- within Family and Matrimonial topic(s)

- with Inhouse Counsel

- with readers working within the Banking & Credit, Insurance and Healthcare industries

Alberta and its Recent Electricity Policy Changes

Alberta is Canada's fourth largest province, with a population of over 4 million people, and a land mass of 660,000 sq kms – about twice the size of Germany.

The market, composed of its generators, transmitters, distributors, retailers, electricity consumers, and wholesale electricity market, (the "Alberta Electricity Market") has had a peak load of 11,200 MW, but daily peak load now averages about 9,000 MW. It is predominantly (>60%) an industrial load due to Alberta's large oil and gas industry. The load is currently 90% serviced by thermal generation that is mainly coal based, with renewables generating only about 10% of the required electricity in Alberta. This is about to change.

The Government of Alberta recently announced a number of policy changes that will impact the Alberta Electricity Market. Generators in Alberta will be forced to utilize lower-carbon natural gas and zero-carbon renewable forms of generation. Alberta is one of the last provinces in Canada to mandate a change in its fuel mix for generating power. The Alberta policy changes require that:

- There will be no pollution from coal-fired power generation in Alberta by 2030, as all coal-fired plants (approx. 6,300 MW) will either be phased out or be pollution free by then.

- Two-thirds of the current coal-generating capacity (approx. 4,200 MW) will be replaced by renewable energy, and one-third (approx. 2,100 MW) by natural gas.

- Beginning in 2018, all coal generators will pay $30 per tonne of CO2 on emissions above what Alberta's cleanest gas plant would emit to generate the same quantity of electricity.

- Renewable power will account for 30% of Alberta's total operating generating capacity by 2030.

These changes have created exciting business opportunities in Alberta for local, national and international power project developers.

Not surprisingly, Borden Ladner Gervais LLP ("BLG") and our Electricity Markets Group have seen a rise in the number of new project developers from outside Alberta who are seeking legal and business advice in this area. In this regard, we are periodically asked by potential entrants into the Alberta Electricity Market to provide an overview of the Alberta Electricity Market to assist them to better understand (i) the structure of the Alberta Electricity Market, (ii) the applicable legislation, regulations and governing agencies, (iii) the existing characteristics of Alberta's load and its generation mix, (iv) the way in which electricity prices are determined in Alberta, and, most importantly, (v) the recent developments that have occurred to create business opportunities for them in the Alberta Electricity Market.

We concluded that this general advice is something that would be of benefit to every new entrant into the Alberta Electricity Market, whether they are a prospective power project developer, investor, lender, constructor, operator or other participant in the market.

The Structure Of The Alberta Electricity Market

History and Evolution

Alberta's Electricity Market is unique in Canada. Its uniqueness is best understood through the historical context from which it developed.

Unlike most other provinces in Canada, Alberta did not form one province-wide vertically integrated utility to generate, transmit and deliver electricity when the Province was initially electrified. Instead, the majority of Alberta's electricity infrastructure was developed and owned by either investor-owned or municipally-owned entities.

These entities have now either been taken over or evolved into some of the players that currently operate in the Alberta Electricity Market. For example, in Southern Alberta the Calgary Power Co. Ltd. generated 99% of Alberta's power at one time. It subsequently changed its name to TransAlta, a large generator in today's Alberta Electricity Market. In the City of Calgary, the distribution of power was done by Calgary's municipal power authority that later became ENMAX, another large player in today's market. In the City of Edmonton, the City formed Edmonton Power to generate and distribute power within that city until it became EPCOR, which was later separated into publicly traded Capital Power for generation and municipally-owned EPCOR Utilities for transmission and distribution. Rural Alberta was serviced mostly by Canadian Utilities Limited until 1980, when it was taken over by ATCO. We say this simply to point out that many of the big existing participants in today's Alberta Electricity Market, like TransAlta, EPCOR, Capital Power, ENMAX and ATCO, have, like BLG, a long history and deep roots in the Alberta Electricity Market.

