Canadian citizens and residents may be exposed to U.S. estate, gift, and generation-skipping transfer tax (together, "U.S. transfer taxes") on the value of certain property gifted or transferred during lifetime or on death. Without realizing it, you and your executors and trustees may have certain liabilities and obligations under the U.S. transfer tax regime.

U.S. citizens and persons domiciled in the U.S. for transfer tax purposes ("U.S. Persons"), are generally liable for U.S. estate tax on the gross value of their worldwide estates, subject to allowable exclusions, deductions and credits. In addition, Canadian tax residents who are not U.S. Persons are generally liable for U.S. estate tax on their U.S. situs property, including U.S. real estate and tangible personal property and certain U.S. securities and other assets.

In this Advisory, we discuss general will and estate planning considerations for Canadian residents who may be exposed to U.S. estate tax. Different or additional considerations may apply if you are not a Canadian resident for income tax purposes or if additional factors, such as citizenship or residency of a third country, are present. The key is effective co-ordination between both the U.S. and Canadian tax regimes to minimize tax and optimize each situation, including by taking advantage of deferral opportunities and available exclusions, credits and deductions.

U.S. TRANSFER TAXES

In general, U.S. estate tax is calculated at graduated rates based on the gross value of certain assets owned by an individual at death. Currently, the maximum rate of U.S. estate tax is 40%. For a U.S. Person, the tax is based on the value of his or her worldwide estate, subject to applicable exclusions, credits and deductions. For a non-U.S. Person, the tax is based on the value of his or her U.S. situs property. U.S. estate tax may be payable where the value of your worldwide estate exceeds the U.S. estate tax exclusion amount (currently $5 million USD indexed for inflation from 2011, and $5.49 million USD for 2017).

The worldwide estate includes certain assets that may not be obvious, such as the proceeds of life insurance policies owned by a deceased person on his or her own life, generally the total value of property held in joint tenancy with right of survivorship (subject to limited exceptions and deductions), and certain property held in trust. In addition to U.S. estate tax which is levied at the federal level, certain U.S. states also levy estate or inheritance taxes on death, including Connecticut, Delaware, District of Columbia, Hawaii, Iowa, Illinois, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Nebraska, New Jersey, New York, Oregon, Pennsylvania, Rhode Island, Tennessee, Vermont and Washington.

In addition to estate tax, the U.S. transfer tax regime includes gift tax and generation-skipping transfer tax ("GSTT"). Generally, U.S. gift tax applies to gifts by U.S. Persons and to gifts of certain U.S. situs property by non-U.S. Persons, subject to exclusions and deductions. Gifts by U.S. Persons in excess of an annual exclusion amount may be tax-free up to the lifetime estate tax exclusion amount.1 Gifts made reduce the estate tax exclusion available on death. GSTT generally applies to gifts valued above the exclusion amount, currently $5.49 million USD, that are made to unrelated persons at least 37.5 years younger than the donor and to or for the benefit of related persons at least two generations below the donor.

WHO IS A U.S. PERSON?

You are a U.S. Person for transfer tax purposes if you are a U.S. citizen, including a dual citizen of the U.S. and another country, or if you are a U.S. resident and have a U.S. domicile.

It is possible to be a U.S. citizen without being aware of your status. For example, you may be a U.S. citizen if you were born in Canada to one or more U.S. citizen parents, even if you have never resided in the U.S. There are also other types of "accidental" U.S. citizens, including children born in U.S. hospitals. You may also be a U.S. Person if you have moved to the U.S. to work and have a U.S. domicile because you intend to permanently reside in the U.S.

In addition to U.S. transfer taxes, U.S. citizens are subject to the U.S. income tax regime and must file an annual tax return. Additional reporting requirements may apply to U.S. citizens with Canadian bank accounts, RRSPs, TFSAs or certain other plans and investments. If you are unsure of your status or obligations, you should seek professional advice.

GENERAL ESTATE PLANNING CONSIDERATIONS

If you, your spouse, or someone you wish to benefit in your estate plan is a U.S. Person, you may wish to consider estate planning strategies and techniques designed to minimize or manage the anticipated exposure to U.S. estate tax. Generally, it is worthwhile to consider planning for U.S. estate tax where the anticipated exposure to the estate exceeds the amount that can be sheltered by available deductions, exclusions and treaty credits, or where you can minimize a beneficiary's unnecessary exposure to U.S. estate tax. Any proposed plan should take into account the anticipated costs associated with the plan and any ongoing compliance.

