- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Business & Consumer Services, Insurance and Healthcare industries

The Tax Court of Canada recently held, in Alta Energy Luxembourg SARL v R, 2018 TCC 152, that a Luxembourg S.A.R.L was entitled to treaty benefits on capital gains and that the general anti-avoidance rule ("GAAR") did not apply on the disposition of shares of a Canadian resource company.

The Tax Court took a commercially realistic approach in its interpretation of the excluded property exception in Article 13(4) of the Canada-Luxembourg tax treaty (the "Treaty") and found that a working interest set aside for future drilling or extraction activities can be considered property in which a business is carried on and therefore excluded from treatment as immovable property. As a result, gains from the alienation of shares that principally derive their value from such property may be taxed in Luxembourg—i.e., the country where the disposing shareholder is resident. These gains will generally be tax-free under Luxembourg's domestic tax laws.

Facts

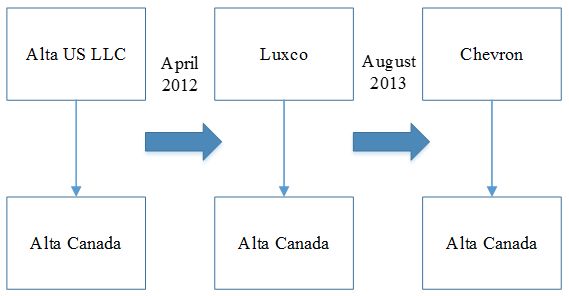

Alta Energy Partners, LLC ("Alta US LLC"), a Delaware LLC, was formed in 2011 and subsequently incorporated Alta Energy Partners Canada Ltd. ("Alta Canada") in Alberta. Alta Canada carried on an unconventional shale oil business in the Duvernay Formation in Northern Alberta. Alta Canada drilled six wells between 2012 and 2013 and, as at March 28, 2013, held petroleum and natural gas leases and licences representing working interests in 67,891 net acres in the Duvernay Formation. Alta Canada's shares derived their value principally from these working interests, which qualified as "Canadian resource property" as that term is defined in subsection 66(15) of the Income Tax Act (Canada) (the "Act"). As a result, Alta Canada's shares were "taxable Canadian property" as defined in paragraph 248(1) of the Act.

A restructuring occurred in 2012 whereby Alta US LLC sold all of the shares of Alta Canada to newly formed Alta Energy Luxembourg S.A.R.L. ("Luxco"). In 2013, Luxco sold its shares in Alta Canada (which was 100 percent thereof) to Chevron for nearly $680 million and realized a capital gain in excess of $380 million, which Luxco claimed was exempt from Canadian tax under the Treaty.

The Canada-Luxembourg Treaty

Under Article 13(4) of the Treaty, gains derived by a resident of Luxembourg from the sale of shares of a company, other than shares listed on an approved stock exchange in Canada, will be taxed in Canada when:

- the shares sold formed part of a substantial interest (i.e., at least 10 percent) of the capital stock of the company; and

- the shares derived their value principally from immovable property situated in Canada.

For the purposes of Article 13(4) of the Treaty, immovable property "does not include property (other than rental property) in which the business of the company, partnership, trust or estate was carried on". Luxco argued that this "excluded property exception" applied on its sale of Alta Canada shares to Chevron and that as a result the $380 million capital gain was not taxable in Canada.

Article 13(5) of the Treaty provides that gains from the alienation of property, other than those referred to in Articles 13(1) to (4) of the Treaty, shall be taxable only in the country where the alienator is resident—i.e, in Luxembourg in this case.

The issue essentially amounted to whether Alta Canada carried on business on its working interests that were set aside for future development and production. The minister argued that the excluded property exception applied on a licence-by-licence basis and that an oil and gas reserve can only qualify as excluded property when it is actively exploited.

The Tax Court summarized the minister's argument as follows:

[49] According to the Respondent, a working interest does not qualify as "Excluded Property" if the working interest has been set aside for future drilling or extraction activities. On this point, the Respondent submits that the phrase "property in which the business was carried on" means property in which the business of the corporation is located and carried on.

In rejecting the minister's argument, the Tax Court discussed the commercial realities of the oil and gas industry, including the process of systematically determining the economic viability of extracting hydrocarbons from working interests before commencing drilling and production.

