The public debate on "fair taxation" has escalated since the Minister of Finance, Bill Morneau, started his political campaign against professional corporations that pay tax at lower tax rates (about 15%) than individuals who operate their businesses without corporate structures, and pay at marginal rates as high as 53 percent. The differential in tax rates goes back some policy decisions stemming from the Carter Commission in 1966, which the Liberal government adopted in 1972 as the foundation of our corporate tax system.

The general consensus amongst Canadians is that we should tax individuals according to their means. Most will agree in theory with the principle that individuals with higher incomes should pay more tax than individuals who earn less. The underlying premise is that higher income individuals have a greater ability to pay taxes and, therefore, it is fair that they pay more tax. But how much more is "fair"? The difficulty is that many believe that a tax system is fair, but only if it taxes the other person.

No one seriously argues with the principle that an individual who earns $100,000 should pay more tax than an individual who earns $30,000. However, is it sufficient to pay proportionately more, or does the principle compel us to inevitably conclude that higher income earners must also pay progressively more than lower income earners? If higher incomes should pay progressively more taxes, what is the appropriate rate of progression? There are no easy answers to these questions, which depend upon domestic and international tax considerations.

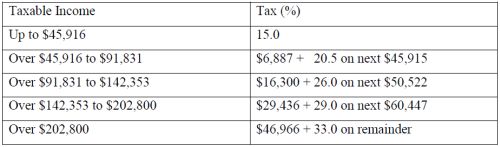

Canada taxes individuals on a progressive scale. The adjective "progressive" refers not to the quality of our Byzantine tax law, but to the aspect of our system by which the marginal rate of tax increases at various levels of income. For example, in 2017, the basic federal rates of tax for individuals are as follows:

Once we add in provincial taxes, the top marginal rate can exceed 50 percent. Ontario, for example, has a top rate of 53.5 percent; Manitoba 50.40 percent; Newfoundland and Labrador 51.30 percent.

Thus, a person who earns $205,000 pays not only more tax in absolute dollars than an individual who earns $45,000, but the federal marginal rate of tax progresses from 15% to 33% as income rises.

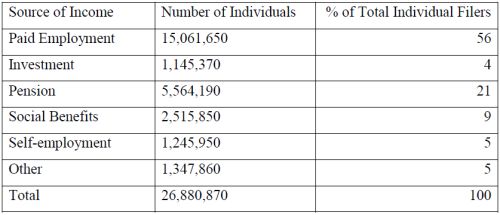

We justify progressive taxation on the principle that an individual's ability (though not enthusiasm) to pay tax increases as his or her income rises. This assumption, however, only starts the debate. One-third of the approximately 27 million taxpayers who filed returns in 2015 (latest year for which figures are available) did not pay any income tax at all. These taxpayers are the beneficiaries of income redistribution, and they file tax returns primarily to receive benefits paid out under rebate programs. That leaves the remaining two-thirds to make up the necessary revenues.

Progressivity really kicks in around the $92,000 income level, and accelerates thereafter until it peaks at the top federal marginal rate of 33 percent, which works out to approximately 53 percent in combined federal and provincial taxes. In 2015, for example, top income bracket individuals, comprising about 3 percent of all filers, contributed about 35 percent of total net federal tax revenues., or ten times their proportional representation of the population.

Contrary to popular opinion, the rich in Canada do actually pay their fair share of personal income taxes. However, after fifty years of teaching and practicing tax law, I have yet to meet two persons who can agree on the meaning of what is "fair" in taxation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.