On October 27th, 2015, Alberta Finance Minister Joe Ceci announced the 2015 Alberta Budget. The Budget does not provide for any tax rate changes over and above those previously announced in June, 2015, as summarized below. Also noted below are highlights of some of the other tax measures contained in the Budget.

Changes to Personal Tax Rates

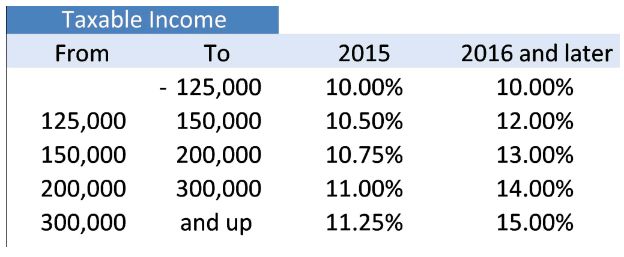

Effective 2015, new personal tax brackets were introduced. For 2015 the highest Alberta tax rate is 11.25% and for 2016 and later years the highest Alberta tax rate is 15%. The Alberta personal tax rates are summarized below. Note that these amounts do not include the applicable federal rates.

In order to maintain integration with recent federal corporate tax changes, the Alberta Government announced that it will introduce amendments to the calculations for the Alberta ineligible and eligible dividend tax credits. The Alberta Government expects to announce these amendments for ineligible dividends in the Fall of 2015. The Alberta Government is currently reviewing the dividend tax credit on eligible dividends and expects to announce the results of this review in its 2016 Budget.

Changes to Corporate Tax Rates

The Alberta general corporate tax rate was increased from 10% to 12% effective July 1, 2015 and the small business tax rate remains at 3%. Note that these amounts do not include the applicable federal rates.

Other Tax Measures

We also note the following items from the 2015 Alberta Budget.

- Alberta Child Benefit. Beginning in July of 2016, families may receive this benefit of up to $1,100 for one child and then up to $550 for each of the next three children. This benefit is reduced as family net income exceeds $25,500 and is fully phased out once family net income reaches $41,220.

- Alberta Family Employment Tax Credit. This benefit will begin in July of 2016 and is aimed at supporting working families with children. The rate at which benefits are phased in on family working income will be increased from 8% to 11% and the phase-out threshold on family net income will also be increased from $36,778 to $41,250.

- Job Creation Incentive Program. This is a two-year program that will provide grants to employers for net new employment created after January 1, 2016. The grants can be up to $5,000 for each new job, with an employer being eligible for up to $500,000 in total support.

- The Health Care Contribution Levy introduced earlier this year was not mentioned in this budget.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.