On November 4, 2015, an expert panel reviewing Ontario's financial regulatory regime released a preliminary position paper outlining initial conclusions and tentative recommendations that, if accepted and implemented, would create an important new provincial regulator, the Financial Services Regulatory Agency ("FSRA"), while strengthening the existing Financial Services Tribunal ("FST"). Guided by an expert Board of Directors and operating at arm's length from the Government, FSRA would largely take the place of two existing agencies: the Financial Services Commission of Ontario ("FSCO") and the Deposit Insurance Corporation of Ontario ("DICO").

Emphasizing that their recommendations and conclusions are merely preliminary, the panel is strongly encouraging all interested parties (including those that commented during the initial stage) to provide feedback, which will be accepted until December 14, 2015.

Background

The three-member panel's mandate focused on four basic questions:

- Whether the mandates of FSCO, DICO and the FST are still relevant to Ontario's goals and priorities;

- Whether the agencies are successfully carrying out their mandates;

- Whether some or all of the functions of these agencies could be performed better by another agency or entity; and

- Whether changes to the agencies' respective governance and/or accountability structures are required.

As these questions might suggest, the overall aim of the review is to determine whether the structure and mandates of Ontario's financial regulators need to be adjusted to meet today's demands, particularly in the light of technological innovation and the emergence of non-traditional financial services providers. By way of background, Ontario regulators regulate a range of entities falling under provincial jurisdiction, including certain insurers, pension plans and loan and trust companies, credit unions and caisses populaires, mortgage brokers, co-ops and service providers who "invoice auto insurers for listed expenses in relation to statutory accident benefits".

Recommendations of the position paper

General principles

The position paper begins by noting that the pace of innovation in the financial services sector requires a flexible regulatory system. Flexibility is emphasized throughout the report, reflecting comments that the existing regulatory structure has not been responsive enough to marketplace developments. The panel was clearly of the view that both industry and ordinary Ontarians would benefit from a regulatory system that vigorously supports the interests of consumers while also serving to encourage innovation in service delivery.

With respect to the four questions above, while the panel found that the existing organizational structures and mandates were still somewhat relevant and effective, it was of the view that major improvements and changes can and should be made. In particular, many of the functions of FSCO and DICO, including a number that appear to overlap, could better be performed by a single organization (FSRA), although a scaled-down and renamed DICO could continue to exist for the purpose of administering Ontario's deposit insurance scheme and Pension Benefits Guarantee Fund.

Financial Services Regulatory Agency (FSRA)

To ensure its independence, FSRA would be a self-funded corporation and not part of the Ontario public service (which would also assist it in recruiting professionals with industry experience). The agency's governance structure would include an independent and expert Board of Directors to which FSRA's CEO would report. The Board itself would report to the Minister of Finance and would meet at least once per year with the sectors that FSRA oversees. It would also have rule-making authority (following an "outcomes based" and "risk based" approach and subject to Ministry of Finance review) and could levy Administrative Monetary Penalties (AMPs) in areas that it regulated, such as pensions. Finally, it could apply funds generated from AMPs and licensing fees to initiatives in keeping with its mandate, such as consumer education or a fraud compensation fund (which the panel envisages as a "payer of last resort" in cases where E&O insurance or fidelity bond coverage is unavailable or insufficient).

Under the structure envisaged by the panel, FSRA would have three separate and distinct divisions, dedicated respectively to the following key regulatory functions (currently exercised by either FSCO or DICO):

- Regulation of market conduct;

- Prudential regulation; and

- Regulation of pensions.

The FSRA branches dedicated to these functions would act in a "coordinated and consistent" manner. All of FSRA's activities would be conducted in a "proactive" manner. Each division would be led by a Superintendent (e.g. a "Superintendent of Pensions") who would report directly to the FSRA CEO. Co-operation and co-ordination among the divisions would be mandated and they would be served by a common corporate infrastructure (i.e. joint communications, IT, legal and finance departments). However, each division would develop its own "statement of approach" with respect to its part of FSRA's mandate and would have sufficient dedicated staff and resources to fulfill its goals. Note that, in the case of prudential regulation, the panel suggested that FSRA should be responsible for entities operating entirely within Ontario, leaving those with extra-provincial operations to the federal regulator, the Office of the Superintendent of Financial Institutions ("OSFI").

FSRA would be mandated to encourage innovation within regulated sectors while staying abreast of the impact of that innovation on Ontario consumers. In general, the agency would have a clear and strong consumer protection focus, grounded on the Ten Principles of the OECD's G20 High-Level Principles on Financial Consumer Protection and backed by firm and consistent enforcement. This responds to a view, expressed by many commenters, that FSCO's consumer protection and enforcement function has been inadequately resourced in the face of ever-changing financial marketplace challenges. A key element in the consumer protection mandate would be the creation, within FSRA, of an "Office of the Consumer", which would operate across all three divisions, ensuring that consumer perspectives are given due consideration in all regulatory initiatives.

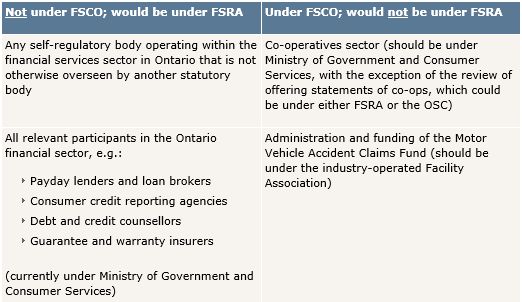

In addition to a more focused approach to consumer protection and enforcement, the position paper recommends that FSRA should work co-operatively with other Ontario regulators, including self-regulatory organizations, in order to avoid regulatory overlap and arbitrage, and to ensure consistency of approach and standards. The paper also proposes that the range of entities over which FSRA exercises authority be somewhat different than the range that currently falls under FSCO:

The panel declined to make a recommendation about whether the advance approval of automobile insurance rates, currently a FSCO function, should transferred to FSRA. However, it did observe that Ontario's existing approach to rate-setting has been abandoned in most other jurisdictions and expressed the concern that, if transferred to FSRA, this function could consume resources better allocated to FSRA's other proposed responsibilities.

Financial Services Tribunal (FST)

Only six of the panel's 37 recommendations directly concerned the Financial Services Tribunal (FST). In addition to having its own budget, separate from that of FSRA, the FST would have a permanent Chair and at least two Vice-Chairs, supported by a roster of part-time adjudicators. The scope of the FST's jurisdiction would depend on the jurisdiction ultimately assumed by FSRA, but the FST's function would, in any event, include hearing appeals from FSRA decisions. The panel also suggested that, if appropriate, the FST could serve a broader adjudicatory function within the financial sector, but it was not specific about what this would entail. Finally, the panel suggested that the Legislature "strive to ensure that the courts defer to the FST on policy or other matters that are within its subject-matter expertise."

Deposit Insurance Corporation of Ontario (DICO)

Under recommendation 22, the panel proposes that DICO should continue to exist for the purpose of administering and overseeing Ontario's deposit insurance scheme and Pension Benefits Guarantee Fund. DICO, under a new and as yet undetermined name, would report to the FSRA board to ensure co-ordination of activities and a consistent policy direction. As noted above, its existing prudential regulatory activities would be transferred to FSRA (and, in some cases, to OSFI), effectively ending what a number of commenters considered an "inherent conflict of interest" in DICO as it is currently constituted.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.