A look at the current healthcare landscape in Canada, including financing, mergers & acquisitions, notable transactions and big announcements.

General Q2 2017 Overview

- Healthcare1 financing activity in Canada in Q2 2017 was lower than Q1 2017 both in terms of number of deals and transaction value, however there were a number of notable financings and M&A transactions.

- Of mergers and/or acquisitions with disclosed deal value, Q2 2017 saw several large acquisitions, particularly in the Cannabis sector.

- There were a number of major financings in the healthcare sector in Q2 2017, including the initial public offering of MedReleaf Corp. for aggregate gross proceeds of approximately $100.7 million and the $89.91 million private placement into Repare Therapeutics Inc. by a group of venture capital firms that included MPM Capital, Versant Ventures, Inc., BDC Venture Capital, Fonds de solidarité FTQ and Celgene Switzerland LLC.

- Financings in the Cannabis sector continue to dominate both in terms of number of deals and total transaction value, with an aggregate transaction value for Cannabis deals of approximately $350 million in Q2 2017.

Q2 Mergers and Acquisition Transactions

- M&A in the Cannabis sector continued to be active in Q2 2017. Major M&A transactions in Q2 2017 included the USD$62.53 million acquisition of CEN Biotech, Inc., a Canadian biopharmaceutical company focused on the cultivation and distribution of medical cannabis, by a wholly owned subsidiary of US-based Incumaker, Inc., and the $43.82 million acquisition of Acreage Pharms Ltd., a licensed producer of medical cannabis, by Invictus MD Strategies Corp.

Notable Healthcare M&A Transactions Q2 2017

| Transaction Announced as Closed | Target | Total Transaction Value (CADmm unless otherwise indicated) | Buyers |

| 04/12/2017 | CEN Biotech, Inc. | USD$62.53 | Incumaker, Inc. |

| 04/26/2017 | Acreage Pharms Ltd. | $43.82 | Invictus MD Strategies Corp. (TSXV:IMH) |

| 04/03/2017 | Pyng Medical Corp. (TSXV:PYT) | $22.25 | Teleflex Medical Canada Inc. |

Source: Data obtained from Capital IQ and Mergermarket

Notable Healthcare M&A Transactions Q1 2017

| Transaction Announced as Closed | Target | Total Transaction Value (CADmm unless otherwise indicated) | Buyers |

| 03/03/2017 | Valenat Pharmaceuticals Inc. (CeraVe, AcneFree and Ambi Skincare brands) | USD$1300 | L'Oréal SA |

| 01/31/2017 | Mettrum Health Corp. | $428.93 | Canopy Growth Corporation (TSX: WEED) |

| 02/16/2017 | Accucaps Industries Limited | $100.5 | Catalent Pharma Solutions, Inc. |

Source: Data obtained from Capital IQ and Mergermarket

Q2 Financing Transactions

- Excluding the approximately $4.4 billion refinancing by Valeant Pharmaceuticals International, Inc. in Q1 2017, deal volume and deal value decreased by 31% and 40%, respectively, between Q1 and Q2 2017.

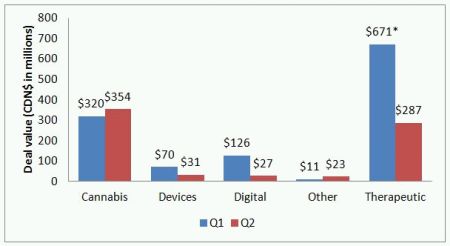

- Investments in Cannabis and Therapeutics companies continue to outpace investments made in Digital and Device companies.