By 1995, on the generation side, Alberta was serviced mainly by three large vertically-integrated utilities, namely TransAlta, ATCO (then Alberta Power), and EPCOR (the "Big 3"), that collectively generated 90% of Alberta's then 8,600 MW of generation capacity. Of that total, 75% was generated by large baseload coal facilities, with the rest split between hydro and natural gas facilities. The Big 3 operated within specific service areas under a cost-of-service regulatory model. Electricity prices in Alberta at that time were set by a central regulatory body.

Creation of the Power Pool – 1996

With the coming into force of the Electric Utilities Act (the "EUA") on January 1, 1996, Alberta moved away from cost-of-service regulation on the generation side. Instead, it established the Power Pool through which all electricity, whether generated in Alberta or imported, in Alberta's Interconnected Electrical System (the "AIES") or grid would be dispatched competitively in a fair, efficient and openly competitive manner. The Power Pool was Canada's first competitive open-access market for the exchange of electricity.

All electricity that is generated and not consumed on site in Alberta must pass through the Power Pool. The Power Pool itself does not buy or sell electric energy, but acts only as a trading platform with financial settlement. It is also "energy only" in that currently generators only receive payments for the electrical energy delivered into the AIES. They do not receive payments for capacity.

The EUA also mandated open access to all transmission facilities in order to support competitive generation. It also put in place financial mechanisms or hedges intended to protect the then existing generation investments of the Big 3 from the new competitive market, while at the same time preventing them from exercising their concentrated market pricing power. The result was that, though developers of new generation were exposed to the risks of the Power Pool and low prices, the existing generation of the Big 3 was protected in 1996, and effectively continued as if it was still operating under the old cost-of-service regulatory model.

Power Purchase Arrangements – 2000

The next big change in the evolution of the Alberta Electricity Market came when Alberta mandated that the existing generation facilities owned by the Big 3 when the EUA was enacted be deregulated and exposed to the risks of Power Pool prices. To do this, Alberta removed the financial mechanisms or hedges that it had put in place when it passed the EUA. They were replaced with a forced auction, whereby the rights to the power from the output from the generation facilities of the Big 3 were sold to qualified bidders. This avoided the Big 3 being forced to divest themselves of their facilities.

The auction was completed using "Power Purchase Arrangements" ("PPA" or "PPAs"). Note the use of the word "Arrangement," as distinguished from the word "Agreement" that we typically equate with the acronym "PPA." In fact, the PPAs are not negotiated contracts – they are statutory instruments determined by Alberta, and enacted by the Alberta Government as Alberta Regulation 175/2000, with "quasi-contractual" characteristics.

The PPAs were used as a way to introduce competition into the Power Pool. The PPAs were intended to allow the "Owners" of the generation facilities the opportunity to recover their fixed and variable costs while transferring the right to offer the output of those generating facilities into the Power Pool to the "Buyers" who were successful in the auction.

The PPAs were, in a sense, a virtual divestiture of the power generated by the existing facilities of the Big 3. They left the ownership and operation of the plants with the Owners, but gave the Buyers of the PPAs the right to offer the electricity into the Power Pool at prices determined by each of the Buyers. The PPAs require that the Buyers pay the Owners their remaining fixed and variable costs, plus a reasonable return on assets – the PPAs mimic the historic cost-of-service model. Accordingly, the Buyers take market risk, and make money if the Power Pool prices exceed the amount they are required to pay to the Buyers under the PPAs, but lose money if the Power Pool prices do not exceed the amount they are required to pay to the Buyers under the PPAs.

The main PPA auction of 12 PPAs occurred in August of 2000, though only 8 PPAs were sold in that auction. Additional auctions for the unsold PPAs or power contracts/strips under those unsold PPAs were held later in 2000, and again in 2002-2003, and in 2005-2006. The approximate $3-billion of proceeds received from these sales was returned by the Province to electricity customers in Alberta as a refund on their bills.