In the following sections, we discuss various will and estate planning strategies in three common scenarios: where one spouse is a U.S. Person and the other is not, where intended beneficiaries, including children and grandchildren, are U.S. Persons and where both spouses are U.S. Persons.

WHERE ONE SPOUSE IS A U.S. PERSON

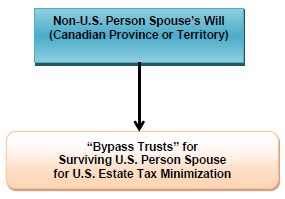

Bypass Trust to Benefit a U.S. Person Spouse Under Non-U.S. Person's Will

Any assets transferred outright under a non-U.S. spouse's will to a U.S. Person surviving spouse if owned by the surviving spouse at his or her death will be included in the surviving spouse's worldwide estate for U.S. estate tax purposes. As a result, it is critical to ensure that the non-U.S. Person's assets are not exposed to any additional U.S. estate tax where the surviving spouse's available exclusion amount for U.S. estate tax will not eliminate any estate tax liability.

To minimize or eliminate U.S. estate tax, instead assets may be transferred to a "bypass trust" for the benefit of the U.S. Person spouse. Assets in the trust are not included in the U.S. Person spouse's worldwide estate on his or her death, provided the trust meets certain requirements. These requirements include limits on the spouse's participation in certain discretionary decisions, including to pay income or capital so that he or she does not have too much ownership, resulting in the value of the assets of the bypass trust being included in his or her estate on death, and as a result, subject to U.S. estate tax.

For Canadian tax purposes, assets with accrued capital gains may be rolled over to the bypass trust on a tax-free basis if it is also a qualified spouse trust under the Income Tax Act (Canada). The assets in the trust will not be subject to tax until the earlier of the date they are disposed of and the death of the surviving spouse.

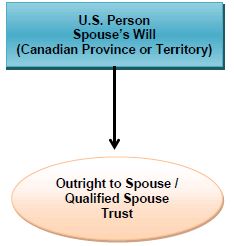

Planning For Utilization of Spousal Credit Under the Canada-U.S. Tax Treaty Under U.S. Person Spouse's Will

The Canada-U.S. Tax Treaty provides special relief. It allows a spousal credit to be taken by a U.S. Person against U.S. estate tax. The spousal credit is in addition to any unified credit or exclusion amount for U.S. estate tax. To qualify for the spousal credit, the property must pass to the surviving non-U.S. Person spouse in a manner that would otherwise qualify for the U.S. marital deduction: 1) outright, or 2) to a special trust called a "QTIP" trust which qualifies for the marital deduction as discussed below.

The spousal credit is approximately equal to the lesser of the unified credit or the estate taxes imposed on the qualifying property, which can allow for up to approximately $10.98 million USD in 2017 of assets to pass from a U.S. Person spouse to his or her non-U.S. Person spouse free of estate tax, or approximately double the exclusion amount.

Qualified Domestic Trust Under U.S. Citizen Spouse's Will

Transfers from a U.S. citizen spouse to a non-U.S. citizen spouse generally do not qualify for the unlimited marital credit available to two U.S. citizen spouses which would allow a deferral of U.S. estate tax. One exception allows a U.S. citizen spouse to pass assets at death to a non-U.S. citizen spouse by means of a special trust called a Qualified Domestic Trust ("QDOT"). Under U.S. rules, the estate tax otherwise due on the death of a U.S. citizen spouse is paid upon distribution of any capital of the trust to the surviving non-U.S. citizen spouse or ultimately upon the surviving spouse's death. It is important to note that the QDOT only defers U.S. estate tax (much like the deferral of capital gains available for Canadian tax purposes for property passing between spouses) that otherwise would have been imposed. The deferred tax is generally imposed at the survivor's death on the gross value of the property remaining in the QDOT. Therefore, if the value of the QDOT property increases, the tax at the survivor's death could be higher than if the tax had been paid at the death of the first spouse.

A QDOT must meet a number of complex requirements, including that it must have at least one U.S. trustee and the trust must be governed by the law of a U.S. state.

