Practical Considerations for the Investment Income Rules for Private Companies

Canadian private companies have seen much newsworthy tax reform in recent years. One change is in the area of income sprinkling. Another major change in tax law is the rules on investment income earned by Canadian-controlled private corporations (CCPCs). The CCPC investment income rules, generally effective starting in 2019, result in various pitfalls where there is more than $50,000 of investment income in a year for an associated corporate group that includes a CCPC.

These rules tend to be particularly punitive for corporations or associated groups with an asset value in the range of $3 million - $10 million, including investments such as real estate or securities. Prudent business owners whose interests fall within this range should take time to revisit their corporate structures.

Background – Investing Using Dollars Taxed Only at Corporate Rates

Investment income earned by CCPCs has long since been taxed at a higher rate than active business income. The rates for CCPCs' investment income generally range from 50% - 55%. Part of this tax is refundable, and so the long-run corporate tax rate will typically approach 20% once dividends are paid out to the shareholders. The theory is that when the corporation pays dividends, the remaining tax is then paid at the personal level to result in a combined or "integrated" tax rate of around 50% - 55%.

Despite the higher tax rates for investment income, you can defer tax by using corporate profits to make passive investments instead of paying dividends or bonuses to shareholders or owner-managers. The difference is illustrated in the table below:1

|

Reinvestment in Corporation |

Investment

at Personal Level |

|

| Pre-tax profits | 100,000 | 100,000 |

| Corporate tax (12%) | (12,000) | (12,000) |

| Net after-tax | 88,000 | 88,000 |

| Personal tax | Deferred | (36,643) |

| Cash to invest | 88,000 | 51,357 |

Because of this tax deferral opportunity, common tax planning for private companies includes the use of a holding company. The holding company stockpiles excess cash received from the operating company, and uses it to acquire investments such as real estate or a portfolio of securities. Personal tax is deferred by pursuing such a strategy. Tax is paid once a distribution is made to shareholders, but business owners have flexibility to delay the tax indefinitely.

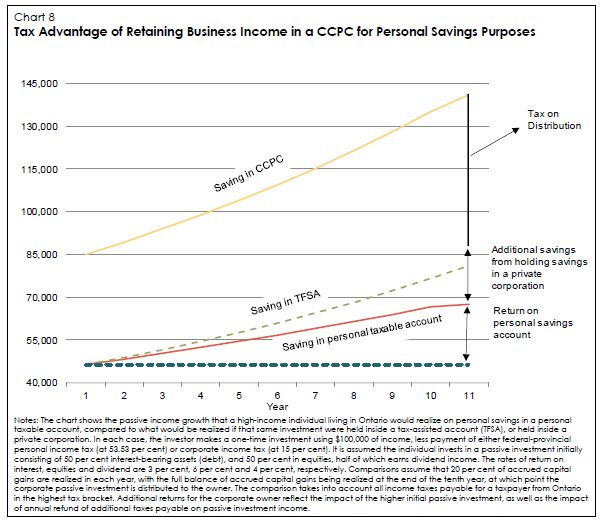

A common comment regarding the strategy of reinvesting profits inside a corporation is that "it's just a deferral" of tax, and not a saving. While this is technically correct, the reality is that over the course of say 10 years, reinvesting profits inside a corporation may yield 50% more wealth - purely because of the tax "deferral" - compared to paying a dividend or bonus and investing in a combination of non-registered and tax-deferred products such as a TFSA or RRSP.

The Canadian Department of Finance has obviously recognized the advantage to reinvesting corporate profits. In the Government's view, this is unfair compared to the tax planning available to employees (mainly RRSPs, TFSAs, and pension and life insurance products).

Figure 1 Canada, Department of Finance, Tax Planning Using Private Corporations (Ottawa: Department of Finance, 2017) at 40

A common, and valid, response by those in the business community is that the Government's analysis fails to account for the fact that employees enjoy pension benefits from employer contributions (minimally, CPP contributions), whereas business owners do not. Further, the Government's economic analysis did not adjust for the significantly higher risk borne by a business owner compared to an employee. But economic policy and value judgments aside, it is clear that there was a tax advantage to reinvesting profits inside a corporation that had been taxed at the small business rate (and then could still be without planning).

The CCPC Investment Income Rules, Simplified

The tax rules regarding investment income earned by CCPCs introduced in the 2018 Federal Budget may operate to reduce the small business limit, and therefore, the available small business deduction. The small business deduction is generally available on the first $500,000 of active business income earned in Canada by a CCPC. The resulting tax rate is 11% compared to 27% which is the general corporate rate (in Alberta in 2019). The small business deduction is worth up to $80,000 per year. But under the new rules, the small business limit is reduced by $5 for every $1 of investment income earned over and above $50,000. If a CCPC has investment income of $150,000 or more, the small business deduction is lost completely, which represents an annual cash loss of $80,000 (more or less, depending on the province).

