- within Employment and HR, Finance and Banking, Litigation and Mediation & Arbitration topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Business & Consumer Services, Healthcare and Technology industries

What follows is a summation of a settlement agreement ("Settlement Agreement") entered into between the Ontario Securities Commission ("OSC") and Peter Volk ("Volk") and is not the result of an OSC tribunal decision nor that of a recognized court in Canada. The Settlement Agreement is based on facts that are perhaps even an expansion of the circumstances of the Lambert settlement agreement with the Alberta Securities Commission. For an overview of the Lambert decision, see Schedule "A" attached hereto.

The Settlement Agreement

Volk was the general counsel to Pacific Rubiales Energy Corporation (currently named Frontera Energy Corporation ("Pacific")) from 2004 to March 2018. Pacific is a Canadian oil and gas company whose common shares trade on the Toronto Stock Exchange. Volk was investigated by the OSC over concerns regarding his trading in Pacific debentures at a time when Pacific was involved in a due diligence process regarding its potential acquisition by two would-be purchasers. As Pacific's general counsel, OSC Staff's position was that Volk:

- was in a position of high responsibility and trust;

- was subject to a high professional standard; and

- was required to avoid any appearance of a conflict of interest and of the misuse of confidential information related to Pacific.

As a result of the investigation, Volk entered into the Settlement Agreement whereby he is required to:

- make a voluntary payment in the amount of $30,000 to be designated for allocation or use by the OSC in accordance with the Securities Act, RSO 1990, c S.5 (the "Act");

- obtain external legal advice in regard to any and all future trades in securities of issuers of which Volk is an insider, in circumstances where Volk is required to self-assess at the time of the trade whether he is in possession of material, generally undisclosed information related to the issuer, for a period of two years from the date of the Settlement Agreement;

- successfully complete either the Directors Education Program of the Institute of Corporate Directors, or the Partners, Directors and Senior Officers Course of the Canadian Securities Institute within 2 years from the date of the Settlement Agreement; and

- pay costs in the amount of $10,000, pursuant to section 127.1 of the Act (Orders in the Public Interest).

The Insider Trading Policy

Pacific's insider trading policy (the "IT Policy") required all employees, including Volk, to sign documentation acknowledging that they were aware of the IT Policy and that they agreed to follow it. The IT Policy covered among other things, prohibitions on insider trading and tipping, insider reporting obligations and trading during blackout periods. Under the IT Policy, blackout periods were imposed in relation to Pacific's financial disclosures and in relation to the knowledge of material, generally undisclosed information held by Pacific employees. The imposition of blackout periods was at Volk's discretion.

Material Timeline

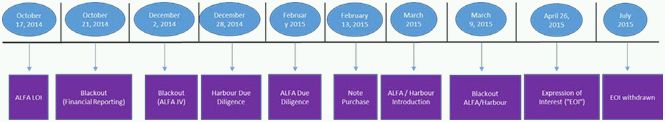

Interest in Acquiring Pacific (October 2014 — July 2015)

- October 17, 2014 – Pacific receives a confidential, non-binding letter of intent from ALFA S.A.B. de C.V. ("ALFA"), a Mexican conglomerate, proposing a potential acquisition of all outstanding Pacific common shares at a price of $20.00 per share.

- October 21, 2014 – a blackout is instituted in relation to the preparation and filing of Pacific's quarterly financial information. The blackout is lifted on November 7, 2014 upon filing of that information.

- October 31, 2014 – despite ALFA's interest, the period by which ALFA and Pacific were to execute a confidentiality agreement with respect to a potential transaction expired in large part because Pacific's stock price had declined significantly. ALFA did not commence any due diligence review of Pacific with regard to a potential transaction.

- December 2, 2014 – Volk imposes a blackout that lasts until December 9, 2014 in relation to the entering into of a joint venture with ALFA on Mexican opportunities, unrelated to any interest ALFA may have had in acquiring Pacific.

- December 28, 2014 – Harbour

Energy Ltd. ("Harbour"), an investment

vehicle specializing in private investments in energy and

energy-related infrastructure, delivers Pacific a due diligence

request in respect of a potential acquisition of Pacific.