Any unsold PPA was held and managed by a government entity called the Balancing Pool, with it acting as the Buyer under that PPA who offers the electricity from that PPA into the Power Pool. The Balancing Pool is required to manage the PPAs in a commercial manner, which includes managing associated payments, forecasting revenues and expenses, and participating in appropriate regulatory, dispute resolution or other proceedings.

The PPAs expire on the earlier of December 31, 2020 (20 years) or the then estimated end of plant life for the applicable facility. At the end of the term of the PPA the right to the output from the facility reverts back to the Owner.

Currently, there are seven PPAs for coal facilities that have not expired and remain in effect in Alberta:

As a result of changes in Alberta's climate change laws, the Buyers identified below have recently exercised rights under the PPAs to terminate their obligations under the PPAs and turn them over to the Balancing Pool. Though this right of termination (really just a turnover to the Balancing Pool) is now being challenged in court by the Alberta Government, the effect is that the Balancing Pool has, for now at least, become the Buyer under all of the existing PPAs and the party who offers that power into the Power Pool. This development is discussed in more detail below in the section titled "Termination of PPAs."

Retail Market Competition – 2001

Effective January 1, 2001, Alberta also permitted competition to occur in the retail component of the Alberta Electricity Market for residential and small commercial customers. This permits independent non-regulated companies to retail electricity to customers in the form of fixed-price contracts, flow-through contracts, dual fuel contracts (natural gas and power), green power or on-site generation (e.g. roof top solar). Retailers also provide billing and consumer services to these customers.

Any residential and small commercial customer who does not choose a retailer is provided a regulated rate option ("RRO") at a price that is set by the Alberta Utilities Commission ("AUC") for most of the RRO providers. RRO was meant to be a temporary option until more retailers could penetrate the market, but RRO has been repeatedly extended to provide an alternative for these small customers.

The Alberta Electricity Market Today

This evolution has created the current Alberta Electricity Market with the usual four components.

1. Generation

Generation is an openly competitive component of the Alberta Electricity Market. The generators choose the form of energy they will convert into the electricity they offer into the "energy only" Power Pool. If dispatched, the generators are paid the competitively determined Pool Price for the hour in which they are delivering their electricity into the AIES. New generation is built with private capital that takes the investment risk over the life of the project. This risk has to be managed because it is not backstopped by customers. There is also no central planning of generation in Alberta – at least there wasn't until Alberta recently announced its new climate change policies.

Apart from a price cap ($999.99) and a price floor ($0), outcomes in the real-time Power Pool are determined solely by the forces of competition. Participants are free to engage in unilateral strategies in an attempt to mitigate the Pool Price risk, as long as they do not impede competition or physically withhold generation from the market. Generators with plants of 5MW or more must also comply with the "must offer, must comply" rule, which requires them to offer all of their power, that they do not consume on site, to the AIES through the Power Pool. The physical withholding of supply is therefore prohibited, although it can be priced in the supply offer at the discretion of the generator subject to the price cap and the price floor.

In order to sell or buy power through the Power Pool, one must become a Power Pool Participant. A Power Pool Participant must sign an agreement to abide by the ISO Rules (sometimes called the Pool Rules) and the Pool Codes, meet the Power Pool's prudential, technical control, and communication requirements, pay an annual Power Pool Participant fee, and arrange for transmission or distribution access.

Under the EUA, offers to supply power into the Power Pool and bids to purchase power from the Power Pool determine in a spot market, on an hourly basis, the wholesale market price for electricity in Alberta. We explain in more detail below how this works in the section titled "Determining the Pool Price."

2. Transmission

Transmission (high voltage from 72KV to 500KV) is generally regulated in Alberta under a cost-of-service model. Customers (commercial and residential) pay the owners of the transmission systems ("Transmission Facility Owners" or "TFOs") their capital and operating costs, plus a reasonable rate of return.

