On April 14th, 2016, Alberta Finance Minister Joe Ceci announced the 2016 Alberta Budget. Below is a summary of some of the tax measures that were included in the Budget.

Corporate Small Business Tax Rate

The corporate small business income tax rate will decrease from 3% to 2% effective January 1, 2017. The general corporate tax rate remains at 12%. The combined federal and Alberta small business and general corporate tax rates for 2017 will be 12.5% and 27% respectively.

Investment Tax Credits

As part of the initiative to promote job creation and diversification in the province, the Budget announced two new tax credits for those who invest in Alberta. The Alberta Investor Tax Credit will benefit investors in eligible small and medium-sized enterprises in Alberta, and the Capital Investment Tax Credit will benefit corporations that make investments in eligible capital assets that are used in certain industries such as the value-added agriculture, tourism infrastructure, culture and manufacturing and processing industries. The Alberta Government will provide further details on these credits later in 2016.

Climate Leadership Adjustment Rebate

The Climate Leadership Adjustment Rebate will be introduced and is intended to protect lower and middle income Albertans from the higher costs resulting from the carbon levy. Effective January 2017, the rebate will be up to $200 for an adult, $100 for a spouse and $30 for each child under the age of 18 in a household (to a maximum of four). The rebate will be adjusted in accordance with increases in carbon prices, and will begin to phase out at $47,500 in family net income for single individuals and $95,000 for couples and families.

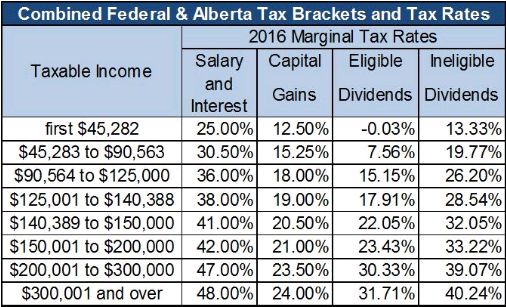

Personal Tax Rates

There are no changes in personal tax rates for 2016, which is the first full year of graduated tax rates. The personal tax rates are summarized below:

In 2017, the dividend tax credit rate for ineligible dividends will be adjusted downwards to correspond with the lowering of the corporate small business tax rate to 2%. There will be no changes to the dividend tax credit for eligible dividends.

Measures Previously Announced

As part of the highlights on benefits for families, the Budget referred to two items that will come into effect in July of 2016. These items were announced in the 2015 Alberta Budget.

- Alberta Child Benefit. Families may receive this benefit of up to $1,100 for one child and then up to $550 for each of the next three children. This benefit is reduced as family net income exceeds $25,500 and is fully phased out once family net income reaches $41,220.

- Alberta Family Employment Tax Credit. This benefit is aimed at supporting working families with children. The rate at which benefits are phased in on family working income will be increased from 8% to 11% and the phase-out threshold on family net income will also be increased from $36,778 to $41,250.

For more information on the 2016 Alberta Budget, please visit the Alberta Government website here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.