No binding offer is made and no price or transaction structure is proposed, but the parties enter into a confidentiality agreement to allow Harbour to commence due diligence investigations in order to determine whether it wishes to make a binding offer. - February 4, 2015 – ALFA and Pacific enter into a confidentiality agreement, which provides ALFA with access to non-public Pacific information for the purposes of conducting a due diligence review for the potential acquisition of Pacific by ALFA.

- February 13, 2015 – Volk

purchases US$100,000 par value Pacific senior unsecured notes (the

"Notes") for a total of $75,349.31 (the

"Note

Purchase")1.

In making the Note Purchase, Volk self-assessed (pursuant to the IT Policy) that he had no knowledge of any material, generally-undisclosed information. - March 2015 – ALFA and Harbour each advise Pacific that they are unwilling to propose a transaction with Pacific without a partner. In response, Pacific introduces Harbour and ALFA in respect of a possible joint offer.

- March 9, 2015 – Volk imposes a blackout in response to the joint expression of interest by ALFA and Harbour to acquire Pacific. The March 2015 blackout was in effect until on or around May 15, 20152.

- April 26, 2015 – ALFA and Harbour deliver a non-binding expression of interest to acquire Pacific (the "Expression of Interest").

- May 20, 2015 – an agreement for ALFA and Harbour to acquire Pacific for $6.50 per common share is reached.

- July 2015 – despite negotiations between all three parties, ultimately the Expression of Interest is withdrawn and no acquisition of Pacific occurs.

INSIDER TRADING

Insider Knowledge

Pursuant to the OSC's investigation, it was agreed that, on the date of the Note Purchase, Volk had knowledge of the non-binding expression of interest received from Harbour by at least January 8, 2015 (which expression lacked material terms, such as a price), the ongoing Harbour due diligence process and meetings between Harbour and Pacific related to the due diligence (the "Harbour Facts").

With respect to ALFA, it was agreed that Volk knew about a February 4, 2015 confidentiality agreement and ALFA having been granted access to confidential Pacific information to conduct due diligence with respect to a potential transaction, although ALFA had not yet commenced its due diligence investigations (the "ALFA Facts").

Contrary to the Public Interest

The OSC alleged, and it was ultimately agreed that, as Pacific's general counsel and the person who supervised Pacific's IT Policy (which allowed him to self-assess whether he was in possession of material, generally- undisclosed information when contemplating a trade in Pacific securities), he was in a position of high responsibility and trust and was subject to a high professional standard to avoid any appearance of conflicts of interest and any appearance of misuse of confidential information related to Pacific. As a result, the OSC found that a prudent course of action for Volk would have been to err on the side of caution given his knowledge of the Harbour Facts and ALFA Facts and refrain from purchasing Pacific securities. Volk's conduct was found to be contrary to the public interest, as he failed to adhere to the high standard of conduct expected of him in the circumstances.

Takeaways

- The Settlement Agreement is illustrative of the position taken by OSC staff and, while approved by the OSC as being within the range of reasonable dispositions available in the circumstances, it was not a decision of the OSC on the merits, but is indicative of the approach that staff may take in similar circumstances.

- Persons such as Volk, who are in a position of responsibility and trust may be subjected to a higher professional standard to avoid any appearance of conflicts of interest and any appearance of misuse of confidential information. In this case, Volk was general counsel and the person who supervised the IT Policy, which allowed him to self-assess whether he was in a position of material, generally undisclosed information when trading.

- It is the law, that notwithstanding any reasoned analysis as to whether undisclosed information is material, the Commission (and staff) may and will second guess that decision.

- The prudent course of action is to err on the side of caution.

Footnotes

1 Volk earned no profit from his trading in the Notes and in fact lost almost the entire value of them due to Pacific entering CCAA proceedings.

2 Volk was not only responsible for self-assessing his own trades, but also the trades of all insiders. Throughout the period between the end of the blackout in November 2014 and the imposition of the blackout in March 2015, a number of trades were proposed and executed by insiders after assessment by Volk; in all cases, he was of the opinion that no material, undisclosed information existed at the time of the trades, an assessment that he applied to the Note Purchase as well

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.