Credit Shelter Trust under U.S. Person's Will

A "credit shelter trust" can be established in a U.S. Person's will in an amount up to the exclusion amount in order to fully utilize the U.S. Person's estate tax exclusion so that the trust assets may eventually pass to the non-U.S. Person spouse free of estate tax.

Life Insurance

The non-U.S. Person spouse may consider purchasing life insurance on the life of the U.S. Person spouse in an amount sufficient to fund his or her expected U.S. estate tax liability. In addition, life insurance on the life of the non-U.S. Person spouse may be designated to a bypass trust for the benefit of the U.S. Person spouse. As well, insurance may be owned through a special trust called an irrevocable life insurance trust, as opposed to direct ownership, to exclude the value of the proceeds from the estate.

Holding Assets Between Spouses

Consider structuring real property holdings to minimize U.S. estate tax, as real property held in joint tenancy with right of survivorship is presumed to be included at its full value in the estate of the U.S. Person spouse (except to the extent the non-U.S. Person spouse can establish the extent of his or her contribution to the purchase price), and the value of any mortgage is generally not deductible from the property value. Canadian real estate might be held solely by the non-U.S. Person spouse, so as not to be included in the estate of the U.S. Person spouse. Conversely, any U.S. real estate might be held in the name of the U.S. Person spouse, among other possible arrangements or consider holding assets of fixed value in the estate of the U.S. Person spouse and assets which are expected to appreciate in the estate of the non-U.S. Person spouse. It is important to carefully consider and seek professional advice with respect to acquiring and holding property in order that all relevant tax and legal considerations are taken into account in each individual case.

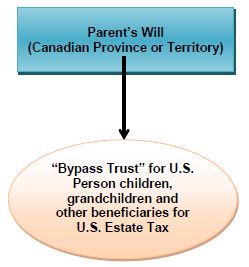

WHERE INTENDED BENEFICIARIES INCLUDING CHILDREN AND GRANDCHILDREN ARE U.S. PERSONS

Where the intended beneficiaries of an estate are your children or grandchildren, who are or are likely to become U.S. Persons, consider transferring assets to a bypass trust under your wills for their benefit in order to protect the assets they inherit from U.S. estate tax. As discussed above with regard to transferring assets by will to a U.S. Person spouse, for U.S. estate tax minimization purposes, the trust must meet certain requirements, including restrictions on the ability of the beneficiary to participate in certain discretionary decisions with respect to the trust. Use of a trust may provide a host of other benefits as well, including ensuring capital succession to the next generation, minimizing probate fees because the assets in the trust on death of the beneficiary do not form part of his or her estate, and general wealth, matrimonial and creditor protection.

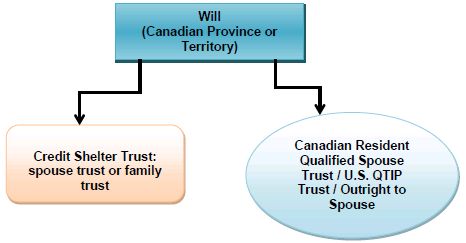

WHERE BOTH SPOUSES ARE U.S. PERSONS

Where both spouses are U.S. Persons and the gross value of one spouse's estate, net of the gift tax exclusion used prior to death, exceeds the exclusion amount ($5.49 million USD for 2017) resulting in possible U.S. estate tax exposure, the following planning options may be available in planning for the spouse who predeceases.

Unlimited Marital Deduction

Transfers on death from a U.S. citizen to a U.S. citizen spouse, outright or through a special marital trust under each will, allow for an unlimited marital deduction against estate tax, providing a deferral of any U.S. estate tax until the death of the surviving spouse or payment of capital from the spouse trust.

The unlimited marital deduction is available for assets passing from the deceased spouse under his or her will via a special trust called a qualified terminable interest property ("QTIP") trust, which must meet certain legal requirements.

From a Canadian tax perspective, a QTIP trust may also meet the requirements of a qualifying spouse trust under Canadian tax legislation. Assets transferred on death by a deceased spouse to a qualifying spousal trust may be "rolled over" and are not subject to tax until the earlier of the date the asset is disposed of by the trust and the death of the surviving spouse.

