Miedzi Copper Corporation v. Her Majesty The Queen (2015 TCC 26) is the most recent case from the Tax Court of Canada to address whether a Canadian holding corporation could claim input tax credits ("ITCs") for GST/HST paid on certain expenses where the holding company's only activity consisted of hold shares in a related corporation.

The taxpayer's appeal was allowed in its entirety.

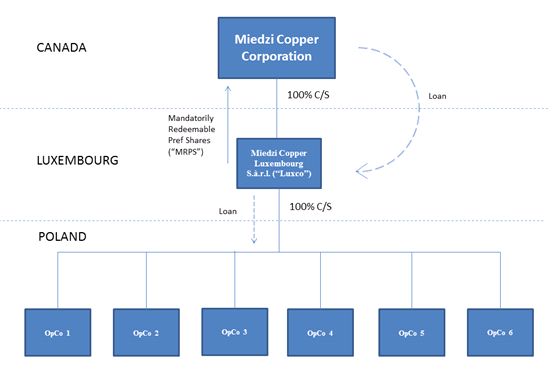

Miedzi was a Canadian corporation based in Vancouver and a GST/HST registrant. It was a holding company that carried on a mineral exploration business through a wholly-owned foreign subsidiary resident in Luxembourg ("Luxco"). Luxco owned six mineral exploration companies that operated in Poland. Miedzi raised money through private placements which it used to finance the exploration projects by way of loan to Luxco who, in turn, would loan it down to the Polish companies.

At the end of each year, the loan owing by Luxco to Miedzi was converted to a Mandatory Redeemable Preference Share ("MRPS") and given to Miedzi. Please see illustrative diagram, below.

Subsection 169(1) of the Excise Tax Act (RSC, 1985, c. E-15) ("ETA") provides that an ITC is available only when the property or service on which tax gave rise to the ITC is acquired for consumption, use or supply in the course of commercial activities, as that term is defined in subsection 123(1).

For a holding company, such as Miedzi, the fundamentally issue is that corporate shares are "financial instruments" and the activity of holding shares is not generally a commercial activity of the shareholder.

Subsection 186(1) deems a holding corporation to have incurred expenses for use in the course of a commercial activity and, therefore, allowing ITCs to be claimed by the parent if the criterion is satisfied. Section 186(1) reads as follows:

186.(1) Related corporations [ITCs for holding companies] — Where

(a) a registrant (in this subsection referred to as the "parent") that is a corporation resident in Canada at any time acquires, imports or brings into a participating province particular property or a service that can reasonably be regarded as having been so acquired, imported or brought into the province for consumption or use in relation to shares of the capital stock, or indebtedness, of another corporation that is at that time related to the parent, and

(b) at the time that tax in respect of the acquisition, importation or bringing in becomes payable, or is paid without having become payable, by the parent, all or substantially all of the property of the other corporation is property that was last acquired or imported by the other corporation for consumption, use or supply by the other corporation exclusively in the course of its commercial activities,

except where subsection (2) applies, for the purpose of determining an input tax credit of the parent, the parent is deemed to have acquired or imported the particular property or service or brought it into the participating province, as the case may be, for use in the course of commercial activities or the parent to the extent that the parent can reasonably be regarded as having so acquired or imported the particular property or service, or as having so brought it into the province, for consumption or use in relation to the shares or indebtedness.

[Emphasis added]

The CRA's position on "exclusively" in the course of commercial activity generally means 90% or more for non-financial institutions (GST/HST Memoranda 8.6, paragraph 4).

Subsection 186(3) allows for the application of subsection 186(1) to tiers of related corporations, and it reads as follows:

(3) Shares, etc., held by corporation — Where at any time all or substantially all of the property of a particular corporation is property that was acquired or imported by it for consumption, use or supply exclusively in the course of its commercial activities, all shares of the capital stock of the particular corporation owned by, and all indebtedness of the particular corporation owed to, any other corporation that is related to the particular corporation shall, for the purposes of this section, be deemed to be, at that time, property that was acquired by the other corporation for use exclusively in the course of its commercial activities.

Subsection 186(3) does not impose residency or registration requirements for its deeming provisions to apply.

