One of the key metrics that business owners and executives should think about when contemplating the sale of their company is prevailing M&A market conditions. A buoyant M&A market attracts a larger number of buyers, thereby increasing valuation multiples for the seller. By the same token, declining M&A market activity generally suggests fewer buyers and lower multiples. In this regard, data on the sale of U.S. mid-market companies is showing a decidedly downward trend. The downward trend is also noticeable in Canada. Meanwhile, private equity firms are taking the opportunity to exit now. Finally, recent and potential tax changes could prove very burdensome for business owners. Could these be warning signs that now is the time to sell?

U.S. Mid-Market Transactions are Declining

The number of transactions in the U.S. mid-market is often used as a barometer for M&A activity. Note that in the U.S., the "mid-market" is defined as companies with a value between $25 million and $1 billion. This is a larger bracket than the definition of the mid-market in Canada (and most other western countries), which usually refers to companies with a value in the range of $5 million to $250 million.

Nonetheless, U.S. mid-market data is relevant because it provides insight into buyer sentiment in the world's largest market. Furthermore, U.S. companies are frequently buyers of Canadian companies, either directly or indirectly (e.g. through an existing Canadian subsidiary).

Exhibit 1 illustrates the number of U.S. mid-market transactions on a monthly basis from January 2014 through March 2016. An examination of this data reveals that the number of transactions was higher (on a year-over-year basis) from January 2015 through April 2015. However, the number of transactions has been lower in every month (vs. the previous year) from May 2015 through March 2016. This suggests that the peak is behind us.

Exhibit 1

Private Equity Exits

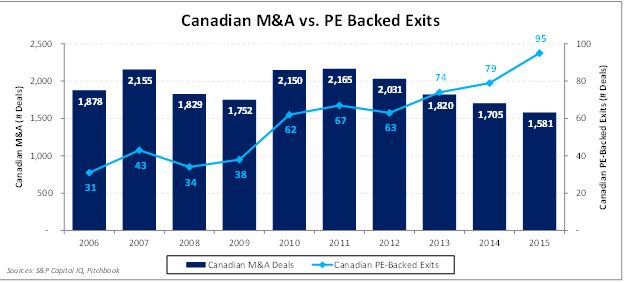

Many private equity firms were devastated by the 2008 financial crisis. But many of those that survived enjoyed several stellar years for raising capital and investing in portfolio companies. Now, an increasing number of private equity firms are heading for the exits. As illustrated in Exhibit 2, while the total number of transactions in Canada has been declining since 2011, the number of exits by private equity firms (of their Canadian portfolio companies) has been rising. This may cause some business owners and executives to consider whether they should "follow the smart money" and get out now.

Exhibit 2

Adverse Tax Changes

The new Liberal government is not being kind to Canadian business owners. Most people are aware that the Liberals retracted their campaign promise to reduce small business tax rates in the March 2016 budget. However, that Liberal budget has other potentially serious tax consequences for business owners who are looking to sell their company. Specifically, there will no longer be a tax deferral opportunity from an asset sale starting in January 2017.

When a business owner sells the assets of his business (as opposed to shares), the purchase price is first attributed to the value of the underlying tangible assets (e.g. net working capital, equipment, etc.). Any excess is attributed to "goodwill". Currently, 50% of the proceeds received on account of goodwill can be withdrawn by the business owner entirely tax-free. The other 50% remains within the business and is taxed at ordinary corporate rates. Therefore, to the extent that funds remain in the business (e.g. for investment purposes), the business owner can defer paying tax at the much higher personal tax rates.

However, all that is about to change. Effective January 2017, any proceeds received in excess of the value of underlying tangible assets will be treated as a capital gain. While capital gains are (currently) only 50% taxable, any monies left in the business will be taxed as investment income. Therefore, the corporation pays higher taxes, but receives a partial refund once the business owner receives a dividend (and pays personal tax at dividend tax rates).

An example will serve to illustrate. Assume that a company is sold for $10 million, and that $2 million of the purchase price is allocated to tangible net assets. The remaining $8 million will be taxed within the company as illustrated in Exhibit 3 (based on Ontario corporate tax rates):

Exhibit 3

If the business owner withdraws all the funds from their company (and pays tax on the dividends), the ultimate impact will be the same under either scenario. However, the tax deferral opportunity that now exists will soon be gone.

An even greater risk is the capital gains inclusion rate, which currently stands at 50%. There was some concern that the inclusion rate would be increased in the last budget. Fortunately this did not happen. However, the Liberals might increase the inclusion rate to 66 2/3% or even 75% in future budgets. Combined with the increases in personal tax rates on high-income earners, the impact would be significant.

Exhibit 4 illustrates the impact of a higher capital gains inclusion rate for an individual residing in Ontario, assuming a capital gain of $10 million (ignoring any lifetime capital gains exemption).

Exhibit 4

Conclusion

It is likely that sellers will reflect back on 2014 and 2015 as the "good old days" in terms of M&A activity and valuation multiples. While there is no reason to believe that a major correction is imminent, there appears to be a stronger case for downside risk, as opposed to upside potential. However, the consequences of a further slowdown could be quite severe if they are coupled with more unfavourable tax changes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.