- within Immigration and Finance and Banking topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Basic Industries, Business & Consumer Services and Insurance industries

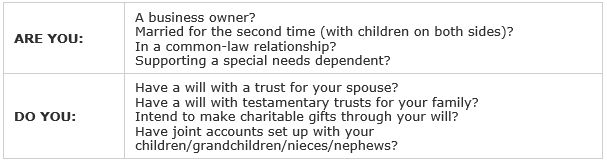

If you answered YES to any of the above, you should consult an expert to make sure that there are no unexpected problems for your loved ones!

New Income Tax rules have changed the way income tax will be charged on estates set up for surviving spouses.

Common-law spouses do not have automatic rights to share in an estate unless there is a will that provides for it. Without a will, a legal, but separated spouse is treated as the only spouse.

New reporting requirements for estate trustees require very detailed reporting of everything you own. However, there are ways to lessen this obligation.

Charitable bequests of money and securities can be done with tax benefits that were not necessarily available under the previous rules.

Trusts created in wills (testamentary trusts) used to be taxed at marginal rates. Beginning in 2016, all continuing trusts, will be taxed at the top marginal rate on all income taxed in the trust.

Trusts for disabled beneficiaries will still be taxed at the marginal rates on reinvested income, but the beneficiary must qualify for a Disability Tax Credit under the Income Tax Act, and only one trust will be allowed for each disabled person.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.