Credit Shelter Trust

A "credit shelter trust" can be established under each will, generally funded in an amount up to the exclusion amount, in order to ensure a U.S. Person's estate tax credit is utilized so that the amount allocated to the credit shelter trust passes to his or her intended beneficiaries free of estate tax. This type of trust acts like and is sometimes called a "bypass trust".

Portability of Exclusion Amount

As between two U.S. citizen spouses, the exclusion amount of approximately $5.49 million USD for 2017 is portable, so that if one spouse dies, any unused exclusion of the deceased spouse may be transferred by making certain elections to the surviving spouse, subject to certain terms and conditions. Effectively, this can allow up to approximately $10.98 million USD in 2017 of assets to pass free of estate tax for a U.S. couple.

Life Insurance

Consideration can be given to purchasing life insurance on each spouse's life in an amount sufficient to fund the expected U.S. estate tax liability. Life insurance if owned by a person other than the insured person will not be subject to U.S. estate tax. As well, consideration can be given to using a trust which has special terms to own large insurance policies, as opposed to individual ownership, to remove the value of the proceeds from the taxable estate.

Charitable Donation Planning

To reduce the amount of a person's U.S. estate, consider a donation to charity. Amounts donated to qualifying U.S. charities and certain qualifying international charities can provide for generous tax relief.

Example

The following is an example of how two U.S. citizens living in Canada may plan to minimize U.S. estate taxes.

Michael and Julia were both born in Cleveland, Ohio, U.S. After their marriage in the U.S., they moved to London, Ontario where they have lived for a number of years. Michael has approximately $10 million USD in assets which will be included in his gross worldwide estate for U.S. estate tax purposes on his death. Julia has approximately $5 million USD in assets.

A credit shelter trust may be established under both of their wills to benefit the surviving spouse during his or her lifetime. The credit shelter trust is funded in an amount equal to the maximum exclusion amount at the time of death (currently $5.49 million USD in 2017), in order to fully utilize the estate tax credit of the first spouse to die. The assets in the credit shelter trust will eventually pass to its beneficiaries free of estate tax.

The assets of the first spouse to die which exceed the exclusion amount can be used to fund a QTIP trust qualifying for the unlimited marital deduction or can pass outright to the surviving spouse. Estate tax will be deferred until the death of the surviving spouse. Upon the death of the second spouse to die, the assets left in the trust or any assets still owned by the surviving spouse which passed outright will be taxed as a part of the estate of the second spouse to die.

Alternatively, all of the assets of the first spouse to die could be used to fund a QTIP trust qualifying for the unlimited marital deduction and/or can pass outright to the surviving spouse. A portability election could be made to transfer the unused exclusion amount of the first spouse to die (i.e., $5.49 million USD) to the surviving spouse. Upon the death of the second spouse to die, the assets left in the QTIP trust will be taxed as part of the estate of the second spouse to die. Estate tax should be payable only to the extent the assets of the second spouse to die exceed the sum of the predeceased spouse's unused exemption amount ($5.49 million USD as adjusted for inflation) and the second spouse's unused exemption amount in effect in the year of his or her death.

Michael and Julia may also purchase life insurance on each other's lives to fund any anticipated U.S. estate tax liability with respect to the estate of either of them and they may also wish to consider charitable donation planning.

The above planning can integrate with Canadian tax planning to provide for one or more of the trusts to also be a qualified spouse trust eligible for a capital gains rollover or a family trust to provide income-splitting among children and grandchildren and other family members, as well as probate fee minimization, capital succession to the next generation, and general wealth protection.

CONCLUSION

It is important that Canadians with connections to the U.S. or who are U.S. Persons or have U.S. Person beneficiaries consider their possible exposure to U.S. estate tax and plan accordingly, including under their will.

Professional advice is recommended when planning for U.S. estate tax, including advice from Canadian and U.S. estate, trust and tax professionals, which can provide an effective, integrated solution to ensure planning opportunities in both jurisdictions are optimized.

Footnote

1. Gift tax exclusions include: for U.S. Persons generally, an annual exclusion of $14,000 in 2017; an annual exclusion of $149,000 for gifts by any person to a non-U.S. Person spouse in 2017; and unlimited exclusions for certain health care or tuition payments. In addition, a gift in any amount between two U.S. Person spouses of a present interest (as opposed to a future interest which vests in the gift recipient only upon some future date) is sheltered by the unlimited marital deduction from gift tax consequences.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.