The Tax Court stated that because the purpose of the excluded property exception is to attract foreign investment, it is reasonable to assume that the treaty negotiators intended for the excluded property exception to apply when oil and gas resources are exploited in accordance with "best" industry practices. Therefore, as the Tax Court found Alta Canada's exploitation activities to be commercially reasonable and prudent, all of Alta Canada's working interests were properties in which its business was carried on and the excluded property exception applied to all of these interests. As a result, Article 13(4) of the Treaty did not apply to tax the $380 million gain in Canada and Article 13(5) applied instead to tax the gain in Luxembourg, where capital gains are generally tax-free under domestic tax laws. The Tax Court did state that the excluded property exception applies when the resource is exploited in accordance with "best" practices. In our view, this part of the decision may lead to some uncertainty on what best practices are, but we would argue that deference should be given to management in how it develops resources and that the word "best" does not add an additional requirement. Instead, the focus should be on commercial realities and generally accepted or prudent industry practices, with specific regards to the unique circumstances of each taxpayer. The Tax Court also affirmed the principle that tax treaties are to be given a liberal interpretation which assisted the Court in arriving at its decision.

The General-Anti Avoidance Rule

In order for the GAAR to apply there must be (1) a tax benefit, (2) an avoidance transaction, and (3) the avoidance transaction must have been abusive. The appellant conceded that it derived a tax benefit from the restructuring of its activities from the United States to Luxembourg and that this restructuring qualified as an avoidance transaction as there was no bona fide reason for the restructuring other than to obtain a tax benefit. The only GAAR issue remaining for the Tax Court to consider was therefore whether the avoidance transaction was abusive.

The minister alleged that sections 38 and 39, subsections 2(3) and 248(1), and paragraph 115(1)(b) of the Act were abused, in addition to Articles 1,4, and 13 of the Treaty. The Court quickly dismissed the alleged abuse against the provisions of the Act (as they did not apply to "treaty protected property") and turned its attention to the alleged misuse or abuse of the Treaty.

The minister asserted that the rationale and purpose of the Treaty is to avoid double taxation. The Tax Court noted that the Treaty is actually a multi-purpose instrument and that the specific purposes of the Articles alleged to have been abused needed to be determined.

The OECD Model Treaty does not contain a carve-out for immovable property similar to the excluded property exception and the treaty negotiators are assumed to have known that Luxembourg generally allows its residents to avoid tax on gains from the disposition of shares of foreign corporations in certain circumstances. Provided with this context, the Court stated that:

[85] In this light, if Canada wished to curtail the benefits of the Treaty to potential situations of double taxation, Canada could have insisted that the exemption provided for under Article 13(5) be made available only in the circumstance where the capital gain was otherwise taxable in Luxembourg. Canada and Luxembourg did not choose this option.

The Court also noted that the Treaty does not contain many limitation provisions and referenced the "beneficial owner" requirement in Articles 10, 11 and 12 of the Treaty, which were not applicable to Article 13 of the Treaty.

The Court also considered the anti-treaty shopping rules in the Canada-U.S.-Treaty and the OECD Model Treaty, as well as the Department of Finance's proposed amendments announced in the 2013 and 2014 federal budgets for the introduction of a domestic anti-treaty shopping rule. The Court cited case law in support of the position that the Treaty should not be selectively applied. That is, if a person is determined to be a resident of Luxembourg under the Treaty, they can use the excluded property exemption—the minister cannot use GAAR to deal with what the Department of Finance considers to be an unintended gap in the Treaty.

The Court concluded as follows:

[100] The rationale underlying the carve-out is to exempt residents of Luxembourg from Canadian taxation where there is an investment in immovable property used in a business. The significant investments of the Appellant to de-risk the Duvernay shale constitute an investment in immovable property used in a business. Therefore, I conclude that the GAAR does not apply to preclude the Appellant from claiming the exemption provided for under Article 13(5) of the Treaty.

As a result, the appellant's appeal was allowed and the matter was sent back to the minister for reconsideration and reassessment in accordance with the Court's reasons.

The Court also considered the minister's allegations that Luxco was a "conduit" for its shareholders who were generally not residents of Luxembourg nor entitled to similar treaty benefits in their respective jurisdictions. The Tax Court noted that "conduit" does not have a precise legal meaning but restated the minister's argument to mean that Luxco was alleged to be an agent or bare nominee. In rejecting this argument, the Tax Court noted that the minister had assessed Luxco consistent with it being the beneficial owner of the disposed of shares, as opposed to being an agent of its shareholders.

The MLI

It should be noted that the multilateral instrument (or "MLI"), when in force, will impact the analysis and scrutinize the use of treaty benefits under a principal purpose test ("PPT"). It is expected that the MLI (and PPT) could curtail the use of these types of structures. However, for dispositions of Canadian resource companies occurring before the MLI comes into force, this decision is helpful.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]