Healthcare Deal Volume (Q1 and Q2 2017)

*Excludes the ~$4.4 billion refinancing by Valeant Pharmaceuticals International, Inc. in Q1 2017. Source: Data obtained from Capital IQ

Healthcare Deal Value (Q1 and Q2 2017)

*Excludes the ~$4.4 billion refinancing by Valeant Pharmaceuticals International, Inc. in Q1 2017. Source: Data obtained from Capital IQ

Q2 Big Announcements

Despite an overall decrease in number of deals and deal value, a number of major announcement were made in Q2 2017:

- The acquisition of TSX-listed Novadaq Technologies Inc., a provider of fluorescence imaging solutions, by NYSE-listed Stryker Corporation for an aggregate transaction value of approximately US$701 million (approximately CDN$925 million).

- The acquisition of TSX-listed Merus Labs International Inc., a specialty pharmaceutical company, by Norgine B.V., a European specialist pharmaceutical company for a total transaction value of approximately CDN$340 million.2

- The initial public offering of Clementia Pharmaceuticals, Inc., a biopharmaceutical company headquartered in Montreal, on the NASDAQ for gross proceeds of approximately $150 million.3

- The offering, being made by way of private placement to accredited investors, of $200 million aggregate principal amount of series A senior unsecured debentures of Chartwell Retirement Residences offered on a reasonable best efforts basis by a syndicate of agents co-led by CIBC Capital Markets and BMO Capital Markets.

Venture Capital Activity in the Life Sciences Sector H1 2017

According to a report released by the Canadian Venture Capital and Private Equity Association4 (the "CVCA"), H1 2017 continued to see strong overall venture capital activity, including a slight year over year uptick in the number and amount of investments in life sciences5 in Canada, with $344 million invested across 52 deals in H1 2017 and $310 million invested across 35 deals in H1 2016. The ~$90 million private placement in Repare Therapeutics Inc. was cited by the CVCA as the second largest disclosed venture capital deal in H1 2017.

Methodology

Data used to complete this report was obtained by conducting searches on Capital IQ and Mergermarket. Capital IQ and Mergermarket were used to identify financing (specifically, private placement, public offerings or shelf registrations) and M&A transactions that met the following criteria: (1) the primary industry classification was "healthcare" (in the case of Capital IQ) or "medical", "medical: pharmaceuticals", and "biotechnology" (in the case of Mergermarket); (2) the primary geographic location of the target or issuer was Canadian, with a Canadian or foreign investor or buyer; and (3) transactions closed or were announced in either calendar Q1 or Q2 of 2017. After running searches in Capital IQ and Mergermarket, deals were manually reviewed and filtered for alignment with the search criteria.

Our focus on this report was on Canadian deal activity in healthcare, which we defined to include the following subsectors: therapeutics (including biotechnology and pharmaceuticals) ("Therapeutics"), medical devices ("Devices"), digital health ("Digital"), other healthcare products and services ("Other"), and cannabis related enterprises ("Cannabis"). After conducting searches in Capital IQ and Mergermarket, subsectors were assigned to target companies based on a subjective assessment of the primary business of the target/issuer.

We acknowledge certain limitations in our data set that may affect our conclusions above. For example, for a number of reported but private M&A transactions in both Q1 and Q2 2017, the total transaction value was not disclosed. In addition, we acknowledge that our data set may not capture undisclosed private financing and M&A transactions, such as angel and VC investments, and that this could significantly affect our conclusions above.

Footnotes

1. For the purpose of this report, healthcare includes the following subsectors: therapeutics (including biotechnology and pharmaceuticals) ("Therapeutics"), medical devices ("Devices"), digital health ("Digital"), other healthcare products and services ("Other"), and cannabis related enterprises ("Cannabis").

2. This transaction, which was done by way of plan of arrangement under the Business Corporations Act (British Columbia) closed on July 17, 2017.

3. Common shares of Clementia Pharmaceuticals Inc. began trading on the NASDAQ Global Select Market on August 2, 2017.

4. Canadian Venture Capital & Private Equity Association, "VC & PE Canadian Market Overview H1 2017".

5. Life sciences are defined by the CVCA to include biotech, medical devices, pharmaceuticals, ehealth, healthcare products and services, and other medical related products and services.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.