The TFOs are generally large corporations that operate to transmit electricity long distances in franchised service territories. The use of dedicated service territories in Alberta is slowly changing for new stand-alone transmission projects. For example, Alberta recently used a competitive process to contract for a new transmission line called the Fort McMurray West Transmission Project that will run from Wabamun (west of Edmonton) to Fort McMurray, Alberta.

There are currently four main TFOs in Alberta, namely AltaLink, ATCO, EPCOR and ENMAX.

Notwithstanding that the TFOs own the transmission system in Alberta, the AESO oversees the design and use of Alberta's transmission system to ensure non-discriminatory access for market participants and the safe and reliable operation of the AIES. It provides system access for market participants to the transmission system within the constructs of the Western Electricity Coordinating Council or WECC that governs the interconnected systems of Alberta, British Columbia and 14 of the western United States. Though the AESO determines and develops a need application for new transmission upgrades, it is actually the AUC that approves the AESO need application work and authorizes a new transmission project. The AESO then assigns the project to a TFO. The AESO pays the TFO based on a cost-of-service model. The transmission tariff setting out the costs that the TFO will charge the AESO for the use of its transmission assets must be approved by the AUC. The transmission rate in Alberta is "postage stamp."

As noted above, system access to the transmission system owned by the TFOs is controlled by the AESO. Accordingly, new Alberta generation that will be transmission connected will have to follow the interconnection process that the AESO has designed in order for that new generation to be built and connected to the Alberta transmission system.

3. Distribution

The local distribution (low voltage of less than 25 KVs) at the load centres is also regulated under a cost-of-service model. Customers (commercial and residential) pay the owners of the distribution systems ("Distribution Facility Owners" or "DFOs") their capital and operating costs, plus a reasonable rate of return.

The DFOs deliver electricity to most consumers in Alberta – all except for very large industrial consumers which are connected directly to the transmission lines. These DFOs include ATCO, FortisAlberta, EPCOR (Edmonton), ENMAX (Calgary), approximately 30 Rural Electrification Associations ("REAs") that are cooperatives that distribute electricity to rural areas of Alberta, and municipalities like Red Deer and Lethbridge. The DFOs operate within specific service areas.

The AUC approves the distribution rates in a tariff for investor-owned and certain municipally-owned DFOs. The REAs and some municipalities determine their own tariffs. These tariffs cover the cost of connecting and disconnecting customers, providing new services, operating and maintaining the distribution system and providing meter-reading services. Retailers bill this distribution tariff on consumers' bills.

Unlike the transmission system where access is controlled by the AESO, system access to the distribution system is managed by the DFOs. Accordingly, new distributed generation will have to follow the interconnection process that the DFO in that territory has designed in order for that new generation to be built and connected to its local distribution system.

4. Retail

Retail of electricity in Alberta has been deregulated and is competitive for large consumers, while small consumers (less than 250,000 kWh per annum), mostly residential, have a choice of either signing a contract with a competitive retailer or choosing a regulated rate with their default supplier. The RRO price is set by the AUC based on the Pool Price for the service areas of ATCO, FortisAlberta, ENMAX and EPCOR, while other municipalities and REAs that own distribution systems determine their own RRO price.

There are also some very large industrial customers who act as self-retailers and participate directly in the Power Pool instead of using a third party retailer.

All retailers and self-retailers buy electricity in the Power Pool.

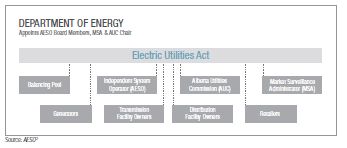

Applicable Legislation And Governing Agencies

Applicable Legislation

The Alberta Electricity Market is regulated by two primary statutes and a number of substantive regulations enacted under these statutes:

- Electric Utilities Act ("EUA"): The EUA is the main

piece of legislation that governs the Alberta Electricity Market.

Among other things, the EUA:

- Defines the structure of the Alberta Electricity Market, including the competitive aspects of generation and retail, and the regulated aspects of transmission and distribution.

