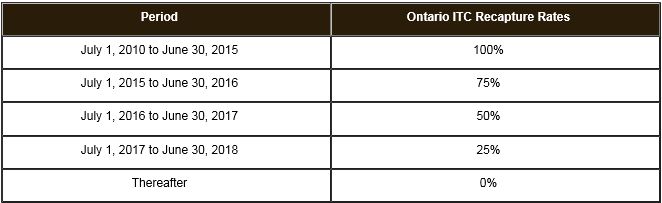

Effective July 01, 2015, this date marks the beginning in the gradual reduction in Recaptured Input Tax Credits (RITC) requirements for large business with annual sales greater than $10 million (for them and all associated persons of taxable and zero-rated sales). This means that clients considered to be a "Large Business" by the CRA, will only be required to restrict the provincial portion of the Input Tax Credit (ITC) they claim on specified property by 75% in Ontario. The 75% Ontario ITC recapture rate will take effect July 1, 2015 to June 30, 2016.

As a reminder, expenses that are considered specified property or services and must be restricted:

- mileage allowances, leases, purchase or rentals of cars and light trucks (<3000kg) including certain vehicle parts and services and gasoline fuel

- energy (electricity, gas, steam)

- telecommunication services (telephone, cable, facsimile and e-mail)

- meals and entertainment currently subject to 50% input tax credit rate

It is important to be aware of the decrease in restriction percentage and advise our clients of this change as updating tax coding in their systems will be required. Moreover, we want to ensure that no overpayment of tax occurs.

Failure to report RITCs could result in a penalty assessment of 5% of the amount plus 1% per month of the difference between what is reported and what should have been reported, until the amounts are corrected (to a maximum of 10%)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.