For the March 31, 2011 to September 30, 2012 reporting periods, Miedzi claimed ITCs of $165,708.18 for HST it paid on management, professional and geological services. The Minister of National Revenue ("Minister") disallowed $47,909.07 of those ITCs claimed on the basis that they related to Miedzi's own corporate costs and were not related to holding the shares or indebtedness of Luxco.

Miedzi had no employees of its own or office premises. It retained a consulting firm on a contract basis for which it was billed hourly for consulting services and certain expenses that were incurred on Miedzi's behalf.

Expenses at issue

During the relevant period, Miedzi paid GST/HST on the following legal expenses:

- incorporation,

- private placement in securities market

- corporation reporting and filing services,

- advice in respect of the HST issue on appeal,

- advice concerning a shareholder's agreement,

- a stock option plan, and

- related amendments to the articles of incorporation.

Miedzi incurred the following accounting expenses:

- Canadian tax returns;

- Audit of financial statements,

- Advice concerning its tax reporting obligations

- Advice related to HST audit

Other expenses included cell phone, parking, meals, courier charges, web domain registration and hotel accommodations.

ANALYSIS

The Honourable Justice Paris focused his analysis on the application of section 186(1) and whether goods and services acquired by the parent company, Miedzi, could reasonably be regarded as having been acquired for consumption or use in relation to the shares of Luxco.

It would seem that because the amount of GST/HST at issue was below $50,000, the Appellant elected to proceed by way of informal procedure at the Tax Court of Canada.

Where does a parent company draw the line between its own expenses and those incurred "in relation to" the subsidiary shares?

Miedzi argued that all the expenses were incurred in relation to its shares in Luxco. The Minister argued that the language in subsection 186(1) imposed an obligation on the appellant to distinguish between costs that related to the subsidiary shares and costs that do not.

Miedzi relied on the decision of the Honourable Justice Miller in Stantec Inc. v. The Queen (2008 TCC 400), and upheld by the Federal Court of Appeal (2009 FCA 285), that the phrase "in relation to" should be given a broad interpretation. Miller, J. cited the Supreme Court of Canada in Slattery (Trustee of) v. Slattery ([1993] 3 S.C.R. 430) and stated that "in relation to" is an expression of the widest possible import.

Paris, J. concluded that Miedzi had no other activity than to own the share of and lend money to Luxco; accordingly, everything done by Miedzi was done in relation to the shares or indebtedness of Luxco. He went on to state that "but for its ownership of the Luxco shares and its funding of Luxco debt, Miedzi would not have acquired those services".

Interesting to note that Miedzi was entitled to claimed ITCs on its own incorporation, stock option plan and Article of Amendments on the basis that they were incurred in relation to the subsidiary shares.

Given the clarity and authority provide by Stantec, it begs the question why was the Miedzi case not settled well in advance of a hearing? GST/HST Memoranda Series 8.6 provides an example (actually the very first example for ss. 186(1)) that is quite similar to Miedzi where a holding company was entitled to claim ITCs:

ParentCo is a GST/HST registrant and a resident in Canada. It is related to MiningCo since it owns all the shares of MiningCo. All of the property of MiningCo is property that it acquired for consumption, use or supply in its commercial activities. ParentCo incurs legal fees that relate to selling 10% of the shares of MiningCo. At the time that GST/HST became payable in respect of the legal fees that ParentCo incurs to sell these shares, all or substantially all of the property of MiningCo is property that was acquired for consumption, use or supply in its commercial activities. Therefore, the provisions of subsection 186(1) apply to deem the legal services related to selling the shares to have been acquired by ParentCo for use in commercial activities.

The example provides a slightly different fact set than in Miedzi but should selling share in the subsidiary (as stated in the example) versus loaning or acquiring more shares in the subsidiary change the result in any way?

It may be that holding companies are attracting GST/HST audits and deeper scrutiny by the CRA due to the fact that are often in a refund position, where expenses are incurred in Canada but commercial activities of the subsidiary take place outside of Canada and not subject to GST/HST. And even with clear taxpayer success in Miedzi and Stantec, it would be prudent for holding companies with little to no activity, other than holding shares of a related company, to ensure there is a clear nexus between expenses and its ownership in the subsidiary.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.