- Establishes the Independent System Operator (the "Alberta Electric System Operator" or "AESO") and the Balancing Pool and sets out their roles and powers.

- Creates the Power Pool and provides for the making of rules by the AESO that define the fair, efficient and openly competitive (generally referred to as "FEOC") functioning of the Power Pool. The AESO is given authority to make ISO Rules in accordance with Section 20 of the EUA and that authority also requires market participants to comply with the ISO Rules. The AESO has made extensive ISO Rules (over 250 pages of them) that govern the Power Pool, including its operation, exchange of energy, transmission system planning and load settlement.

- Permits small consumers to have choice on whether to choose a retailer or choose the RRO.

- Provides for the continuation of the PPAs.

- Grants broad oversight powers to the AUC, especially with respect to the amounts charged by, and terms of service for, the TFOs, DFOs and the AESO.

Regulations passed under the EUA govern matters such as the role of the Balancing Pool in administering the PPAs, the content of customer bills, codes of conduct for market participants, the distribution tariff, the FEOC obligation, payments in lieu of taxes to be paid by non-taxable market participants (i.e. municipalities), the RRO, distribution connected micro-generation of less than 1 MW, and the regulation of transmission.

- Hydro and Electric Energy Act ("HEEA"): HEEA is the primary piece of legislation that governs how the AIES or grid is built. It ensures that generation, transmission and distribution facilities are constructed in an economic, orderly, efficient and safe manner that is in the public interest. To construct and connect new generation, transmission and distribution facilities, certain approvals under HEEA must be obtained from the AUC. There is only one regulation that has been enacted under HEEA and it deals with the requirement of generators and transmitters to provide certain statistical information about their operations.

Governing Agencies

In addition to the Department of Energy for Alberta, the Alberta Electricity Market has four key not-for-profit quasi-government agencies that play a significant role in regulating Alberta's Electricity Market.

The roles of the AESO and Balancing Pool have already been previously explained in some detail. The AESO is the public body that plans, develops and controls access to the transmission system, directs the operation of the AIES, and designs and operates the Power Pool that determines the Pool Price. The Balancing Pool is the public body that manages any PPAs for which there is no independent buyer, and also acts as a backstop for the other PPAs in the event of force majeure or termination by Buyers. Any profit or loss of the Balancing Pool from these PPAs is passed on to Alberta consumers.

The AUC is an independent, quasi-judicial agency of the province. The AUC is responsible for implementing the legislation, regulations and policies of the Department of Energy for Alberta. In addition, it is responsible for generation facility oversight; ensuring each facility is built, operated and decommissioned in an efficient and environmentally responsible manner. The AUC does not generally regulate REAs, municipally owned utilities (with the exception of EPCOR in Edmonton and ENMAX in Calgary), or competitive retailers.

The Market Surveillance Administrator ("MSA") is a public agency created under the Alberta Utilities Commission Act whose mission is to take action to promote effective competition and a culture of compliance and accountability in the Alberta Electricity Market. The MSA undertakes surveillance and investigation to ensure that market participants are conducting themselves in accordance with the FEOC (fair, efficient and openly competitive) obligation, the EUA and its regulations, and the ISO Rules. As an example, in 2015 the MSA assisted in the prosecution of TransAlta before the AUC for breaching the FEOC obligation in a manner that caused a manipulation of the Pool Price. This resulted in TransAlta agreeing to pay the MSA approximately $56 million to settle the FEOC prosecution.

Other non-profit agencies that participate on behalf of their members in shaping the Alberta Electricity Market include the Independent Power Producers Society of Alberta, the Industrial Power Consumers Association of Alberta, Alberta Direct Connect Consumer Association, Alberta Federation of Rural Electrification Associations, Canadian Wind Energy Association and the Canadian Solar Industries Association.

All of these public agencies and non-profit associations have websites that also provide useful background information about the Alberta Electricity Market.

Footnote

To view the full report please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]