- with readers working within the Banking & Credit and Construction & Engineering industries

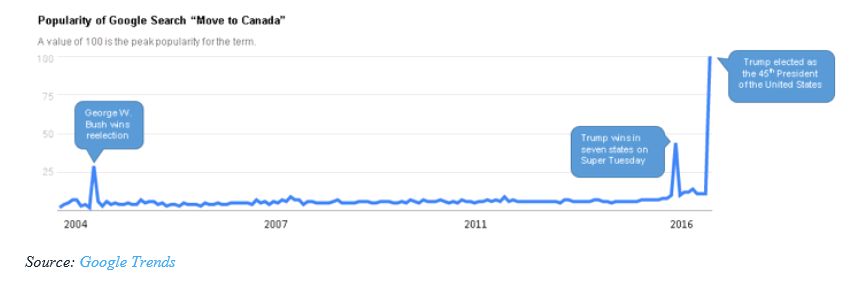

It seems like every time there is an American election, Google is inundated with search traffic from panicked Americans looking to move to Canada. However, the most recent American election was met with a particularly colossal surge of interest. In fact, the demand was so great that the Government of Canada's Department of Immigration, Refugees and Citizenship website crashed due to the high volume of visitors.

Many Americans are surprised to learn that moving to Canada involves a lot more than simply packing up a moving truck. In addition to learning how to play hockey and build an igloo, there are considerable legal hurdles to cross when moving to Canada. Many immigration lawyers (including myself) have been swamped with inquiries from people seriously considering this move.

AMERICAN EXCEPTIONALISM DOES NOT APPLY TO CANADIAN IMMIGRATION

Since U.S. citizens do not require a visa to enter Canada for short trips, many Americans mistakenly believe that they can move to Canada by simply showing up with their belongings at the border. What they do not realize is that this entry does not authorize them to settle in Canada, but rather only authorizes them to visit Canada.

An American is a foreign national and therefore must receive approval from the Canadian government to live and work in Canada. An American attempting to settle in Canada will be treated no differently than an Indian, a South African, a Mexican, a Norwegian or a South Korean. The rules that apply to them, will generally apply to you.

WHAT IF I MARRIED A CANADIAN?

Although some TV shows or movies lead us to believe otherwise, it is a myth that simply marrying a Canadian citizen will allow you to legally settle in Canada. In fact, marrying a Canadian national just for immigration purposes is a good way to get yourself removed and barred from Canada.

That being said, if your marriage is legitimate, it may open a path to legally settling in Canada. But there are still a number of steps involved. In addition to the immigration documents you need to file, you are required to prove that:

- Your marriage is legitimate, which can be extremely difficult for newly married couples;

- Your spouse can support you while you live in Canada;

- If your spouse is outside of Canada, that they have the intention to reside in Canada; and

- You will not become an undue burden on the Federal or Provincial Treasury.

Even if you can prove all of this, it may take an additional 9 – 12 months to simply process your application.

BUT I HAVE A JOB OFFER...

Again this is not enough. Unless your job fits in a limited number of skilled job categories or you are a recent graduate from a Canadian post-secondary institution, merely having a job offer is not sufficient for you to settle in Canada.

With a few notable exceptions, it is illegal to hire a foreign worker in Canada without first seeking out a Labour Market Impact Assessment (LMIA). Employers are often hesitant to seek out an LMIA just to keep a single employee in Canada. The process of getting an LMIA is extremely lengthy and costly for the employer. Usually, it is much easier to simply hire someone locally.

I WANT TO MOVE TO CANADA, HELP ME!

If you still want to move to Canada, the following is a simple guide on how to become a Canadian Citizen. This guide only applies to Americans attempting to immigrate to Canada as economic migrants.

STEP 1: DETERMINE IF YOUR OCCUPATION IS LISTED UNDER APPENDIX 1603.D.1 OF THE NORTH AMERICAN FREE TRADE AGREEMENT (NAFTA)

American and Mexican citizens are offered a quick entry option through NAFTA. The occupations which qualify under NAFTA are as follows:

Skilled Professionals

Accountants, Architects, Computer Systems Analysts, Disaster Relief Insurance Claims Adjusters, Economist, Engineers, Graphic Designers, Hotel Managers, Industrial Designers, Interior Designers, Land Surveyor, Landscape Architect, Lawyers, Librarians, Management Consultants, Mathematicians (including statisticians), Range Manager/Range Conservationist, Research Assistant, Scientific Technician, Technologist, Social Workers, Technical Publication Writers, Urban Planner, or Vocational Counselor.

Medical/Allied Professionals

Dentists, Dietitians, Medical Laboratory Technologist, Nutritionists, Pharmacist, Physician, Physiotherapist, Psychologist, Recreational Therapist, Registered Nurse, or Veterinarian.

Scientist

Agriculturalist including Agronomist, Animal Breeder, Animal Scientist, Apiculturist, Astronomer, Biochemist, Biologist, Chemist, Dairy Scientist, Entomologist, Epidemiologist, Geneticist, Geologist, Geophysicist, Horticulturist, Meteorologist, Pharmacologist, Physicist, Oceanographer, Plant Breeder, Poultry Scientist, Soil Scientist, or Zoologist.

Teacher

College, Seminary, or University.

If you qualify under one of these occupations, you are extremely lucky. The employer can hire you without first obtaining an LMIA. With your job offer, you can easily apply for a Canadian Work Permit. Once you have your Work Permit, proceed to STEP 5.

