exception in the Netherlands; - Dutch "Cooperative Associations" (usually abbreviated to "Coops") are another fine example: there are three formats available under Dutch civil law which differ as regards the liability of the "owners" or "partners" for the debts of the Coop. Under Dutch corporate tax law all three types of Coop are treated as tax entities for Dutch corporate income tax purposes (but not for Dutch dividend tax purposes); but the foreign tax denomination of a Dutch Coop will likely differ with the degree of partner liability it has opted for in its by-laws: a Coop with "excluded liability" will likely trigger foreign tax treatment as a Dutch entity, but Coops with "restricted liability" or even "full liability" may well cause tax treatment abroad as limited partnerships, so again a tax mismatch is born.

- As observed above: "playing" with the tax classification of entities (at home or abroad) is a dangerous exercise if one is not fully aware of the Dutch and foreign legal and tax ramifications. With 35 years of experience in this difficult but rewarding tax area I can say that it will be easy to limit the discussion to hybrids which are (almost) "automatic" and easy to implement, whereby the foreign tax consequences must be clear and unambiguous from the outset and the foreign tax treatment is governed by clear and unambiguous tax treaty rules.

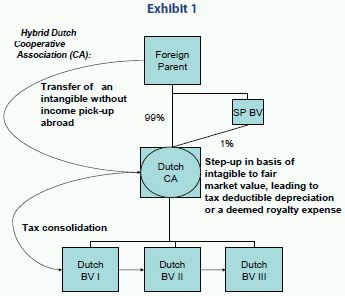

Example 1: a hybrid Dutch Cooperative Association

As explained above, Dutch Cooperative Associations (hereinafter: CA or CA's) can take three legal formats in the Netherlands and although each of these three is considered a legal entity for Dutch corporate income tax purposes, the foreign tax denomination of a Dutch CA may well be that of a Dutch partnership.

One major tax classification element, worldwide, of the distinction between (foreign) entities and partnerships for corporate income tax purposes, is the question whether the founders/owners/partners/ members or whatever the investors are called under foreign law, are liable for the debts of the joint venture or not. If not liable, the foreign joint venture is close to a limited company, but if the founders/owners etc. are liable for the joint venture's debts, a tax classification as foreign partnership is more likely. This will depend on the foreign entity tax classification system of the home country of the multinational enterprise and will require analysis.

Another widely used tax classification criterion is, whether the foreign joint venture format requires one owner/partner/member or more. If more than one, a tax classification of the foreign joint venture as partnership is more likely than when only one owner/partner/ member is required under foreign civil law or foreign common law. Dutch CA's require at least two "members".

So multinationals have the option to create a Dutch CA with unlimited liability. Let's assume for a moment that this Dutch CA will indeed qualify under foreign tax law as a partnership. Let's also assume that the obligatory second member in a Dutch CA is a Dutch limited liability company owed by the group, which has a very minor interest (1%) in the CA, so it plays a very minor role in the tax analysis (a role which will also not be further discussed here).

The foreign tax consequences of setting up a Dutch CA structure will then be that the main member (ie. a foreign group entity) will be considered to operate a Dutch permanent establishment or "branch office", not a Dutch subsidiary. It will then likely be possible to transfer intangibles to such a branch without recognizing any capital gain abroad; after all, one transfers the intangible to oneself, not to a third party.

The Dutch tax treatment of such a transfer of an intangible is spectacularly different however! The Dutch CA, a tax entity for Dutch corporate income tax purposes, is allowed to enter the intangible it will obtain in its opening balance sheet against fair market value and to depreciate it over its economic lifetime. Alternatively, the Dutch CA is allowed to deduct an annual mount of deemed royalties which it would have had to pay if it had obtained the intangible from a third party. A hybrid CA may therefore be a fully legitimate method to create a considerable tax deductible expense within a multinational enterprises "out of the blue" without an (immediate) pick-up of income elsewhere in the group!

Exhibit I shows how this works. Obviously, if the Dutch CA is allowed a considerable tax deductible item (depreciation of the intangible or a deemed royalty expense related to the intangible), further tax planning is required to effectively use this deductible item against taxable income from other (group) sources. One important element in this further planning (considered out of scope for this article) is that a Dutch CA can act as parent of a Dutch tax consolidated group, so the loss created in the CA will be deductible from any operating income of its Dutch subsidiaries. One such subsidiary might well be the principal in a commissionaire structure (whereby foreign taxable profits from sales activities in the group are shifted to the Netherlands) or the principal in a contract manufacturing arrangement (whereby foreign profits from production activities in the group are shifted to the Netherlands).

In a next issue I will develop further examples of how multinationals might be able to use one or more of the Dutch hybrid entity concepts to their financial advantage.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.