If the investment income is earned by a private corporation that is "associated" with a CCPC, the reduction to the small business limit also applies to the CCPC that is so associated. The "associated corporations" rules are complex, and tax advice is typically required to determine which corporations are associated. One common example of associated corporations is if the CCPC and the investment corporation are controlled by the same person, or related group. It is possible, however, to have two different family members control the CCPC and the investment corporation without the two corporations being associated, provided that certain conditions are satisfied. In the tax practitioner's language, this would be called "related" but not "associated". If a corporate group were structured in such a way, the small business deduction may not be lost.

Historically, the associated corporation rules were mainly relevant for determining whether the small business limit must be shared among a corporate group, or whether the small business limit is reduced as a result of the "taxable capital employed in Canada" (as calculated under the Income Tax Act) being greater than $10 million. Unfortunately, it cannot be quickly determined by examining financial statements whether a corporation's taxable capital has reached $10 million. Practically speaking, if it can reasonably be expected that the book value of a corporation's assets will approach $10 million, structuring considerations should be addressed. If taxable capital reaches $15 million, taking into account the entire associated group, the small business deduction will be lost completely.

The reduction to the small business deduction where taxable capital reaches $10 million works in tandem with the investment income rules where a CCPC or associated corporation has at least $50,000 of investment income. If taxable capital reaches $15 million, or if investment income reaches $150,000, there is no small business deduction available.

Structuring Considerations for Reductions to the Small Business Deduction

As mentioned, the reductions to the small business limit for taxable capital and investment income operate together. The pitfalls arise where a corporation in an associated group causes the taxable capital or investment income thresholds to exceed $10 million or $50,000, respectively. A few examples will help illustrate this concept.

An Inter-generational Business

The Founder of a business, the Father, is retiring and his daughter has taken over day to day operations. Daughter is now the main shareholder of the corporation, "Opco", that carries on the business. Father is the shareholder of a private corporation, "Holdco", which has a rental property and a reasonable-sized portfolio. The Holdco investments produce $100,000 of investment income annually, which is sufficient to fund the parents' retirement, but not for an overly extravagant lifestyle.

In his succession plan to transfer the Opco to Daughter, Father implemented a common reorganization known as an "estate freeze". The result of the estate freeze is that Father owns preferred shares that represent a substantial portion of the votes and value of the business. These shares are not of a "specified class", as defined by the Income Tax Act, which may otherwise prevent Opco and Holdco from being associated. But since Holdco and Opco are associated, the investment income rues will reduce the small business limit of Opco, costing Opco an additional $37,500 of tax for the year, and a similar amount every year if Holdco maintains similar levels of investment income.

Appreciated Real Estate in the Lower Mainland

Retired parents in the Vancouver area own real estate in their "Landco", which has increased in value substantially. They have mortgaged the real estate to acquire other investments including a rental property in the U.S., which has increased slightly in value in USD. When converted to CAD, the value of the increase is over $2,000,000, consisting largely of an unrealized foreign exchange gain due to the depreciation of Canadian currency. The unrealized foreign exchange gain, as well as the mortgage, is included in the taxable capital calculation, pushing the taxable capital of Landco to $12,500,000.

Landco generates investment income of $100,000 per year. The shares of Landco are owned by a discretionary family trust. The parent's son is a beneficiary of the trust.

Son operates an IT consulting corporation. Unlike the inter-generational example above, Son is the sole shareholder of the "Consultco", and the parents do not own any shares of Consultco. However, because Son is a beneficiary of the trust, Landco and Consultco are associated, even though Consultco is a completely independent business in which the parents have no involvement. The greater of the two reductions, taxable capital of Landco or its investment income, will cause Consultco's small business limit to be reduced (i.e. the taxable capital and investment income reductions are not cumulative). In this case, both reductions are equal to $250,000. Consequently, the Consultco's small business limit would be reduced from $500,000 to $250,000.

A Time to Re-examine Corporate Structures

Often, the pitfalls resulting from the investment income rules, and the erosion of profits that follow, may be avoided. While a powerful planning tool, discretionary family trusts may cause corporations to be associated inadvertently, as exemplified above. The solution is not to say that trusts should not be used, but rather they should be drafted and organized with a view to these new rules. The strategies for business succession to family members should also be considered. Historical estate freezes should be reviewed to determine if the structure of the shareholdings will trigger a needless loss of family wealth.

It is unclear whether the Canadian government truly intended or even foresaw all of the negative ramifications of the new investment income rules. What is clear, however, is that business owners who are proactive and seek advice from knowledgeable professionals will find themselves better positioned in the long term.

Footnote

1. Using 2018 Alberta rates where the small business deduction is available and assuming the highest marginal personal tax rate applies

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.