CAD/USD currency pair range bound as central banks weigh mixed economic data

The CAD/USD currency pair traded in a relatively narrow range, between 75.6 and 77.9 US¢/CAD, throughout the month of July. With both the Bank of Canada and Federal Reserve opting to maintain their key policy rates at current levels throughout July, and both justifying their decisions on the basis of mixed economic data, it comes as little surprise that the currency pair is little changed over the past month. As such, RBC, TD and Scotiabank left their June publication forecasts largely unchanged, while BMO and National made slight downward revisions to express a slightly more pessimistic outlook on the Loonie. National cites weak exports and expresses concern that Canada's large current account deficit continues to be financed by short term foreign capital flows, thereby limiting any relative upside of the Loonie. Further, National believes that risk-aversion is poised to make a comeback; therefore driving demand for the USD, the world's major reserve currency, Overall, the consensus amongst the surveyed banks is that the Loonie is currently about fairly priced, as they anticipate it to trade between 75.0 and 80.0 US¢/CAD through 2017 year end.

Currency forecasts by bank (USȼ per CAD)

CAD/EUR little changed through July as ECB reaffirms stimulus

The Governing Council of the European Central Bank ("ECB") confirmed its commitment to maintain key ECB interest rates at present or lower levels for an extended period of time. Further, the ECB has reaffirmed it will continue its monthly asset purchase program until at least the end of March 2017, or until it sees a sustained adjustment in the path of inflation consistent with its inflation aim. These efforts have the same root: to stave off disinflationary forces, support investor risk appetite, and keep the global economy moving forward. Despite the aftermath of the Brexit referendum, the CAD/EUR currency pair has also traded in a relatively narrow range. Further, given the impending uncertainties of the U.K.'s decision to leave the European Union and the difficult to measure impacts of the ECB's unprecedented stimulus measures, it is not surprising to observe that the surveyed banks lack a consensus as to the future value of the currency pair, as evidenced by the wide range of reported forecasts.

Currency forecasts by bank (CAD or EUR)1

1. Where a CAD/EUR forecast was not published, cross-rates were derived using CAD/USD and USD/EUR currency pairs.

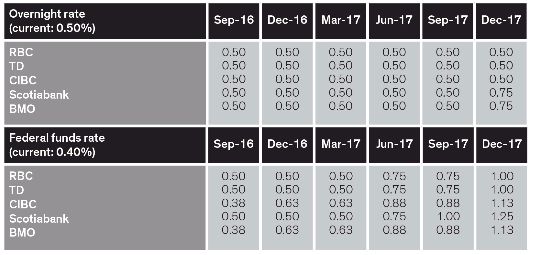

Fed and Bank of Canada to remain accommodative as economic data disappoints

On July 13th, the Bank of Canada maintained its overnight rate target at 0.50%, as expected. Reviewing the surveyed bank forecasts, we observe that BMO is the only surveyed bank to anticipate an overnight rate hike, with the remaining banks anticipating no change through at least 2017. According to BMO, weak exports are worrying and no tightening should be expected from the Bank of Canada until at least October 2017.

On July 27th, the Fed also decided to remain accommodative by leaving the federal funds rate unchanged. However, according to National, the FOMC sounded less dovish than usual by stating that "near-term risks to the economic outlook have diminished". National further added that it maintains its view that the FOMC will refrain from tightening monetary policy until at least 2017, despite the fact that the markets are still pricing in some probability of a Fed interest rate hike later this year.

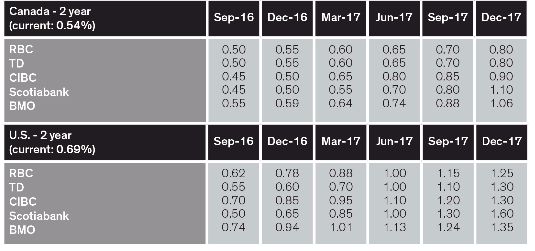

2 year government bond yields relatively unchanged; expected to rise through 2017

The 2 year government bond yields continue to remain range bound for much of 2016 in both the U.S. and Canada. RBC, TD and Scotiabank left their forecasts over last month intact, whilst BMO has increased its yield forecasts by a few basis points at most forecast dates for both U.S. and Canadian 2 year government bonds. CIBC on the other hand revised down its U.S. forecast significantly, likely as a result of the Brexit referendum, given that their reported forecasts in last month's publication occurred prior to the historic vote. Overall, the banks maintain the consensus that 2 year government bond yields should rise through 2017, but it will be worth monitoring whether they maintain this view should economic risks materialize or should anemic global growth persist.

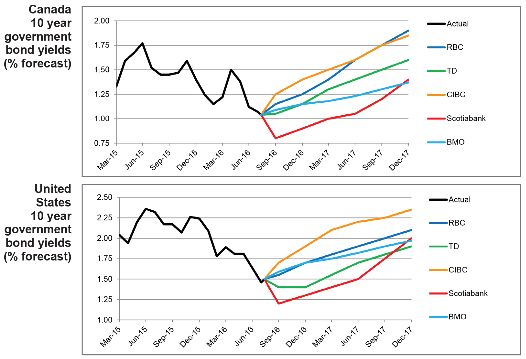

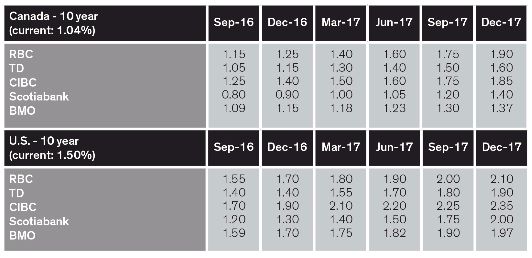

10 year government bond yields continue to slide due to worrying economic growth

For the first half of 2016, weak business investment growth in the U.S. and shrinking non-energy export volumes in Canada gave market a worrisome economic outlook. Although Canadian and U.S. 10 year government bond yields have steadily fallen, they still yielded 1.04% and 1.50% as of August 12th respectively, which is low by historic, but not by global-comparative current standards. According to the surveyed banks, Canadian 10 year government bonds are expected to yield between 1.37% and 1.90%, while the U.S. 10 year Treasuries are expected to yield between 1.90% and 2.35% by the end of 2017, significantly higher than current yield levels.

Long bond yields remain low as global central banks grow more accommodative

Long bond yields continue their slow decline and are presently at historically low levels in both the U.S. and Canada. As uncertainty continues to plague global economic outlooks, central banks around the world are implementing accommodative monetary measures to help promote growth. The Bank of Japan bumped up its quantitative easing program on July 29th, the Reserve Bank of Australia cut its cash rate to a record low of 1.50% on August 2nd, and the Bank of England lowered its key interest rate to a record low of 0.25% on August 4th. Such measures have placed pressure on government bond yields and have made the historically low yields in Canada and the U.S. appear attractive to yield seeking investors. With the exception of Scotiabank, the surveyed banks anticipate yields to rise. The modest expectation of Canadian export-led growth and the "on hold" anticipation of Fed rate for the rest of 2016 give Scotiabank reasons to call for further decline of long bond yields till 2016Q3.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.