If you do not qualify under NAFTA, proceed to STEP 2.

STEP 2: DOES YOUR COMPANY HAVE A CANADIAN BRANCH OFFICE?

If your company has a Canadian branch office and you are an executive, senior manager, functional manager or have specialized knowledge, you may qualify for immigration to Canada under the Significant Benefit – Intra-Company Transfer Program. Your next step would be to convince your employer to relocate you to their Canadian branch office and then sponsor you for a Canadian Work Permit. An LMIA is not required in this case either.

If you qualify and can convince your employer, please proceed to STEP 4. If you do not, proceed to STEP 3.

STEP 3: APPLY UNDER THE FEDERAL SKILLED WORKER PROGRAM OR PROVINCIAL NOMINEE PROGRAM

If your job falls under Skill Type 0 or Skill Level A or Skill Level B and you can score 67 of 100 points under the Federal Skilled Worker Program or meet a similar requirement under a Provincial Nominee Program, you may qualify for Canadian Permanent Residency under the Express Entry Program. In that case, please proceed to STEP 5. If not proceed to STEP 4.

STEP 4: ARE YOU A HIGH NET WORTH INDIVIDUAL WILLING TO START A BUSINESS?

If you are a high net worth individual, some Canadian provinces might be interested in sponsoring you for Canadian permanent residency. This option is only available to those who have a net worth of at least CAD $1,000,000.00 or more and have at least CAD $500,000.00 available to invest in a government-sponsored business.

If you qualify, you would need to pick a province and apply for permanent residency under their Provincial Nominee Program. Once accepted, proceed to STEP 6. If not, you will need to find a non-economic means to immigrate to Canada.

STEP 5: APPLY FOR PERMANENT RESIDENCY UNDER THE EXPRESS ENTRY PROGRAM

After you have completed the above steps, you will apply for Permanent Residency under the Express Entry Program.

Once you receive your Canadian permanent residency, proceed to STEP 6.

STEP 6: APPLY FOR CANADIAN CITIZENSHIP

If you have obtained your permanent residency, been physically present in Canada for at least 1,460 days in the past 6 years, and have learned your Canadian history, you may apply for Canadian citizenship.1

STEP 7: PLEDGE ALLIGENCE TO THE QUEEN

Welcome to Canada!

I'M OFFICIALLY CANADIAN! NOW WHAT?

Remember that as long as you remain an American citizen (or green card holder), you are legally obligated to file a U.S. income tax return every year, and there could be substantial IRS penalties if you don't. The United States is unique in taxing based on both citizenship and residence, and until an individual formally gives up his or her U.S. citizenship or permanent resident status, he or she must file a U.S. tax return just like anyone living in the United States. Most Americans in Canada do not end up actually writing a cheque to the IRS because they are able to claim foreign tax credits for taxes paid to Canada, but they still must file returns to claim those credits. Renouncing U.S. citizenship or terminating a green card status is possible, but requires proper planning in order to avoid the many pitfalls along the way.

Regardless of whether or not an American decides to eventually give up U.S. citizenship, it is also important to keep in mind is that both the United States and Canada require disclosure of foreign assets when an individual files his or her annual income tax return. Failure to do so can result in hefty penalties from the Canada Revenue Agency (CRA), the Internal Revenue Service (IRS) or both.

Canada requires disclosure of aggregate specified foreign property with a cost equal to or greater than CAD $100,000.00 per year on CRA Form T1135; an American who moves to Canada and chooses to maintain U.S. banking or investment accounts could easily be subject to this requirement. With respect to the United States, an American who opens financial accounts in Canada will usually be required to report account ownership and balances each year on the U.S. Department of the Treasury Financial Crimes Enforcement Network Report of Foreign Bank and Financial Accounts (FinCEN Form 114, commonly known as the FBAR). Depending on the individual's assets, IRS Form 8938, Statement of Foreign Financial Assets, may also be required. Failure to timely file the FBAR or 8938 can result in a penalty of USD $10,000.00 per form per year.

Americans with interests in U.S. businesses or trusts may face special tax challenges upon moving to Canada. Limited liability companies, for example, are not taxed the same way in Canada as they are in the United States, potentially resulting in double taxation of the same income. Setting up a Canadian corporation, likewise, will trigger both another U.S. information-reporting obligation with stiff failure to file penalties (IRS Form 5471, Information Return of U.S. Persons With Respect To Certain Foreign Corporations) and U.S. tax rules designed to make sure that Americans cannot easily defer U.S. tax on investment activities. Canada, too, has anti-deferral rules that an American contemplating a move to Canada may need to consider.

Moving to Canada may be possible, but it is not simple. Further, Americans looking to relocate anywhere outside the United States must be mindful that they will have to keep filing U.S. income tax returns as long as they remain U.S. citizens or green card holders, and may need to plan carefully to optimize the amount of tax they pay worldwide.

Footnote

1 This may change to 1,095 days, in the past five years, if Bill 6 passes.

Moodys Gartner Tax Law is only about tax. It is not an add-on service, it is our singular focus. Our Canadian and US lawyers and Chartered Accountants work together to develop effective tax strategies that get results, for individuals and corporate clients with interests in Canada, the US or both. Our strengths lie in Canadian and US cross-border tax advisory services, estateplanning, and tax litigation/dispute resolution. We identify areas of risk and opportunity, and create plans that yield the right balance of protection, optimization and compliance for each of our clients' special circumstances.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.